PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694039

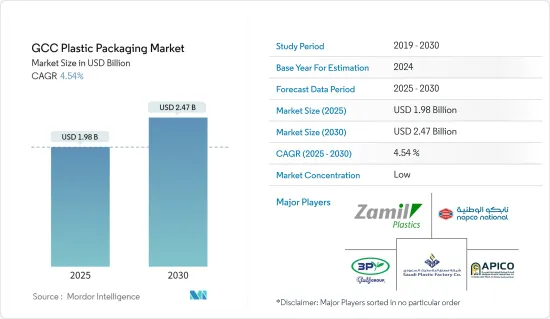

GCC Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The GCC Plastic Packaging Market size is estimated at USD 1.98 billion in 2025, and is expected to reach USD 2.47 billion by 2030, at a CAGR of 4.54% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 1.75 thousand kilotons in 2025 to 2.14 thousand kilotons by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

Key Highlights

- The plastics industry supports sustainability and the circular economy concept in various sectors by lowering regional dependence on scarce natural resources and achieving alignment with the GCC national visions of sustainable long-term growth. With a focus on the circular economy, up to 95% of plastic material value can be saved along its lifecycle. The drive toward a circular economy has accelerated rapidly in the last few years, with many regional companies adopting circular business models and innovation strategies to guarantee manufacturers access to more sustainable materials.

- In September 2023, the Gulf Petrochemicals and Chemicals Association (GPCA) and the GCC Accreditation Center (GAC) signed a Memorandum of Understanding (MoU). Their collaboration focuses on assessment and accreditation, aiming to foster sustainable solutions. These solutions aim to bolster the quality infrastructure within the Gulf Cooperation Council (GCC), encompassing nations like Saudi Arabia, Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates (UAE).

- The MoU will establish a framework to enhance the efficiency of conformity assessment processes in the region and guarantee that chemical and petrochemical products and processes meet specified standards and regulations. The agreement will also involve adopting a management to address the leakage of plastic waste into marine environments.

- The cosmetics and beauty industry in GCC countries is rapidly growing due to urbanization, demographic growth, and increasing consumer spending. Fueled by digitalization, the Gulf countries offer growth opportunities with the increasing online shopping trend among young consumers.

- The food industry in the GCC region recovered after the pandemic. The growing population, coupled with the increasing number of working professionals and a high proportion of expatriates, is a significant driver for the region's food industry. Growing awareness of healthy eating habits of consumers in the region seeking high nutritional value has led to rising demand for fresh and organic food items. The use of plastic containers and pouches for food packaging, as pouches are low in weight and high in strength, drives the demand for plastic packaging.

- Plastic is one of the most used polymers in GCC as it can change and adapt its shape, offering opportunities for making bottles, pouches, bags, and other products. The availability of plastic substitutes essentially for packaging can hamper market growth. Consumers in GCC countries, particularly in Saudi Arabia and the United Arab Emirates, are increasingly becoming environmentally conscious owing to rising environmental concerns. This is influencing their purchase decisions regarding the materials used in product packaging.

- Plastic packaging is a crucial aspect in various end-use industries, including food and beverage, pharmaceutical, cosmetics, personal care, and industrial in the GCC region. Demand for sustainable packaging solutions produced from recycled or renewable sources in the region is an impactful way for manufacturers to promote eco-friendly solutions to customers.

GCC Plastic Packaging Market Trends

Berlin Leads in Total Warehousing Take-up

- The GCC region's food industry is rapidly expanding, primarily fueled by a surge in the demand for packaged and processed foods. Millennials, known for their preference for on-the-go and single-serving foods, are propelling the need for flexible food packaging.

- GCC countries, notably the UAE and Saudi Arabia, are witnessing a surge in the production of flexible plastic packaging, particularly stand-up pouches. These pouches cater to a variety of snacked foods, ranging from chips and cookies to bars and pretzels. The region's affinity for pouches and bags for snacked food packaging is further bolstered by a culture that embraces snacking at any time, contributing significantly to market growth.

- As the GCC's food consumption rises, so does the demand for flexible plastic packaging, especially for baked goods like bread, cakes, and pastries. This demand is further accentuated by a growing consumer emphasis on healthy eating, particularly favoring fresh and clean-label baked products.

- With a rising population in GCC nations showing a penchant for meat, seafood, and poultry, the demand for flexible plastic packaging is rising. Data from the Government of Canada underscores this trend, attributing it to factors like population growth, increased tourism, and urbanization.

- In addition, food and beverage manufacturers are making significant efforts to provide sustainable materials and packaging, functional and convenient displays, and healthier and fresh food options to meet consumer demand.

- Plastic bags are becoming increasingly popular among food manufacturers. Consumer expectations are changing owing to sustainability and customization, which drive innovation in flexible plastic packaging. The GCC food market is expected to cross USD 160 billion by 2029.

