PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629770

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629770

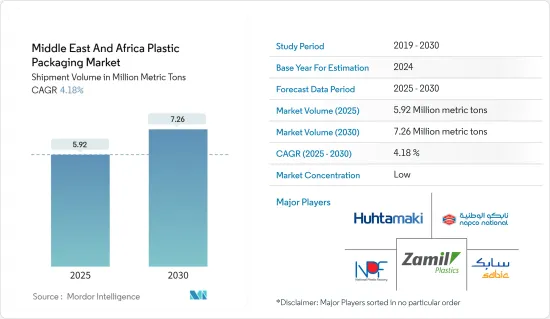

Middle East And Africa Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East And Africa Plastic Packaging Market size in terms of shipment volume is expected to grow from 5.92 million metric tons in 2025 to 7.26 million metric tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- As consumer preferences increasingly lean towards health-conscious and sustainable products, and with evolving regulations in the Middle East and Africa, professionals in plastic packaging are feeling the pressure to innovate. They are adjusting materials, designs, and technologies to align with these shifting demands.

- The beverage sector, buoyed by a rise in bottled water and soft drink consumption, emerges as the dominant end-user of plastic packaging. A recent study by researchers from the UAE and Egypt unveiled a striking trend: even with the UAE's stringent municipal water quality standards, over 80% of participants opted for bottled plain drinking water.

- Oxo-degradable plastics are on the rise. Countries in the Middle East and Africa, such as the UAE, Saudi Arabia, Yemen, Ivory Coast, South Africa, Ghana, and Togo, are not only endorsing oxo-degradable plastics but some have even made their use mandatory.

- With East and West Africa witnessing booming domestic economies, a surge in consumer markets, rising incomes, and a youthful demographic, the continent is emerging as a pivotal hub for the plastic packaging industry.

- Regional government agencies are backing projects aimed at curbing carbon emissions and energy consumption, signaling a positive outlook for the market. For example, in February 2024, Qatar's Ministry of Municipality (MoM) began offering recyclable materials at no cost to local recycling factories, underscoring their commitment to sustainability and a circular economy.

- In another move, December 2023 saw the Alliance to End Plastic Waste ink a Memorandum of Understanding (MoU) with Saudi Investment Recycling Company (SIRC) in Dubai. This strategic collaboration is set to roll out effective waste management solutions in Saudi Arabia, specifically addressing challenges linked to certain plastics.

- New materials, set to gradually take the place of conventional plastics, present a challenge for market vendors. Furthermore, growing environmental concerns and a rising demand for sustainable packaging, such as those crafted from paper, could pose hurdles to the market's growth.

Middle East And Africa Plastic Packaging Market Trends

Flexible Packaging is Expected to Witness Significant Growth

- Countries like Saudi Arabia, the United Arab Emirates and Egypt are primarily fueling the rising demand for pharmaceutical packaging in the Middle East and Africa. This emphasis and a growing demand for flexible plastic solutions, particularly pouches across various industries, propel the market's expansion.

- With a rising demand for structured packaging, the sector is poised for significant volume growth during the forecast period. Furthermore, as meat and dairy consumption increases, so will the demand for plastic packaging. All these factors contribute to the burgeoning market for flexible plastic packaging.

- Middle Eastern manufacturers of plastic bags and pouches are expected to benefit from access to cost-effective feedstock and raw materials, such as crude oil and polypropylene. This advantage bolsters the local production of plastic pouches and their use in e-commerce.

- The changing consumer food preferences in the United Arab Emirates have created significant growth opportunities in the packaging industry, especially for the food and beverage industry. According to report by Alpen Capital, a financial institute in United Arab Emirates, the food industry in the Middle East and African region is estimated to grow due to its strategic location and region's growing population. Post-pandemic, the surge in online food delivery has enhanced the demand for flexible packaging such as wraps, sleeves , labels and others, which is driving industry growth.

- Additionally, growth in the food processing industry in the country drives the demand for plastic packaging. Around 568 food and beverage processors operate across the United Arab Emirates, producing 5.96 million metric tonnes annually, boosting the demand for plastic packaging in the country. Also, the rise in the food service industry in the country due to a boost in tourism, changing consumer preferences, and the growing spending capacity of the population is likely to boost the market growth in the coming years.

Saudi Arabia is Expected to Witness Significant Growth

- Saudi Arabia stands out as a dominant player in the Middle Eastern packaging industry. Beyond its renowned oil and gas sector, the nation boasts a diverse array of industrial activities, fueling a surging annual demand for plastic packaging.

