Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683789

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683789

Speed Pedelec E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029)

PUBLISHED:

PAGES: 326 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

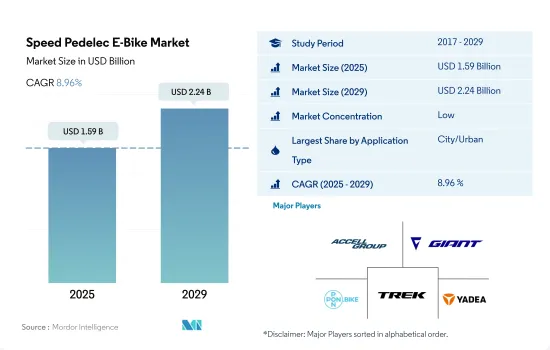

The Speed Pedelec E-Bike Market size is estimated at 1.59 billion USD in 2025, and is expected to reach 2.24 billion USD by 2029, growing at a CAGR of 8.96% during the forecast period (2025-2029).

- Electric bicycles are rapidly becoming more popular globally, with the increasing trend of more people buying e-bikes for transportation and commuting. Previously, people used mountain bikes or trekking bikes for this purpose. However, the preference for e-bikes is growing, as they are more suited for commuting and can be more easily used in wintertime, especially in big towns. According to a recent study published in the journal of Transportation Research, Norwegian e-bike riders more than quadrupled their daily use of the bicycle for transport over six months. After buying an e-bike, riders covered 9.2 km (5.7 miles) per day on average, up from 2.1 km (1.3 miles) per day before their purchase.

- The primary driver of the market's expansion is a rise in young people's awareness of exercise and health. The market for pedelecs is expanding due to reasons like rising consumer health awareness, growing traffic congestion problems, and growing environmental consciousness. These e-bikes are practical and simple to charge, and easy to operate. Due to these factors, the demand for speed pedelec e-bikes increased in 2021 and 2022.

- Players in the e-bike industry are working to introduce cutting-edge technological innovations, including intelligent control systems, which may be used to implement automatic or semi-automatic transmission for speed pedelecs that have the best energy efficiency. The growing demand for recreational activities like off-road cycling and the demand for speed pedelecs are likely to drive the demand for above 250 W e-bikes during the forecast period.

Country Level Overview

- The global e-bike market is expected to be mainly driven by the increasing adoption of electric bikes as a daily mode of transportation globally. Additionally, the market is seeing an upsurge in the unit sales of electric bikes owing to their benefits, such as health benefits, economic mobility, and convenience in riding.

- In the APAC e-bike market, unit sales amounted to around 34.8 million in 2023. China, Japan, and Indonesia accounted for the majority of unit sales during the historical period. China accounted for over a 90% share by volume in the global electric bike market in 2022. However, the Chinese e-bike market has been witnessing growth stagnate in recent years and is almost at saturation point.

- In Europe, electric bike sales have skyrocketed in recent years, with countries including Germany, Belgium, and the Netherlands selling large numbers of electric bikes. The sales are being driven by consumers' growing preference for using electric bikes for transportation, sports, and leisure activities. Additionally, the subsidies and tax incentives programs for electric bikes in Sweden, Belgium, and France are expected to support the significant growth of the European electric bike market during the forecast period.

- In North America, the electric bike market is currently at an early growth stage as people's preference for using low-speed two-wheelers has increased only in recent years. The inclusion of more electric bikes by various bike-sharing operators as part of their fleet expansion is expected to support the sales growth of these bikes in the near future.

Global Speed Pedelec E-Bike Market Trends

The steady global increase in e-bike adoption rates reflects a worldwide shift toward sustainable and efficient personal mobility solutions

- There has been an increase in the demand for electric bicycles in many countries over the past several years. Increased gasoline costs, traffic congestion during rush hours, and the health advantages of exercise are driving the adoption of e-bikes in several countries, including the United Kingdom and the United States. With a greater adoption rate in 2019 compared to other regions, Europe was the primary market for the sales of electric bikes. The increasing demand for e-bikes accelerated the adoption rate in 2019 compared to 2018.