Fashion and Apparel Segment to Lead in Revenue

- Saudi Arabia, a cornerstone of the GCC's packaging industry, owes much of its economic activity to the oil and gas sector. With a surge in production across sectors like food, retail, and pharmaceuticals, the demand for flexible plastic packaging in the nation is on the rise.

- As Saudi Arabia witnesses a rise in its restaurant count, its food manufacturing sector reaps the benefits of a growing population, rising incomes, evolving lifestyles, and supportive trade agreements. This has fueled a heightened demand for disposable packaged foods, attracting a wave of multinational corporations to the market.

- According to the IMF, the total population of Saudi Arabia from 2019, with projections of 2029, is growing rapidly. In 2023, Saudi Arabia's total population amounted to 32.82 million inhabitants; by 2029, the total population would be 36.96 million.

- Highlighted by the Ministry of Commerce and Industry, Saudi Arabia's soft drinks and beverage sectors stand as stalwarts, commanding a significant share of the nation's food and beverage exports. Notably, many manufacturers are enhancing their packaging with EVOH films, leveraging their cost-effectiveness and robust seal strength. These films, prized for their ability to preserve food properties and safeguard against contamination during transit, are becoming a staple in food packaging solutions.

- The recent plastic regulations in Saudi Arabia are set to impact a broad spectrum of products, including stretch films, shrink films, cling films, and various other flexible plastic packaging items. Mandated by the Saudi Standards, Metrology, and Quality Organization (SASO), plastic exports must adhere to stringent guidelines, necessitating the use of approved oxo-biodegradable materials.

- An increase in disposable income, ease of availability, improvement in living standards, wide variety, increasing tourism, and domestic and international players in the market are expected to fuel the beverage industry in the country, thereby driving the market studied. PET manufactures plastic bottles for soft drinks, water, juices, and sports drinks. There is a growing demand for PET bottles in the beverage industry due to their lightweight properties. Market vendors are increasingly focusing on the urgency of recycling PET into food-grade products, such as beverage containers. For instance, The Coca-Cola Company intends to use 50% recycled PET in its containers by 2030.

GCC Plastic Packaging Industry Overview

The GCC plastic packaging market is fragmented with the presence of major players like Zamil Plastics Industries Inc., Napco National, Saudi Plastic Factory Company, 3P Gulf Group, and Arabian Plastic Industrial Company Limited (APICO). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

May 2024 - Napco National announced the expansion of its packaging division with the strategic acquisition of Alsharq Plas LLC, a UAE-based brand that will be rebranded as Napco Sharq Plas LLC. The strategic acquisition will likely help both companies to provide high-quality solutions to the evolving customer requirements in the GCC region. In addition, the acquisition will likely expand the company's market share in the region.

May 2024 - Huhtamaki, a player in the Flexible Packaging sector, streamlined its operations in the United Arab Emirates. The company plans to centralize its manufacturing, opting to retain its Jebel Ali factory while significantly expanding its Ras Al Khaimah facility. This strategic move is set to progressively throughout the second half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 GCC PLASTICS INDUSTRY LANDSCAPE

- 4.1 Current State of the Industry

- 4.2 Production Landscape for Plastics

- 4.2.1 Current Production Capacities of Key Countries - Kingdom of Saudi Arabia, United Arab Emirates, Qatar, Kuwait, etc.

- 4.2.2 Plastic Production by Resin Type

- 4.2.3 Local Plastic Consumption in Key GCC Countries

- 4.2.4 Plastic Demand by Key Industries - Packaging Vs Others (Construction, Textiles, etc.)

- 4.2.5 Plastic Demand by Resin Type

- 4.2.6 Key Regulations in North America and Europe on Sustainability and Their Impact on Plastic Producing Countries in the GCC Region

5 GCC PLASTIC PACKAGING MARKET

- 5.1 Market Overview and Current Market Trends

- 5.2 Plastic Packaging Production Analysis and Trade Scenario in the GCC Region

- 5.3 Market Dynamics

- 5.3.1 Market Driver Analysis

- 5.3.1.1 Growing Cosmetics and Personal Care Industry in the Region

- 5.3.1.2 Proliferation of HoReCa and Food Industry in GCC Countries

- 5.3.2 Market Restraint Analysis

- 5.3.2.1 Threat of Potential Substitutes

- 5.3.3 Market Opportunities

- 5.3.1 Market Driver Analysis

- 5.4 MARKET SEGMENTATION

- 5.4.1 Flexible Plastic Packaging

- 5.4.1.1 Resin Type

- 5.4.1.1.1 Polyethylene (PE)

- 5.4.1.1.2 Polyethylene Terephthalate (PET)

- 5.4.1.1.3 Polypropylene (PP)

- 5.4.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.4.1.1.5 Polyvinyl Chloride (PVC)

- 5.4.1.1.6 Other Resin Types

- 5.4.1.2 Product Type

- 5.4.1.2.1 Pouches

- 5.4.1.2.2 Bag

- 5.4.1.2.3 Films and Wraps

- 5.4.1.2.4 Other Product Types

- 5.4.1.3 End-use Industries

- 5.4.1.3.1 Food

- 5.4.1.3.2 Beverages

- 5.4.1.3.3 Pharmaceuticals and Healthcare

- 5.4.1.3.4 Personal Care and Cosmetics

- 5.4.1.3.5 Household Care

- 5.4.1.3.6 Other End-use Industries

- 5.4.1.4 Country

- 5.4.1.4.1 Saudi Arabia

- 5.4.1.4.2 United Arab Emirates

- 5.4.1.4.3 Rest of GCC

- 5.4.2 Rigid Plastic Packaging

- 5.4.2.1 Resin Type

- 5.4.2.1.1 Polypropylene (PP)

- 5.4.2.1.2 Polyethylene Terephthalate (PET)

- 5.4.2.1.3 Polyethylene (PE)

- 5.4.2.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.4.2.1.5 Other Resin Types

- 5.4.2.2 Product Type

- 5.4.2.2.1 Bottles and Jars

- 5.4.2.2.2 Trays and Containers

- 5.4.2.2.3 Caps and Closures

- 5.4.2.2.4 Other Product Types

- 5.4.2.3 By End-use Industries

- 5.4.2.3.1 Food

- 5.4.2.3.2 Foodservice

- 5.4.2.3.3 Beverages

- 5.4.2.3.4 Pharmaceuticals and Healthcare

- 5.4.2.3.5 Personal Care and Cosmetics

- 5.4.2.3.6 Household Care

- 5.4.2.3.7 Other End-use Industries

- 5.4.2.4 Country

- 5.4.2.4.1 Saudi Arabia

- 5.4.2.4.2 United Arab Emirates

- 5.4.2.4.3 Rest of GCC

- 5.4.1 Flexible Plastic Packaging

- 5.5 Sustainability and Substitution Analysis

- 5.5.1 Impact of Sustainability on Plastic Packaging in the Region

- 5.5.2 Plastic Packaging Waste Generation and Recycling Trends

- 5.5.3 Analysis of Key Materials Substituting Plastic Resins in the Packaging Industry - Paper and Paperboard, Metal, and Glass

- 5.5.4 Future of Biodegradable, Compostable, and Recyclable Plastics in the Packaging Industry - PLA, PHA, etc.

- 5.5.5 Future Outlook of the Market for Plastics in Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Zamil Plastics Industries Inc.

- 6.1.2 Napco National

- 6.1.3 Saudi Plastic Factory Company

- 6.1.4 3P Gulf Group

- 6.1.5 Arabian Plastic Industrial Company Limited (APICO)

- 6.1.6 Packaging Products Company (PPC)

- 6.1.7 AL Rashid Industrial Co.

- 6.1.8 Takween Plastics Industries

- 6.1.9 NPF Advanced Plastic Solutions

- 6.1.10 Falcon Pack

- 6.1.11 Hotpack Industries LLC

- 6.1.12 ENPI Group

- 6.1.13 Amber Packaging Industries LLC

- 6.1.14 Precision Group

- 6.1.15 Emirates Printing Press LLC

- 6.1.16 Hutamaki Flexibles UAE

- 6.1.17 Gulf East Paper and Plastic Industries LLC

- 6.1.18 Radiant Packaging LLC

- 6.1.19 Cosmoplast Industrial Company LLC

- 6.1.20 Interplast (Harwal Group of Companies

- 6.1.21 Integrated Plastic Packaging LLC

- 6.1.22 IFFCO Group

- 6.1.23 Premier Plastic Company (PPC)

- 6.1.24 Oman Plastic LLC

- 6.1.25 Manama Packaging Industry WLL

- 6.1.26 Madayn Plastic Company

- 6.1.27 Al Amoudi Plastic Factory

- 6.1.28 Asia Petrochemicals LLC

- 6.1.29 Carbokene FZE

- 6.1.30 Polytec Masterbatch LLC

- 6.1.31 Saudi Basic Industries Corporation (SABIC)

- 6.1.32 Qatar Petrochemical Company (QAPCO)

- 6.2 Heat Map Analysis by Country

- 6.3 Company Categorization Analysis - Emerging Vs Established Companies

- 6.4 Key Mergers and Acquisitions

- 6.5 Company Market Share/Ranking Analysis

- 6.5.1 Top 10 Companies Ranking Analysis Based on Sales Revenue

- 6.5.2 Top 10 Companies in GCC Plastic Packaging Market

7 FUTURE OUTLOOK OF THE MARKET