PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665432

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665432

Sauces, Dressings, and Condiments Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

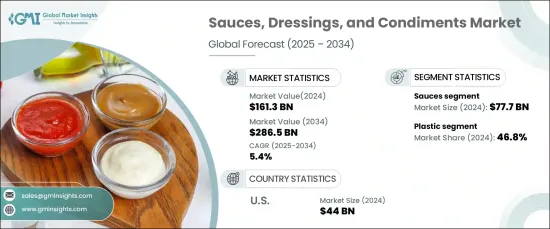

The Global Sauces, Dressings, And Condiments Market was valued at USD 161.3 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. This growth is fueled by changing consumer preferences, including a desire for convenience, diverse flavors, and premium products. The demand for packaged items has increased significantly due to busier lifestyles, with plastic packaging emerging as a popular choice for its affordability and user-friendly design. Glass packaging, often linked to premium brands, maintains its appeal while cartons are commonly used for larger volumes, and food service purposes.

The market is evolving as health-conscious consumers seek organic and natural alternatives, driving innovations in flavor combinations and ingredient choices. Online platforms are becoming a key sales channel as digital shopping gains popularity, though traditional retail remains dominant. Interest in environmentally friendly options and sustainable packaging solutions further supports market growth. Despite challenges such as pricing concerns and regional preferences, the industry's resilience stems from its ability to adapt to emerging trends and consumer needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $161.3 Billion |

| Forecast Value | $286.5 Billion |

| CAGR | 5.4% |

In 2024, the sauces segment accounted for USD 77.7 billion in revenue, making it the largest contributor to the market. Sauces are increasingly favored for their ability to enhance everyday meals and cater to the growing popularity of quick-preparation and ready-to-eat foods. Rising interest in global cuisines has amplified their appeal, while advancements in healthier and premium formulations have further spurred demand. As a result, sauces play a crucial role in driving overall market growth.

Plastic packaging represented 46.8% of the market share in 2024, making it the most widely used material due to its lightweight design, cost efficiency, and adaptability. Features such as squeezable bottles and resealable pouches make plastic highly practical for both retail and food service uses. Efforts to address environmental concerns through innovations in recyclable and biodegradable plastics continue to bolster its popularity. Compared to glass and carton packaging, plastic stands out for its versatility and convenience.

The online distribution channel is witnessing rapid growth, driven by the expanding presence of e-commerce platforms and changing consumer shopping habits. The convenience of online purchasing, coupled with product variety and home delivery, has made this segment highly attractive. Enhanced logistics and secure digital payment systems further support the channel's rise, even as traditional retail remains the primary mode of distribution.

In the United States, the sauces, dressings, and condiments market generated over USD 44 billion in 2024. Consumer interest in ready-to-use food products, alongside rising demand for health-focused and innovative options, has propelled growth. Additionally, advancements in sustainable packaging and digital shopping solutions are shaping the market's future trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for convenience

- 3.6.1.2 Health and wellness trends

- 3.6.1.3 Expanding E-commerce platforms

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price sensitivity

- 3.6.2.2 Flavor preferences and regional differences

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.2.1 Tomato-based

- 5.2.2 Soy-based

- 5.2.3 Chili-based

- 5.2.4 Cream-based

- 5.2.5 Others

- 5.3 Dressings

- 5.3.1 Mayonnaise and creamy dressings

- 5.3.2 Yogurt-based dressings

- 5.3.3 Oil-based dressings

- 5.3.4 Others

- 5.4 Condiments

- 5.4.1 Relishes

- 5.4.2 Pickles

- 5.4.3 Others

Chapter 6 Market Estimates & Forecast, By Packaging Material, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Glass

- 6.3 Plastic

- 6.4 Cartons

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.1.1 Online

- 7.1.1.1 E-commerce platform

- 7.1.1.2 Brand websites

- 7.1.2 Offline

- 7.1.2.1 Super market

- 7.1.2.2 Convenient

- 7.1.2.3 Specialty

- 7.1.2.4 Others

- 7.1.1 Online

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Apis India

- 9.2 Heinz

- 9.3 Hellmann’S

- 9.4 Kikkoman India

- 9.5 Kissan

- 9.6 Nestle

- 9.7 Nutralite

- 9.8 Orchard Lane

- 9.9 Tops

- 9.10 Unilever

- 9.11 Veeb