- The bicycle industry was favorably impacted by the rapid global expansion of COVID-19 cases. E-bikes are one of the most practical and affordable solutions for everyday commutes to work and other local locations compared to other means of transportation, which has revolutionized how consumers commute. This has encouraged people to invest in e-bikes, which accelerated their adoption rate in 2020 over 2019 in various countries worldwide.

- The return of commercial operations and the lifting of trade restrictions like lockouts have accelerated the adoption of e-bikes in numerous countries throughout the world. The improvement of import and export activities has been a result of the removal of trade obstacles globally. According to estimates, during the forecast period, the adoption rate of e-bikes will increase in a number of countries worldwide due to consumers' growing interest in them as a result of their features and advantages, such as the ability to exercise while riding, the lack of fuel costs, and cleaner rides.

A global uptick in 5-15 km commutes underscores a universal shift towards moderate commuting distances, aligning with evolving work-life dynamics and urban planning.

- The global bicycle market is made up of several bicycle-friendly regions, including North America, Europe, and Asia-Pacific. Bicycle demand has grown recently among many countries in various regions. People from different countries and regions are gradually shifting to using bicycles for their everyday commutes of 5 to 15 km or other nearby locations such as offices and commercial districts. The APAC region has witnessed the most daily commuters traveling 5 to 15 km among all regions.

- Following the COVID-19 outbreak, which forced the closing of gyms and public transportation in several countries worldwide, many people discovered bicycles to be a secure and isolated method of transportation. People also preferred to exercise during the pandemic by bicycling or going on weekend runs to neighboring sites, which led to an increase in the number of commuters with a daily journey distance of 5 to 15 km in 2020 over 2019 globally. Consumers who commute 5 to 15 km daily are drawn to e-bikes with cutting-edge battery packs that offer an increased range of up to 40 to 45 km.

Speed Pedelec E-Bike Industry Overview

The Speed Pedelec E-Bike Market is fragmented, with the top five companies occupying 29.69%. The major players in this market are Accell Group, Giant Manufacturing Co. Ltd., Pon Holding B.V., Trek Bicycle Corporation and Yadea Group Holdings Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93670

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Number Of Trekkers

- 4.12 Battery Charging Capacity

- 4.13 Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Application Type

- 5.1.1 Cargo/Utility

- 5.1.2 City/Urban

- 5.1.3 Trekking

- 5.2 Battery Type

- 5.2.1 Lead Acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Others

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Japan

- 5.3.2.1.5 New Zealand

- 5.3.2.1.6 South Korea

- 5.3.2.1.7 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 Austria

- 5.3.3.1.2 Belgium

- 5.3.3.1.3 Czech Republic

- 5.3.3.1.4 Denmark

- 5.3.3.1.5 Finland

- 5.3.3.1.6 France

- 5.3.3.1.7 Germany

- 5.3.3.1.8 Italy

- 5.3.3.1.9 Luxembourg

- 5.3.3.1.10 Netherlands

- 5.3.3.1.11 Norway

- 5.3.3.1.12 Poland

- 5.3.3.1.13 Spain

- 5.3.3.1.14 Sweden

- 5.3.3.1.15 Switzerland

- 5.3.3.1.16 UK

- 5.3.3.1.17 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Saudi Arabia

- 5.3.4.1.2 United Arab Emirates

- 5.3.4.1.3 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 US

- 5.3.5.1.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group

- 6.4.2 Aima Technology Group Co. Ltd

- 6.4.3 Cycling Sports Group, Inc.

- 6.4.4 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

- 6.4.5 Giant Manufacturing Co. Ltd.

- 6.4.6 Kalkhoff Werke GmbH

- 6.4.7 Merida Industry Co. Ltd

- 6.4.8 Pon Holding B.V.

- 6.4.9 Riese & Muller

- 6.4.10 Royal Dutch Gazelle

- 6.4.11 Specialized Bicycle Components

- 6.4.12 Tianjin Fuji-Ta Bicycle Co. Ltd.

- 6.4.13 Trek Bicycle Corporation

- 6.4.14 VanMoof BV

- 6.4.15 Yadea Group Holdings Ltd.

- 6.4.16 Yamaha Motor Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.