PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714099

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1714099

Global Landing gear testing Market 2025-2035

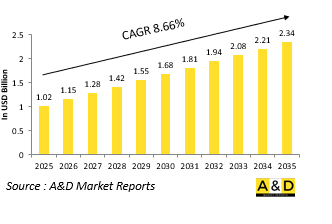

The Global Landing gear testing market is estimated at USD 1.02 billion in 2025, projected to grow to USD 2.34 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.66% over the forecast period 2025-2035.

Introduction to Landing gear testing Market:

Landing gear testing plays a foundational role in ensuring the structural integrity, reliability, and operational readiness of military aircraft across air forces and naval aviation units worldwide. As one of the most mechanically complex and stress-prone components of an aircraft, the landing gear must withstand repeated high-impact forces, variable environmental conditions, and extreme load cycles over the life of the airframe. In defense aviation, this becomes even more critical as landing gear is subject to intense usage patterns, including carrier-based operations, short and rough-field takeoffs, rapid deployment scenarios, and emergency landings on unprepared terrain. Unlike civilian aircraft, military platforms such as fighter jets, cargo planes, helicopters, and unmanned aerial systems must perform under unpredictable and often harsh conditions, requiring rigorous testing standards. Defense landing gear testing encompasses a range of evaluations, from static and dynamic load tests to fatigue and drop tests, to validate not only the design's endurance but also its capability to function in mission-critical environments. Additionally, the testing process verifies hydraulic and brake system performance, assesses actuator behavior under real-time loads, and simulates deployment/retraction cycles to replicate combat readiness. The development of more agile, lightweight, and stealth-capable aircraft has further increased the demand for sophisticated landing gear systems and correspondingly advanced test methodologies in military aviation programs.

Technology Impact in Landing gear testing Market:

Technological advancement has profoundly reshaped landing gear testing in the defense sector, enhancing both precision and scope. The integration of electromechanical testing rigs with multi-axis actuators allows real-time simulation of complex landing scenarios, including asymmetric load distribution and uneven terrain impact. These test benches often support full-scale landing gear systems, enabling engineers to analyze realistic stress, strain, and wear over thousands of simulated flight cycles. Finite element analysis (FEA) and multibody dynamics simulation are now regularly used in the design-validation phase to predict failure points and optimize weight-to-strength ratios before physical prototyping begins. These simulations are often coupled with digital twin models, allowing synchronization between virtual behavior and physical test data. Innovations in sensor technology, including fiber-optic strain gauges, wireless load cells, and infrared thermal imaging, provide highly granular insights into material fatigue, heat buildup in braking systems, and deformation under load. Moreover, advances in braking system testing, especially for electro-hydraulic and carbon brake modules, allow for precise analysis of deceleration performance under varied environmental and load conditions. AI-driven analytics are increasingly used to evaluate test data, identify anomalies, and predict component lifecycle thresholds. Additionally, technologies like augmented reality (AR) are being used in maintenance simulation scenarios to visualize component wear and conduct procedural rehearsals, particularly useful for military technicians tasked with operating in austere or rapid-response environments.

Key Drivers in Landing gear testing Market:

Several strategic factors and operational needs are driving the heightened focus on landing gear testing within defense aerospace programs. One of the foremost drivers is the increased need for mission adaptability and ruggedization. Modern military aircraft must be capable of operating from a variety of surfaces-including unpaved runways, aircraft carriers, and makeshift landing strips-making it essential that landing gear systems are robust, agile, and reliable under adverse conditions. As defense forces move toward multi-role and expeditionary platforms, the gear systems must accommodate greater weight variability and irregular deployment cycles, demanding extensive fatigue and load testing. Another critical driver is the trend toward stealth and low observable designs, which often necessitate retractable, space-efficient landing gear with optimized radar cross-sections. Testing in these cases involves evaluating deployment mechanisms in confined geometries without compromising structural performance. Lifecycle cost and maintainability are also major considerations. Defense procurement agencies are increasingly focused on minimizing long-term maintenance demands and maximizing uptime, which requires predictive maintenance protocols supported by thorough gear testing for wear, corrosion, and hydraulic fluid integrity. International defense collaborations-involving joint aircraft development programs-also fuel demand for standardized and repeatable test processes to meet diverse compliance requirements. Additionally, the emphasis on safety and survivability in contested environments pushes the limits of operational testing, including trials that simulate crash landings, wheel burst scenarios, and actuator failure under duress.