- In light of declining global crude oil prices, Saudi Arabia recognizes the imperative to bolster its non-oil sector. To this end, the nation has rolled out several initiatives and regulatory reforms, including the National Industrial Development and Logistics Program (NIDLP) and Vision 2030, aiming to amplify industrial production.

- Saudi Arabia leads the GCC in plastic consumption. Recent GPCA estimates highlight a per capita plastic consumption exceeding 95 kg, underscoring its position as the GCC's top plastic consumer. Additionally, a growing embrace of Western culture, spurred by tourism and educational pursuits, is poised to further energize the market. The burgeoning popularity of food malls and courts further underscores this growth trajectory.

- Furthermore, the ready-to-eat meals and frozen food segment offers prepared food that requires minimal or no preparation before consumption. This segment is gaining popularity in Middle Eastern countries, particularly in the United Arab Emirates and Saudi Arabia, due to the fast-paced urban lifestyle and diverse cultural influences.

- The Saudi Arabian market for processed meat, seafood, and meat alternatives is experiencing growth. In 2023, the market volume was approximately 1,499.10 metric tons. Projections indicate an increase to about 1,839.50 metric tons by 2027, reflecting the country's changing and growing consumer preferences for processed meat.

Middle East And Africa Plastic Packaging Industry Overview

The Middle East and Africa Plastic Packaging Market is fragmented in nature, with multiple players in the market operating regionally. The major vendors in the market adopt strategies such as product innovation and partnerships, among others, to expand their reach and stay competitive in the market. Some of the major players in the market are SABIC, Zamil Plastic Industries Co., and Huhtamaki Flexibles UAE (Huhtamaki Oyj), National Plastic Factory LLC, Napco Group (Napco National), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Recycling and Sustainability Landscape

- 4.5 Industry Regulation, Policy and Standards

- 4.6 Import-Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Oxo-Degradable Plastics

- 5.1.2 Steady Rise in Demand for Processing Food

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns over Recycling and Safe Disposal

- 5.2.2 High Raw Material Costs and Limited Recycling Infrastructure

6 MARKET SEGMENTATION

- 6.1 Rigid Plastic Packaging

- 6.1.1 By Material Type

- 6.1.1.1 Polyethylene (PE)

- 6.1.1.2 Polyethylene Terephthalate (PET)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.1.1.5 Polyvinyl Chloride (PVC)

- 6.1.1.6 Other Material Types

- 6.1.2 By Product Type

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and containers

- 6.1.2.3 Caps and Closures

- 6.1.2.4 Other Product Types

- 6.1.3 By End-User Industry

- 6.1.3.1 Food

- 6.1.3.2 Beverage

- 6.1.3.3 Healthcare

- 6.1.3.4 Cosmetics and Personal Care

- 6.1.3.5 Household Care

- 6.1.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.1.1 By Material Type

- 6.2 Flexible Plastic Packaging

- 6.2.1 By Material Type

- 6.2.1.1 Polyethylene (PE)

- 6.2.1.2 Bi-Orientated Polypropylene (BOPP)

- 6.2.1.3 Cast Polypropylene (CPP)

- 6.2.1.4 Polyvinyl Chloride (PVC)

- 6.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.2.1.6 Other Material Types

- 6.2.2 By Product Type

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films & Wraps

- 6.2.2.4 Other Product Types

- 6.2.3 By End-User Industry

- 6.2.3.1 Food

- 6.2.3.2 Beverage

- 6.2.3.3 Healthcare

- 6.2.3.4 Cosmetics and Personal Care

- 6.2.3.5 Household Care

- 6.2.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.2.1 By Material Type

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zamil Plastic Industries Co.

- 7.1.2 Takween Advanced Industries

- 7.1.3 Packaging Products Company (PPC)

- 7.1.4 PrimePak Industries Nigeria Ltd (Enpee Group)

- 7.1.5 Constantia Flexibles Afripack

- 7.1.6 Huhtamaki South Africa (Pty) Ltd

- 7.1.7 Al Bayader International (H&H Group of Companies

- 7.1.8 Napco National

- 7.1.9 Falcon Pack

- 7.1.10 Arabian Flexible Packaging LLC

- 7.1.11 Hotpack Packaging Industries LLC

- 7.1.12 ENPI Group

- 7.1.13 Gulf East Paper and Plastic Industries LLC

- 7.2 Heat Map Analysis

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS