PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906997

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906997

Sauces, Condiments, And Dressings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

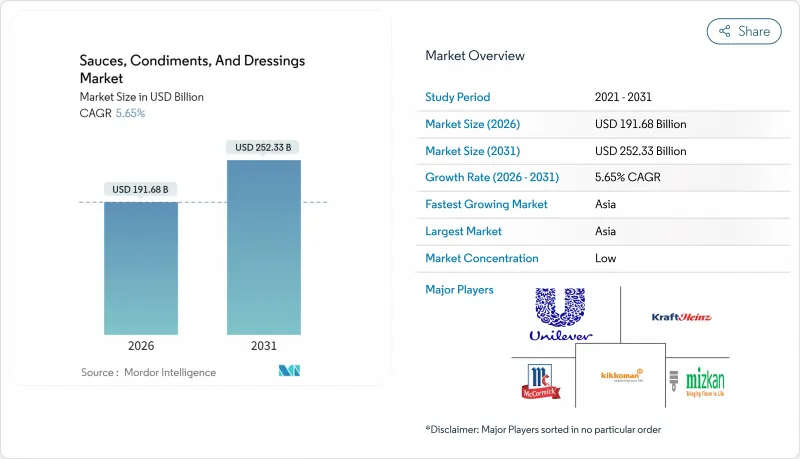

The global sauces, dressings, and condiments market size in 2026 is estimated at USD 191.68 billion, growing from 2025 value of USD 181.43 billion with 2031 projections showing USD 252.33 billion, growing at 5.65% CAGR over 2026-2031.

As consumers increasingly seek authentic flavors, premium clean-label recipes, and convenient meal solutions, value creation is surging across all channels. Modernization efforts, especially the U.S. Food and Drug Administration's decision to revoke 52 outdated standards in 2025, have eased reformulation challenges and expanded avenues for innovation. This regulatory change is expected to encourage manufacturers to experiment with new ingredients and formulations, fostering product differentiation and catering to evolving consumer preferences. Additionally, the growing emphasis on health-conscious eating habits has led to a surge in demand for low-sodium, organic, and gluten-free options within the sauces, dressings, and condiments category. Factors such as rapid urbanization in the Asia-Pacific, which is driving demand for ready-to-use condiments, a global rise in e-grocery adoption that enhances accessibility to diverse product offerings, and strategies for vertically integrated ingredient sourcing, which ensure cost efficiency and quality control, are bolstering the growth of the sauces, dressings, and condiments market. Furthermore, the increasing influence of international cuisines and the rising popularity of fusion flavors are creating new opportunities for market players to innovate and expand their product portfolios.

Global Sauces, Condiments, And Dressings Market Trends and Insights

Product Innovation and Flavor Diversification

In a 2024 study published in Frontiers in Nutrition, researchers highlighted a breakthrough: brands can now reduce sodium in ketchup by up to 52% without compromising taste. This innovation is made possible through advanced encapsulation technologies, which ensure flavor retention while meeting health-focused reformulation goals. Multinational companies are leveraging these micro-delivery systems, integrating them with rapid prototyping kitchens. This integration enables pilot recipes to transition from concept to store shelves in under nine months, significantly accelerating product development timelines. With the FDA set to introduce new criteria for the "healthy" label in February 2028, there's a heightened push for nutrient-dense reformulations. These criteria are particularly impactful as condiments will no longer assist main dishes in qualifying for this label, prompting manufacturers to innovate independently. Consequently, flavor houses and branded manufacturers are collaborating to craft bolder and more diverse flavor profiles, such as gochujang barbecue, fermented yuzu aioli, and chipotle-lime crema. These flavors cater to both adventurous consumer palates and regulatory sodium limits, striking a balance between taste and compliance. Thus, the sauces, dressings, and condiments market is increasingly valuing research and development agility. Companies are also focusing on cross-regional flavor translation to meet the growing demand for globally inspired tastes, ensuring their products resonate with diverse consumer preferences while adhering to evolving regulatory standards.

Rising popularity of ethnic and regional cuisines

USDA data reveals that American households are increasingly embracing global spices, suggesting a trend where shoppers are recreating restaurant dishes at home. This shift reflects a growing consumer interest in diverse culinary experiences and a willingness to experiment with flavors beyond traditional American cuisine. Heritage products, once confined to local wet markets, are now making their way to mainstream grocery shelves. This shift, seen with items like Sichuan doubanjiang and Mexican mole negro, underscores a growing acceptance of international ingredients. In response, major players like Unilever are rolling out region-specific products, such as a guasacaca-inspired mayo tailored for South American consumers, to cater to this evolving demand. Meanwhile, smaller craft brands are carving out shelf space, aided by distributors who prioritize authentic narratives that resonate with consumers seeking genuine cultural connections. Authenticity, rooted in origin and traditional processing, has led to a surge in popularity for sauces, dressings, and condiments. The emphasis on native fermentation methods and single-estate pepper varietals has further enhanced the appeal of these products, particularly among flavor explorers who value unique and high-quality ingredients.

High sugar/salt and preservative concerns

With the FDA setting a January 1, 2028 deadline for updated nutrition labels, global brands are being compelled to simultaneously adjust sodium and sugar levels across their entire portfolios. This regulatory shift aims to promote healthier consumer choices, but it presents significant challenges for manufacturers. Given that sauces and dressings can't help main dishes meet "healthy" standards, companies are tasked with revamping these products independently, requiring substantial reformulation efforts. As traditional preservatives come under scrutiny, challenges arise in preserving taste and ensuring product safety. Notably, benzoates and parabens, which were once widely used, have made their way onto several retailer avoidance lists due to growing consumer and regulatory concerns. To address these issues, manufacturers are increasingly relying on proprietary salt-taste enhancers and natural antimicrobial systems. However, these advanced ingredients come at a premium, increasing production costs and potentially altering established flavor profiles, which could impact brand loyalty. For smaller players in the sauces, dressings, and condiments market, these challenges are even more pronounced. Limited resources and tighter budgets restrict their ability to experiment with new formulations, making it harder to compete with larger companies that can absorb higher costs and invest in innovative solutions. As a result, the market dynamics are likely to shift, favoring well-resourced brands that can adapt to these regulatory and consumer-driven changes.

Other drivers and restraints analyzed in the detailed report include:

- Premium-priced clean-label formulations

- Influence of food culture and social media

- Volatile tomato/chili commodity prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, sauces raked in a retail value of USD 89.36 billion, commanding a robust 49.25% share of the global market for sauces, dressings, and condiments. They dominate the market, finding versatile applications in everything from meal kits and marinades to all-day dips. The rise of artisanal chili pastes and fermented soybean blends has propelled sauces into premium retail spaces, catering to consumers with a palate for authentic and bold flavors. Brand innovation shines through, with packaging like squeeze pouches for wok sauces and family-size jars for gravie,s enhancing convenience and relevance. This segment's allure extends into adjacent categories, notably ready-to-eat meals and snacks, broadening consumption avenues. While dressings and other condiments vie for attention, sauces firmly anchor the market, adeptly evolving with culinary trends while maintaining their essential role in homes and foodservice kitchens.

Dressings are emerging as the fastest-growing segment in the sauces, dressings, and condiments arena, projected to achieve a CAGR of 6.61% by 2031. Their ascent is driven by health-centric reformulations, such as reduced-oil emulsions and fermented bases, resonating with calorie-conscious consumers. Innovations like Greek yogurt and avocado oil dressings offer nutrient-rich profiles without sacrificing flavor. Enhanced packaging, like pour-over bottles with spice infusers, boosts at-home customization, allowing dressings to rival sauces. Dressings now complement a broader meal spectrum-from salads and grain bowls to sandwiches-expanding their usage. As brands delve into hybrid products merging features of both dressings and sauces, the lines blur. Yet, with a robust health-focused innovation pipeline, the dressings category is poised for sustained growth through the decade's close.

In 2025, conventional recipes dominated the global sauces, dressings, and condiments market, commanding an impressive 82.10% share. Budget-conscious shoppers, particularly in price-sensitive regions, gravitate towards these value-driven brands, solidifying their market leadership. Yet, an inflation-adjusted basket analysis indicates a notable resilience in premium conventional condiments, with consumers showing a reluctance to downgrade to lesser alternatives. Retail channels prominently feature conventional products, occupying the lion's share of shelf space. While health trends usher in competition from cleaner formulations, many conventional brands are making subtle reformulations, such as reducing sodium or substituting synthetic emulsifiers with plant-based fibers to bridge the perception gap. These strategic moves not only safeguard their market share but also enhance their competitiveness against claims typically associated with clean-label brands.

Clean-label sauces, dressings, and condiments are on an upward trajectory, expanding at an estimated CAGR of 6.05%, making them the market's fastest-growing segment. This surge is fueled by a growing consumer appetite for transparency, with purchasing choices swayed by familiar ingredients and certifications like USDA Organic, EU Leaf, and Non-GMO Project Verified. In response, retailers are curating dedicated "natural" sections, placing no-additive ketchups alongside gluten-free soy sauces to promote cross-category exploration. Despite facing challenges, such as a 4% dip in organic tomato acreage in 2024, brands are innovating. They're blending certified-organic bases with conventionally grown spices, marketing them as "better-for-you" alternatives. This adaptability not only navigates supply constraints but also resonates with quality-conscious consumers. As conventional products gradually embrace clean-label traits, the emphasis on ingredient purity may wane, shifting the competitive focus towards branding, narrative, and pricing strategies.

The Global Sauces, Dressings, and Condiments Market Report is Segmented by Product Type (Sauces, Herbs and Spices, and More), Category (Conventional, Organic/Clean-label), Packaging (PET/Glass Bottles, Sachets/Pouches, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, Asia-Pacific commanded a dominant 41.20% share of the global market, with urban hubs seamlessly blending street-food traditions and contemporary safety measures. China's February 2025 introduction of unified additive limits, GB 2760-2024, is set to expedite export approvals for its chili bean pastes and soy-based dips. Meanwhile, Japan and South Korea are charting premium paths, leveraging cold-chain logistics to safeguard their kimchi and low-acid dressings. In contrast, India and Indonesia are focusing on volume, with mid-tier brands expanding their reach through cash-and-carry wholesalers and dark-store aggregators. The region's flavor fusion is evident, as Korean gochujang finds its way atop Thai rice bowls, boosting cross-border demand for these blended condiments.

Though the Middle East and Africa currently holds a modest mid-single-digit market share, it's on track to achieve the fastest growth rate of 7.09% CAGR from 2026 to 2031. The UAE boasts a robust USD 7.63 billion food-processing sector, adeptly repackaging imported tomato paste for local brands. In alignment with its Vision 2030, Saudi Arabia is backing its domestic sauce factories, aiming to curtail import dependencies and champion halal-certified products. South Africa's burgeoning quick-service chicken outlets are fueling a surge in peri-peri sauce consumption, while Nigeria's digital grocery platforms cater to the urban youth with convenient portion pouches. Free-trade zones in Jebel Ali and Tanger-Med are streamlining re-export processes, broadening the market's regional reach.

North America and Europe, while established, continue to be lucrative markets. Here, a focus on premiumization and regulatory-compliant reformulations is driving modest value growth rates in the low single digits. With a synchronized FDA label deadline set for January 2028, U.S. brands are proactively revamping recipes, aligning national updates with trends like shrinkflation and healthier perceptions. Europe is pushing for packaging circularity, driven by the PPWR initiative, leading to significant investments in innovations like tethered caps and monomaterial pouches, emphasizing differentiation beyond mere taste. South America's growth, spearheaded by Mexico and Brazil, is buoyed by local chili farming and craft-beer pairings, witnessing a rebound in expansion as GDPs rise. Furthermore, the bloc's harmonized Mercosur additive codes, set to take effect in late 2026, promise to simplify formulary designs, facilitating smoother cross-border innovations.

- Kikkoman Corporation

- The Kraft Heinz Company

- McCormick & Co Inc

- Unilever Plc

- Conagra Brands Inc.

- Lee Kum Kee Company Ltd.

- Nestle SA

- Foshan Haitian Flavouring & Food Ltd

- PepsiCo Inc

- Vilore Foods Company

- Kewpie Corp

- The Clorox Company

- Barilla Holding SpA

- The Campbell's Company

- Ajinomoto Co Inc

- Strauss Group Ltd

- Mizkan Holdings Co. Ltd.

- S Narendrakumar & Co

- S&B Foods Inc

- Ken's Foods Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Product innovation and flavour diversification

- 4.2.2 Rising popularity of ethnic and regional cuisines

- 4.2.3 Premium-priced clean-label formulations

- 4.2.4 Influence of Food Culture and Social Media

- 4.2.5 Rising Home Cooking and Hybrid Meal Occasions

- 4.2.6 Fortification of condiments with functional ingredients

- 4.3 Market Restraints

- 4.3.1 High sugar/salt and preservative concerns

- 4.3.2 Volatile tomato/chilli commodity prices

- 4.3.3 Regional labelling-compliance costs for exporters (under-reported)

- 4.3.4 Consumer skepticism toward additives and preservatives

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Sauces

- 5.1.1.1 Condiment Sauces

- 5.1.1.2 Cooking Sauces

- 5.1.2 Herbs and Spices

- 5.1.3 Dips

- 5.1.4 Dressings

- 5.1.5 Other Product Types

- 5.1.1 Sauces

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic/Clean-label

- 5.3 by Packaging

- 5.3.1 PET/Glass Bottles

- 5.3.2 Sachets/Pouches

- 5.3.3 Others (Tetra packs, Jars, Cups, and others)

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Sweden

- 5.5.2.11 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Nigeria

- 5.5.5.4 Egypt

- 5.5.5.5 Morocco

- 5.5.5.6 Turkey

- 5.5.5.7 South Africa

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kikkoman Corporation

- 6.4.2 The Kraft Heinz Company

- 6.4.3 McCormick & Co Inc

- 6.4.4 Unilever Plc

- 6.4.5 Conagra Brands Inc.

- 6.4.6 Lee Kum Kee Company Ltd.

- 6.4.7 Nestle SA

- 6.4.8 Foshan Haitian Flavouring & Food Ltd

- 6.4.9 PepsiCo Inc

- 6.4.10 Vilore Foods Company

- 6.4.11 Kewpie Corp

- 6.4.12 The Clorox Company

- 6.4.13 Barilla Holding SpA

- 6.4.14 The Campbell's Company

- 6.4.15 Ajinomoto Co Inc

- 6.4.16 Strauss Group Ltd

- 6.4.17 Mizkan Holdings Co. Ltd.

- 6.4.18 S Narendrakumar & Co

- 6.4.19 S&B Foods Inc

- 6.4.20 Ken's Foods Inc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK