PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911742

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911742

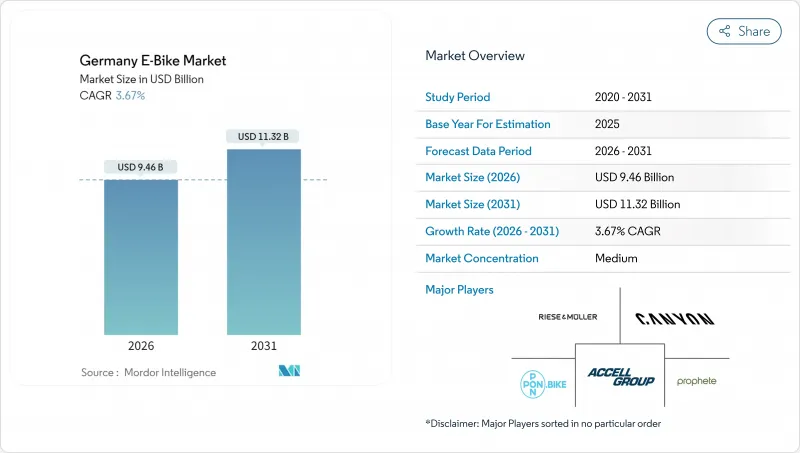

Germany E-Bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The German E-Bike market is expected to grow from USD 9.13 billion in 2025 to USD 9.46 billion in 2026 and is forecast to reach USD 11.32 billion by 2031 at 3.67% CAGR over 2026-2031.

Demand normalization after the pandemic surge now pivots growth toward steady replacement cycles, commercial fleet expansions, and incremental first-time adoption. Battery regulation, corporate mobility budgets, and improving infrastructure sustain forward momentum even as average selling prices stabilize. Competitive dynamics reflect consolidation, inventory rebalancing, and a decisive shift from volume chasing to profitability, yet the German E-Bike market continues to capture a notable share of total bicycle sales as of 2024.

Germany E-Bike Market Trends and Insights

Urban Congestion-Driven Modal Shift

Germany's Federal Government has unveiled the National Cycling Plan (NCP) 3.0, a strategic initiative aimed at promoting cycling across the nation, with a vision extending to 2030. NCP 3.0's primary objective is to enhance the appeal and safety of cycling in Germany, thereby aiming for a substantial uptick in the distance covered by cyclists . E-bikes, although forming a smaller portion of the total fleet, play a disproportionately significant role in overall bicycle usage. Protected lanes in Munich are set to reach 1,200 km by 2025, enabling commutes once considered car-only. Longer range, hill-flattening assistance, and lower weather sensitivity explain why urban residents substitute cars with e-bikes more often than with acoustic bikes.

Corporate Mobility-Budget Leasing

Germany's corporate bike-leasing boom is largely driven by fiscal policy. A 2019 amendment to the Income Tax Act, which allows employees leasing bicycles or e-bikes through salary sacrifice to treat only a small portion of the manufacturer's list price as a monthly taxable benefit. The National Cycling Plan 3.0 highlights company-bike leasing as a "key action" to shift work-related travel from cars. They estimate a substantial annual CO2 saving if a significant portion of short commutes transitions to bicycles or e-bikes. Through gross-salary leasing, employees enjoy significant savings on bike models. Employers value the predictability of monthly deductions, while suppliers appreciate the stability of bulk contracts, which are less vulnerable to retail fluctuations.

High Upfront Cost Post-Subsidy

In 2024, consumers became increasingly price-conscious, with many opting to delay significant discretionary purchases, according to surveys. In 2024, average retail prices declined, but many mainstream buyers still perceive a specific price point as a psychological ceiling. Without nationwide incentives, Germany ranks below neighboring France on net purchase support, encouraging cross-border shopping in border towns.

Other drivers and restraints analyzed in the detailed report include:

- Battery and Motor Technology Advances

- Government Purchase Incentives

- Domestic Battery-Cell Supply Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pedal-assisted systems generated 79.35% of the Germany E-Bike market in 2025, benefiting from a bicycle-equivalent legal status that avoids insurance and license requirements. Speed Pedelecs post a 3.76% CAGR as commuters seek 45 km/h cruising on longer routes. This segment will contribute disproportionately to the expansion of the German e-bike market between 2026 and 2031.

Regulatory debate on EPAC definitions adds forecast volatility. ZIV's proposal to cap peak power at 750 W and maintain a 1:4 assist ratio aims to preserve the non-motor-vehicle classification. Advocacy group LEVA-EU counters that tighter rules would restrain cargo innovation. A decision expected in 2026 could widen or narrow the addressable market for high-assist bicycles, directly influencing Germany's E-Bike market share trajectories.

City/Urban riding held 70.92% of 2025 revenue, but the cargo/utility segment is on track for a 3.74% CAGR to 2031, the top growth lane within the German E-Bike market. Cargo/Utility usage follows closely as parcel companies and grocery platforms electrify last-mile fleets to meet city emission zones.

In 2024, the industry experienced significant growth in cargo units, reflecting a notable year-on-year increase, with many fleets now spec 1,000 Wh batteries to secure a full shift without midday recharging. Combined with diesel vehicle bans in Berlin, fleet orders promise steady demand inflows that stabilize quarterly shipment cycles previously driven by consumer seasonality.

Lithium-ion packs represented 99.82% of 2025 shipments and will chart a parallel 3.67% CAGR through 2031, underpinning most gains in the German E-Bike market size. Alternative chemistries remain relegated to sub-USD 1,000 entry bikes or experimental solid-state pilots.

