PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1624582

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1624582

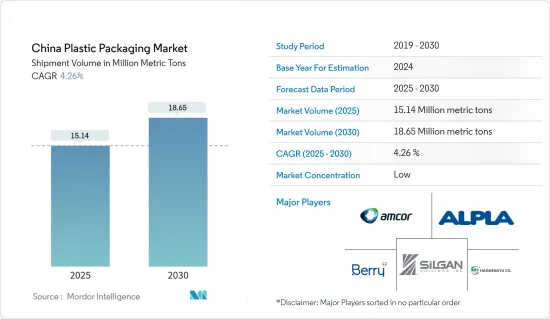

China Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Plastic Packaging Market size in terms of shipment volume is expected to grow from 15.14 million metric tons in 2025 to 18.65 million metric tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

In China, heightened consumerism and a burgeoning manufacturing sector are driving the expansion of the plastic packaging market. This growth is further fueled by a surging food industry and a thriving packaging sector.

Key Highlights

- China is a dominant player on the global stage, both as a leading producer and consumer of plastic. The nation's intensified focus on plastic production and export is largely due to its heightened reliance on PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), and other polymer-based bottles and containers. These materials are pivotal for sectors like food and beverage, pharmaceuticals, and personal care.

- Asia's rising appetite for bottled water, with China leading the charge, is propelling the plastic market. Data from the United Nations University Institute for Water, Environment and Health, a UN agency, underscores this trend, revealing that Asia-Pacific nations dominate bottled water consumption. China, as the world's second-largest bottled water market, only behind the United States, further amplifies the demand for PET plastics.

- Responding to the surging demand for eco-friendly products, Chinese manufacturers are making a notable pivot towards sustainable packaging. For instance, in May 2024, Alpla Werke Alwin Lehner GmbH & Co KG, an Austrian firm operating in China, unveiled a recyclable PET wine bottle. This innovative bottle not only slashes carbon consumption by 38% compared to traditional glass but also enhances the company's environmental credentials.

- However, the market faces challenges from a growing shift towards alternative packaging solutions. China's battle with plastic pollution, a significant contributor to global waste and marine debris, highlights the environmental stakes. As the world's top producer and consumer of plastic, China's market growth is at risk, especially with a noticeable consumer shift towards alternatives like paper packaging.

China Plastic Packaging Market Trends

Food Industry is Expected to Dominate the Market

- In 2023, China's gross domestic product (GDP) reached USD 17.52 trillion (126.06 trillion yuan), marking a year-on-year increase of 5.2%, as reported by the National Bureau of Statistics (NBS). The United States Department of Agriculture (USDA) highlighted that China, the world's largest food-importing nation, saw its total food import value exceed USD 140 billion in 2023.

- Shifting consumer preferences in China, especially the rising trend of packaged foods, are driving an increased demand for plastic packaging. The USDA notes that a significant trend in China's food market is the burgeoning e-commerce sector. Forecasts suggest that China's food e-commerce market will hit USD 148 billion in 2024, further fueling the demand for rigid plastic packaging solutions.

- Moreover, China's food service industry made a strong comeback in 2023, particularly in the prepared food segment. The uptick in on-the-go food consumption has spurred using rigid and flexible plastic packaging solutions. This trend is further amplified by the booming takeaway food industry in China, leading to a heightened demand for plastic packaging.

- China's food imports encompass a range of consumer-oriented products, including dairy, processed foods, and meat, with a notable emphasis on beef. USDA data reveals that in 2023, China's imports of these consumer-oriented products totaled USD 106.4 billion. Key exporters to China, New Zealand, Thailand, Brazil, and the United States each holding a 10-12% share, play a pivotal role in driving the nation's demand for plastic packaging.

Bottles and Jars Segment to Register Highest Market Share

- Polyethylene terephthalate (PET), polypropylene (PP), and polyethylene (PE) are the primary materials used in the production of plastic bottles and jars for packaging solutions. These materials are lightweight and unbreakable, enhancing their ease of handling. In China, the food and beverage industry's surging demand for bottles and jars is rapidly boosting the need for rigid plastic packaging. Specifically, the rising use of PET bottles for packaging bottled water, juices, soft drinks, medicines, household cleaners, and personal care items is a key driver of the plastic packaging market's expansion.