Regional Trends in Landing gear testing Market:

Across global regions, the nature and focus of landing gear testing reflect localized defense priorities, industrial capabilities, and platform specialization. In North America, particularly in the United States, the presence of tier-one defense OEMs and expansive test facilities supports some of the most comprehensive landing gear testing programs in the world. These programs focus on heavy-duty gear systems for long-range bombers, naval aircraft, and fifth-generation fighters, with advanced drop towers, high-speed braking rigs, and arrestor hook simulation environments in widespread use. Canada contributes significantly through MRO and test services for military rotorcraft and tactical transports, often as part of NATO support operations. In Europe, countries like Germany, France, and the UK conduct testing for both legacy and next-generation aircraft, including joint programs such as the Future Combat Air System (FCAS). European test facilities prioritize environmental testing for extreme cold, saltwater corrosion resistance, and modular landing gear configurations for UAVs and VTOL platforms. In the Asia-Pacific region, China is investing in high-throughput, automated testing platforms for fighter jet landing gear, with a focus on durability and integration with indigenous braking systems. India is ramping up its capacity for shock absorption, fatigue testing, and indigenous gear component validation to support aircraft like the Tejas and transport aircraft initiatives. Japan and South Korea are advancing testing for carrier-capable aircraft and stealth UAVs, with emphasis on compact yet high-load landing gear solutions. In the Middle East, nations such as Saudi Arabia and the UAE are building domestic aerospace test capabilities to support licensed production and maintenance of Western aircraft. These initiatives often include modular landing gear testing cells focused on brake testing and hydraulic system diagnostics. In South America and parts of Africa, landing gear testing remains largely dependent on international partnerships, though efforts are underway to develop indigenous testing ecosystems, especially for light transport aircraft and surveillance drones. As regional defense programs evolve, the need for locally available, adaptable, and data-integrated testing setups will continue to grow.

Key Landing gear testing Program:

Boeing has been awarded the Engineering and Manufacturing Development (EMD) contract for the U.S. Air Force's Next-Generation Air Dominance (NGAD) fighter jet program. In an announcement made from the Oval Office, President Donald Trump, Defense Secretary Pete Hegseth, and Air Force Chief General David Allvin confirmed that the new aircraft will be designated the F-47-marking the United States' first sixth-generation fighter. This milestone marks Boeing's first "clean-sheet" fighter design to be selected since its 1997 merger with McDonnell Douglas. Unlike aircraft such as the F-15EX, which are based on legacy McDonnell Douglas platforms, a clean-sheet design begins entirely from scratch, tailored specifically to meet the mission requirements and vision of the customer.

Table of Contents

Global Landing gear testing in defense- Table of Contents

Global Landing gear testing in defense Report Definition

Global Landing gear testing in defense Segmentation

By Region

By Type

By Application

By End user

Global Landing gear testing in defense Analysis for next 10 Years

The 10-year Global Landing gear testing in defense analysis would give a detailed overview of Global Landing gear testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Landing gear testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Landing gear testing in defense Forecast

The 10-year Global Landing gear testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Landing gear testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Landing gear testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Landing gear testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Landing gear testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Landing gear testing Market Forecast, 2025-2035

- Figure 2: Global Landing gear testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Landing gear testing Market Forecast, By End User, 2025-2035

- Figure 4: Global Landing gear testing Market Forecast, By Application, 2025-2035

- Figure 5: Global Landing gear testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 17: France, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 33: India, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 35: China, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Landing gear testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Landing gear testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Landing gear testing Market, By End User (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Landing gear testing Market, By End User (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Landing gear testing Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Landing gear testing Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Landing gear testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Landing gear testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Landing gear testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Landing gear testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Landing gear testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Landing gear testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Landing gear testing Market, By End User, 2025-2035

- Figure 62: Scenario 1, Landing gear testing Market, By Application, 2025-2035

- Figure 63: Scenario 1, Landing gear testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Landing gear testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Landing gear testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Landing gear testing Market, By End User, 2025-2035

- Figure 67: Scenario 2, Landing gear testing Market, By Application, 2025-2035

- Figure 68: Scenario 2, Landing gear testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Landing gear testing Market, 2025-2035