The EU Battery Regulation introduces mandatory digital passports from February 2027 and collection targets of 51% by 2028. These measures institutionalize circular-economy practices, reinforcing lithium-ion incumbency while encouraging European cell production to cut embedded scope-3 emissions and lower transport risk.

The Germany E-Bike Market Report is Segmented by Propulsion Type (Pedal Assisted, Speed Pedelec, and More), Application Type (Cargo/Utility, City/Urban, and More), Battery Type (Lead Acid Battery, Lithium-Ion Battery, and More), Motor Placement (Hub (Front/Rear), Mid-Drive), Drive Systems, Motor Power, Price Band, Sales Channel, and End Use. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Accell Group

- Canyon Bicycles GmbH

- CUBE Bikes

- Giant Manufacturing Co. Ltd.

- KTM Fahrrad GmbH

- Merida Industry Co. Ltd.

- Pon Holdings B.V.

- Prophete In Moving GmbH

- Riese & Muller GmbH

- Specialized Bicycle Components, Inc.

- Winora Staiger GmbH

- Bulls Bikes (ZEG)

- STEVENS Vertriebs GmbH

- Moustache Bikes

- Urban Arrow

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Key Industry Trends

- 4.1 Annual Bicycle Sales

- 4.2 Average Selling Price & Price-Band Mix

- 4.3 Cross-Border Trade in E-Bikes & Parts

- 4.4 E-Bike Share of Total Bicycle Sales

- 4.5 Commuters with 5-15 km One-Way Trips (%)

- 4.6 Bicycle/E-Bike Rental Market Size

- 4.7 E-Bike Battery Pack Price

- 4.8 Battery Chemistry Price Comparison

- 4.9 Last-Mile (Hyper-Local) Delivery Volume

- 4.10 Protected Bicycle Lanes (km)

- 4.11 Trekking/Outdoor Activity Participation

- 4.12 E-Bike Battery Capacity (Wh)

- 4.13 Urban Traffic Congestion Index

- 4.14 Regulatory Framework

- 4.14.1 Homologation & Certification of E-Bicycles

- 4.14.2 Export-Import & Trade Regulation

- 4.14.3 Classification, Road Access and User Rules

- 4.14.4 Battery, Charger and Charging Safety

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Urban Congestion-Driven Modal Shift

- 5.2.2 Corporate Mobility-Budget Leasing

- 5.2.3 Battery and Motor Technology Advances

- 5.2.4 Government Purchase Incentives

- 5.2.5 Environmental Awareness and CO2 Targets

- 5.2.6 Tourism-Driven E-MTB Trail Expansion

- 5.3 Market Restraints

- 5.3.1 High Upfront Cost Post-Subsidy

- 5.3.2 Domestic Battery-Cell Supply Risk

- 5.3.3 After-Sales Workshop Bottlenecks

- 5.3.4 Rising Theft-Insurance Premiums

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Suppliers

- 5.7.3 Bargaining Power of Buyers

- 5.7.4 Threat of Substitutes

- 5.7.5 Competitive Rivalry

6 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 6.1 By Propulsion Type

- 6.1.1 Pedal Assisted

- 6.1.2 Speed Pedelec

- 6.1.3 Throttle Assisted

- 6.2 By Application Type

- 6.2.1 Cargo/Utility

- 6.2.2 City/Urban

- 6.2.3 Trekking/Mountain

- 6.3 By Battery Type

- 6.3.1 Lead Acid Battery

- 6.3.2 Lithium-ion Battery

- 6.3.3 Others

- 6.4 By Motor Placement

- 6.4.1 Hub (Front/Rear)

- 6.4.2 Mid-Drive

- 6.5 By Drive Systems

- 6.5.1 Chain Drive

- 6.5.2 Belt Drive

- 6.6 By Motor Power

- 6.6.1 Below 250 W

- 6.6.2 251-350 W

- 6.6.3 351-500 W

- 6.6.4 501-600 W

- 6.6.5 Above 600 W

- 6.7 By Price Band

- 6.7.1 Up to USD 1,000

- 6.7.2 USD 1,000-1,499

- 6.7.3 USD 1,500-2,499

- 6.7.4 USD 2,500-3,499

- 6.7.5 USD 3,500-5,999

- 6.7.6 Above USD 6,000

- 6.8 By Sales Channel

- 6.8.1 Online

- 6.8.2 Offline

- 6.9 By End Use

- 6.9.1 Commercial Delivery

- 6.9.1.1 Retail and Goods Delivery

- 6.9.1.2 Food and Beverage Delivery

- 6.9.2 Service Providers

- 6.9.3 Personal and Family Use

- 6.9.4 Institutional

- 6.9.5 Others

- 6.9.1 Commercial Delivery

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 7.4.1 Accell Group

- 7.4.2 Canyon Bicycles GmbH

- 7.4.3 CUBE Bikes

- 7.4.4 Giant Manufacturing Co. Ltd.

- 7.4.5 KTM Fahrrad GmbH

- 7.4.6 Merida Industry Co. Ltd.

- 7.4.7 Pon Holdings B.V.

- 7.4.8 Prophete In Moving GmbH

- 7.4.9 Riese & Muller GmbH

- 7.4.10 Specialized Bicycle Components, Inc.

- 7.4.11 Winora Staiger GmbH

- 7.4.12 Bulls Bikes (ZEG)

- 7.4.13 STEVENS Vertriebs GmbH

- 7.4.14 Moustache Bikes

- 7.4.15 Urban Arrow

8 Market Opportunities & Future Outlook

9 Key Strategic Questions for E-Bikes CEOs