- China's burgeoning pharmaceutical sector is increasingly turning to PET bottles and containers for packaging, further fueling this segment's growth. Data from Policy Circle, a media platform, highlights that in 2023-24, China constituted 43.45% of India's pharmaceutical imports, underscoring the heightened demand for plastic packaging solutions.

- In response to the rising consumer preference for recyclable and reusable packaging, Chinese manufacturers such as Amcor Group prioritise launching sustainable rigid packaging solutions, including beverage bottles. In April 2024, Amcor Group, a Switzerland-based entity with a footprint in China, unveiled a one-liter PET bottle crafted entirely from 100% post-consumer recycled (PCR) content, specifically designed for carbonated soft drinks.

- As a leading hub for plastic product manufacturing, China has seen significant production milestones. ChemAnalyst reported that in December 2023, China's plastic product output reached around 6.98 million tons, marking a 2.8% increase from the previous year. Notably, China exports its plastic products, especially bottles, to the United States and several Asian nations, including Australia, Malaysia, and Japan.

China Plastic Packaging Industry Overview

The plastic packaging market in China exhibits a fragmented landscape. Key players, including Amcor Group, Berry Global Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc., and Shangdong Haishengyu Plastic Industry Co. Ltd., are actively enhancing their product portfolios in a bid to capture a larger share of the market. These companies are employing a mix of organic and inorganic strategies, such as mergers and acquisitions, partnerships, expansions, new product launches, and collaborations, to assert their dominance in the Chinese market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surging Demand for Plastic Packaging in the Food and Beverage Sector

- 5.1.2 Increasing Adoption of Eco-Friendly Packaging Options

- 5.2 Market Challenges

- 5.2.1 Rising Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Flexible Plastic Packaging

- 7.1.1.1 By Product Type

- 7.1.1.1.1 Pouches

- 7.1.1.1.2 Bags

- 7.1.1.1.3 Films & Wraps

- 7.1.1.1.4 Other Product Types

- 7.1.1.2 By End-User Industry

- 7.1.1.2.1 Food

- 7.1.1.2.2 Beverage

- 7.1.1.2.3 Healthcare

- 7.1.1.2.4 Cosmetics and Personal Care

- 7.1.1.2.5 Household Care

- 7.1.1.2.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 7.1.2 Rigid Plastic Packaging

- 7.1.2.1 By Product Type

- 7.1.2.1.1 Bottles and Jars

- 7.1.2.1.2 Trays and Containers

- 7.1.2.1.3 Caps and Closures

- 7.1.2.1.4 Other Product Types

- 7.1.2.2 By End-User Industry

- 7.1.2.2.1 Food

- 7.1.2.2.2 Beverage

- 7.1.2.2.3 Healthcare

- 7.1.2.2.4 Cosmetics and Personal Care

- 7.1.2.2.5 Household Care

- 7.1.2.2.6 Other End-User Industries (Industrial, Automotive, Among Others)

- 7.1.1 Flexible Plastic Packaging

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Shangdong Haishengyu Plastic Industry Co. Ltd

- 8.1.2 ALPLA Werke Alwin Lehner GmbH & Co KG

- 8.1.3 Amcor Group

- 8.1.4 Berry Global Inc.

- 8.1.5 Silgan Holdings Inc.

- 8.1.6 Taizhou Huangyan Baitong Plastic Co. Ltd

- 8.1.7 Shenyang Powerful Packing, Co., Ltd.

- 8.1.8 Jieshou Tianhong New Material Co. Ltd

- 8.1.9 Qingdao Haoyu Packing Co. Ltd

- 8.1.10 Ningbo Kinpack Commodity Co. Ltd

9 RECYCLING & SUSTAINABILITY LANDSCAPE**

10 FUTURE OF THE MARKET