PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871310

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871310

Sauces and Condiments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

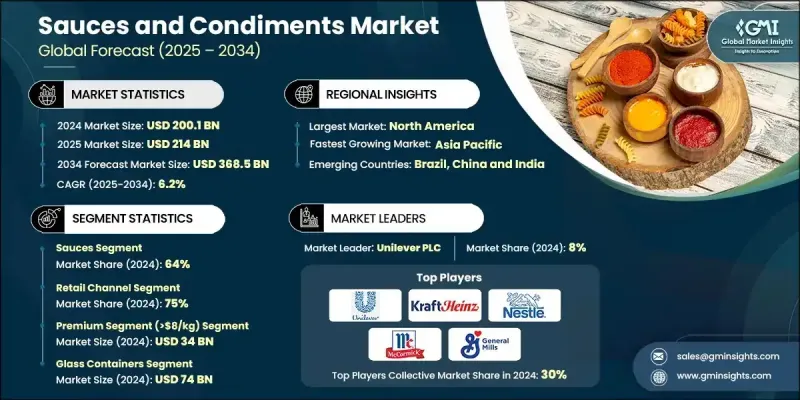

The Global Sauces and Condiments Market was valued at USD 200.1 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 368.5 billion by 2034.

This growth is driven by consumers' increasing preference for convenience and enhanced culinary experiences. With hectic lifestyles and expanding global palates, many consumers now favor ready-to-use sauces and condiments that enrich meals quickly and easily. The rising trend of home cooking and meal preparation has further fueled demand, prompting manufacturers to innovate by reformulating recipes for better taste and health benefits, exploring new ingredients, and improving packaging to align with evolving consumer needs. These factors are propelling the market forward. However, intensified competition from emerging brands and well-established companies alike is putting pressure on profit margins, as more players enter the market with aggressive pricing, novel products, and robust marketing strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $200.1 Billion |

| Forecast Value | $368.5 Billion |

| CAGR | 6.2% |

Additionally, the proliferation of private-label brands is attracting budget-conscious consumers with lower-priced options, challenging branded sauce manufacturers to maintain their market share and profitability. These private labels are not only competing on price but are increasingly focusing on improving quality, taste, and packaging, closing the gap with well-established brands. Retailers are giving more shelf space and visibility to their product lines, offering promotions and loyalty incentives that drive customer preference toward store-brand condiments. As a result, established players are under pressure to differentiate their offerings, innovate product lines, and justify premium pricing through enhanced flavor profiles, cleaner ingredient labels, and sustainable packaging. The intensifying presence of private labels is shifting the competitive landscape, forcing traditional brands to rethink their positioning strategies in an evolving, price-sensitive market.

The sauces segment held 64% share in 2024 and is projected to grow at a CAGR of 5.4% through 2034. The sauces and condiments market continues to experience strong momentum, now broadly divided into two key categories: sauces and condiments. The sauces segment accounts for many innovations, fueled by consumers' growing desire for diverse and bold flavor experiences. Convenience is another major driver, as more households and foodservice operators are opting for ready-to-use, globally inspired sauces that simplify meal preparation. From marinades and gravies to pasta and stir-fry sauces, these products have become essential pantry staples for modern consumers seeking to explore international cuisines with minimal effort while elevating everyday meals.

The retail channel captured a 75% share in 2024 and is anticipated to grow at a CAGR of 6.9% during 2025-2034. Globally, the sauces and condiments industry is segmented into retail and foodservice channels, both playing vital roles in shaping the market's overall trajectory. Retail remains the preferred purchasing avenue as consumers increasingly seek convenience, variety, and premium options. Supermarkets, hypermarkets, and online platforms serve as key access points for a wide range of sauces and condiments catering to diverse culinary preferences and dietary needs. The rise of e-commerce and online grocery shopping has significantly strengthened retail sales by enabling brands to expand reach, personalize offerings, and engage customers through targeted digital marketing strategies.

North America Sauces and Condiments Market held a 26% share in 2024. The rising popularity of international flavors is fueled by a multicultural population and widespread global travel and media consumption. This trend is reflected in the growing consumption of diverse spicy and bold condiments. The surge in social media's influence on culinary trends has made international sauces more accessible and desirable to American consumers, accelerating demand for new and exotic flavors.

Leading companies in the Global Sauces and Condiments Market include Conagra Brands, Nestle, McCormick & Company, The Kraft Heinz Company, Mars, Incorporated, Berner Foods, Kikkoman Corporation, Unilever, Bay Valley, Casa Fiesta, Fuchs Gewurze GmbH, Lee Kum Kee, Hormel Foods Corporation, and Huy Fong Foods. To solidify their market presence, companies in the sauces and condiments industry adopt several strategic approaches. Product innovation remains at the forefront, with firms continuously developing healthier, all-natural, and specialty sauces to meet shifting consumer preferences. They also invest heavily in sustainable and eco-friendly packaging solutions to align with environmental goals and appeal to eco-conscious buyers. Expanding distribution networks through both traditional retail and e-commerce channels enables broader market reach and accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Distribution channel

- 2.2.4 Price positioning

- 2.2.5 Packaging type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Health and wellness transformation

- 3.2.1.2 Premiumization and artisanal movement

- 3.2.1.3 Asia-pacific economic development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material cost volatility

- 3.2.2.2 Private label competition intensification

- 3.2.3 Market opportunities

- 3.2.3.1 E-commerce channel development

- 3.2.3.2 Consolidation and M&A value creation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.2.1 Table sauces

- 5.2.1.1 Ketchup & tomato sauces

- 5.2.1.2 Soy sauces & Asian sauces

- 5.2.1.3 Hot sauces & chili sauces

- 5.2.1.4 Specialty table sauces

- 5.2.2 Cooking sauces

- 5.2.2.1 Pasta sauces

- 5.2.2.2 Stir-fry & Asian cooking sauces

- 5.2.2.3 Curry & Indian sauces

- 5.2.2.4 Other cooking sauces

- 5.2.3 Premium/artisanal sauces

- 5.2.1 Table sauces

- 5.3 Condiments

- 5.3.1 Spreads & dressings

- 5.3.1.1 Mayonnaise & mayo-based

- 5.3.1.2 Mustard

- 5.3.1.3 Salad dressings

- 5.3.2 Pickled products

- 5.3.2.1 Pickles & relishes

- 5.3.2.2 Olives & capers

- 5.3.3 Vinegars & specialty condiments

- 5.3.1 Spreads & dressings

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Retail channel

- 6.2.1 Modern trade

- 6.2.1.1 Hypermarkets & supermarkets

- 6.2.1.2 Convenience stores

- 6.2.1.3 Warehouse clubs

- 6.2.2 Traditional trade

- 6.2.2.1 Independent grocers

- 6.2.2.2 Specialty food stores

- 6.2.3 E-Commerce

- 6.2.3.1 Pure-play e-commerce

- 6.2.3.2 Retailer online platforms

- 6.2.1 Modern trade

- 6.3 Foodservice channel

- 6.3.1 Quick service restaurants (QSR)

- 6.3.2 Full-service restaurants

- 6.3.3 Institutional (schools, hospitals, corporate)

- 6.3.4 Food processing/manufacturing

Chapter 7 Market Estimates and Forecast, By Price Positioning, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Premium segment (>$8/kg)

- 7.2.1 Artisanal/craft brands

- 7.2.2 Organic/natural

- 7.2.3 Gourmet/specialty

- 7.3 Mainstream segment ($3-8/kg)

- 7.3.1 National brands

- 7.3.2 Regional brands

- 7.4 Value segment (<$3/kg)

- 7.4.1 Private label

- 7.4.2 Economy brands

Chapter 8 Market Estimates and Forecast, By Packaging Type, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Glass containers

- 8.3 Plastic containers

- 8.4 Metal/Aluminum (cans, tubes)

- 8.5 Flexible packaging (pouches, sachets)

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Unilever PLC

- 10.2 Kraft Heinz Company

- 10.3 Nestle S.A.

- 10.4 McCormick & Company

- 10.5 General Mills

- 10.6 Kikkoman Corporation

- 10.7 Lee Kum Kee

- 10.8 Conagra Brands

- 10.9 Campbell Soup Company

- 10.10 Mizkan Holdings

- 10.11 Barilla Group

- 10.12 Orkla ASA

- 10.13 Develey Senf & Feinkost

- 10.14 Premier Foods

- 10.15 Foshan Haitian Flavouring & Food

- 10.16 Ajinomoto Co., Inc.

- 10.17 Grupo Herdez

- 10.18 La Costena

- 10.19 Borges International Group

- 10.20 Yeo Hiap Seng