Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685829

South America Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 150 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

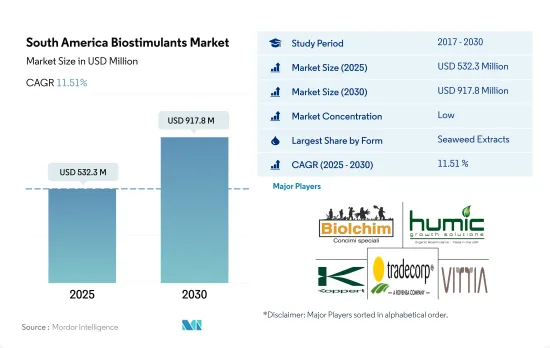

The South America Biostimulants Market size is estimated at 532.3 million USD in 2025, and is expected to reach 917.8 million USD by 2030, growing at a CAGR of 11.51% during the forecast period (2025-2030).

- In the South American biostimulant market, many biostimulants are used as active ingredients, including humic acids, fulvic acids, amino acids, protein hydrolysates, seaweed extracts, chitosan, biopolymers, and other biostimulants such as plant and animal derivatives. Between 2017 and 2022, the value of the biostimulants market in the region increased by 21.4%.

- The extreme crop stress of Argentina's historic drought season helped demonstrate the powerful effects of biostimulants under difficult growing conditions for corn and soybean. Row crops accounted for 78.3% of the biostimulants market value in 2022. This is due to row crops accounting for approximately 82.3% of the total organic crop area in the region in 2022. Cash crops and horticultural crops accounted for 16.1% and 5.6% of total biostimulants, respectively.

- In South America, seaweed extract biostimulants held the largest market share, amounting to 51.8% in 2022. With a consumption volume of 26.5 thousand metric tons, the segment was worth USD 199.9 million in 2022. This is due to their ability to improve overall plant health, stress tolerance, root growth, nutrition & water intake, plant growth, and crop yield. Seaweed extracts improve the nutrient uptake and translocation in crops such as maize, oilseed, rapeseed, tomato, wheat, and soybean.

- Amino acids are the second most consumed biostimulants in the region, with consumption increasing by 20.9% between 2017 and 2022, from 9.3 thousand metric tons in 2017 to 11.2 thousand metric tons in 2022, owing primarily to the region's increasing trend toward sustainable or organic agriculture. The biostimulants market value is anticipated to grow by 89.4% between 2023 and 2029.

- The South American biostimulants market is experiencing significant growth, driven by the region's focus on low-carbon agriculture and the need to feed a growing global population. The usage of both microbial and non-microbial biostimulants in agriculture can lead to substantial reductions in greenhouse gas emissions, making it a top priority for South American nations.

- Brazil is the largest market for biostimulants in the region, accounting for 64% of the market share. However, the expansion of agriculture for commodity production has resulted in severe erosion of arable land. To address this issue, Brazil aims to meet the United Nations' soil restoration goal well before 2030 by inoculating degraded lands with beneficial soil microbes, including more effective biostimulants.

- Argentina is a leading country in terms of organic food production in South America, with major organic exports, including cereals, oilseeds, fruits, and sugarcane. The rise in domestic and international demand for organic products is driving the growth of the biostimulants market in the country, which is expected to register a CAGR of 11.2% between 2023 and 2029.

- The growing awareness among farmers in the region about the benefits of organic agriculture is another factor driving the market growth of organic inputs such as biostimulants. Farmers are considering organic agriculture as an alternative to maintain and protect their local resources and avoid damage to the environment. The biostimulants market in South America is projected to register a CAGR of 11.2% between 2023 and 2029, indicating significant potential for the region's agriculture industry.

South America Biostimulants Market Trends

Growing organic acreage owning to the rising international demand for soy, corn, sunflower, and wheat.

- The area under organic cultivation of crops in South America was recorded at 672.8 thousand hectares in 2021, according to the data provided by The Research Institute of Organic Agriculture (FibL statistics). Argentina and Uruguay are the major organic-producing countries in the region, with a large area under organic crop cultivation, with Argentina occupying a share of 11.5% of the organic area in the region in 2021. The primary organic crops produced in Argentina include sugarcane, raw wool, fruits, vegetables, and beans. The primary organic exports are soy, corn, sunflower, and wheat.

- Cash crops accounted for the maximum share of 53.9% under organic crop cultivation in 2021, with 384.3 thousand hectares of land. The region is a major grower of cash crops like sugarcane, cocoa, coffee, and cotton. Brazil is the largest sugarcane-growing country in the region.

- On the other hand, Uruguay is a large grower of organic fruits and vegetables in the region. The Organic Farmers' Association of Uruguay promotes organic cultivation in the country by partnering with various organic retail outlets. The World Bank-financed Sustainable Management of Natural Resources and Climate Change project (DACC) assisted 5,139 farmers in 2022 to adopt climate-smart agriculture (CSA), which helped increase the area under cultivation of organic crops in the region.

- Millions of farmers in South America continue to practice no-external input agriculture, which may very well represent the future of the region's economy despite the noticeably low domestic production. The population is becoming more health conscious, which creates a larger market for South America's increasingly environmentally friendly and sustainable farming system.

Approximately 49.0% consumers in Argentina, Brazil and Colombia are interested in purchasing organic food.

- South America is one of the important producers and exporters of organic food products globally. The per capita spending on organic food products in South America is comparatively lesser than in other parts of the world. The average per capita spending was recorded as USD 4.3 in 2022. Nevertheless, these export-oriented countries are now generating an often-overlooked domestic demand.

- The demand for naturally grown products like organic food in South American countries like Argentina, Brazil, and Colombia has increased. A survey conducted by Wisconsin Economic Development in 2021 proved that consumers are willing to pay higher prices for organically grown food. The study revealed that 43-49% of consumers are conscious about their health. Brazil ranks 43rd globally for per capita spending on organic packaged food and beverages.

- The organic products market in Argentina reached a value of USD 15.9 million in 2021, representing 0.03% of the global market value, with a per capita consumption of USD 0.35, as per the data given by Global Organic Trade in 2021.

- Currently, the market for organic foods in the region is very fragmented, with its availability limited to a few supermarkets and specialty stores, as only people from higher-income families are potential customers. Many supermarkets, specialized stores, and local farmers' markets in the region are now selling organic food to satisfy the growing latent demand for such products, mainly in Costa Rica, Mexico, and urban centers of South America. Growing awareness among consumers and their buying motives are expected to lead to a better understanding of the sustainability attributes of organic food in the region.

South America Biostimulants Industry Overview

The South America Biostimulants Market is fragmented, with the top five companies occupying 7.24%. The major players in this market are Biolchim SpA, Humic Growth Solutions Inc., Koppert Biological Systems Inc., Trade Corporation International and Vittia Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48262

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Atlantica Agricola

- 6.4.2 Biolchim SpA

- 6.4.3 Haifa Group

- 6.4.4 Humic Growth Solutions Inc.

- 6.4.5 Koppert Biological Systems Inc.

- 6.4.6 Plant Response Biotech Inc.

- 6.4.7 Sigma Agriscience LLC

- 6.4.8 Trade Corporation International

- 6.4.9 Valagro

- 6.4.10 Vittia Group

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.