PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690885

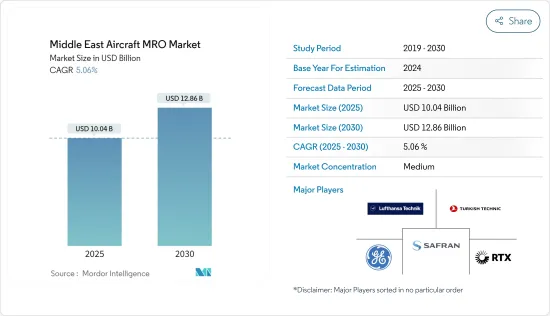

Middle East Aircraft MRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East Aircraft MRO Market size is estimated at USD 10.04 billion in 2025, and is expected to reach USD 12.86 billion by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

The Middle East Aircraft MRO market is fueled by regional airlines expanding and modernizing their fleets. Furthermore, partnerships among aircraft MRO providers enhance their technical capabilities, allowing them to service the new-generation aircraft that airlines are acquiring. The Gulf countries' major cities are witnessing the construction of new airports, a key factor driving the growth of aircraft fleets in the Middle East and Africa (MEA) region, subsequently boosting the demand for MRO services.

However, the aviation industry has long struggled with a shortage of maintenance technicians. Technological advancements in aircraft manufacturing exacerbate this challenge, amplifying the need for skilled technicians.

As airlines introduce newer-generation aircraft, the demand for maintenance technicians with a broader and more advanced skill set is rising, intensifying the anticipated labor shortage. Moreover, cutting-edge technologies like AI and machine learning are aiding airline crews and management in assessing aircraft airworthiness.

Middle-East Aircraft MRO Market Trends

Engine MRO to Hold Highest Market Share During the Forecast Period

Engine MRO encompasses a wide range of activities, including inspections, repairs, and overhauls to maintain aircraft propulsion systems' reliability, efficiency, and safety. Stringent regulations govern these activities, OEMs (original equipment manufacturers) specifications, and industry best practices to ensure compliance and airworthiness.

Aircraft engines, such as turbofans, turboprops, and turboshafts, are subjected to rigorous operational demands, including high-speed maneuvers, extreme temperatures, and prolonged missions. As a result, engine MRO demands higher precision, reliability, and durability than commercial counterparts. An increasing number of engine failures due to improper MRO has made aircraft operators focus on engine health. In the engine MRO sector, original equipment manufacturers (OEMs) control approximately half of the market, with the other half roughly split between independent and airline overhaul shops.

For instance, in April 2024, Sanad Group signed a five-year contract extension to provide maintenance, repair, and overhaul services for Asiana Airlines. Under the agreement, worth USD 145 million, Sanad would maintain 30% of the V2500 engine fleet that powers the South Korean airline's A321 aircraft at its facilities in Abu Dhabi. In November 2023, Honeywell International Inc. announced a 10-year agreement with Saudia Technic to expand the company's support network in the Middle East. The agreement encompassed a worldwide license for maintenance to the auxiliary power unit, known as the 331-500, which is integrated into the B777 aircraft. Such developments are envisioned to increase the region's competition and drive the engine MRO segment during the forecast period.

United Arab Emirates to Dominate the Market During the Forecast Period

United Arab Emirates (UAE) carriers are driving a surge in demand for MRO services through their ambitious fleet expansion and modernization initiatives. Notable orders include Emirates' procurement of 115 B777-9s and 30 B787-9 Dreamliners, while Etihad Airways is set to introduce A350-1000s and B787-10s. These cutting-edge aircraft feature advanced materials and systems, necessitating specialized MRO attention.

The shift towards composite structures, fly-by-wire systems, and enhanced electric architectures mandates investments in new tooling, NDT equipment, and technician training. As airlines move to update their fleets with modern cabin interiors and inflight connectivity, the MRO sector is presented with fresh opportunities in modification and refurbishment services.

In November 2023, Emirates bolstered its fleet by ordering an additional 15 A350-900s, expanding its total fleet to 65 aircraft. This strategic move significantly boosts the airline's long-haul capacity, especially targeting markets with up to a 15-hour flying time from Dubai. Collaborating closely with Rolls-Royce, Emirates aims to enhance operating efficiency and elevate the overall passenger experience. Such investments underscore Emirates' commitment to fleet modernization, further cementing its market dominance and operational prowess. The rising demand for advanced aircraft also signals a promising growth trajectory for the MRO sector in the UAE, where maintenance, repair, and overhaul services will be crucial to support this expanding fleet.

Middle-East Aircraft MRO Industry Overview

The Middle East Aircraft MRO Market is semi-consolidated. Some of the key players in the market are General Electric Company, Turkish Technik Inc., Safran, Lufthansa Technik AG, and RTX Corporation.

MRO service providers in the region are expanding their offerings and collaborating with domestic and international airlines. For instance, in April 2024, Rolls-Royce and Turkish Airlines, fresh off sealing a substantial order for Trent XWB-powered A350 aircraft, have inked a joint statement. This statement outlines their collaborative efforts to explore engine maintenance and supply chain services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 MRO Type

- 5.1.1 Airframe

- 5.1.2 Engine

- 5.1.3 Component

- 5.1.4 Line Maintenance

- 5.2 Application

- 5.2.1 Commercial Aviation

- 5.2.2 General Aviation

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 Jordan

- 5.3.3 Turkey

- 5.3.4 United Arab Emirates

- 5.3.5 Kuwait

- 5.3.6 Egypt

- 5.3.7 Bahrain

- 5.3.8 Oman

- 5.3.9 Qatar

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Safran

- 6.2.2 General Electric Company

- 6.2.3 Rolls-Royce plc

- 6.2.4 RTX Corporation

- 6.2.5 Lufthansa Technik AG

- 6.2.6 Fl Technics

- 6.2.7 Saudia Technic (Saudia Aerospace Engineering Industries)

- 6.2.8 Execujet MRO Services

- 6.2.9 Honeywell International Inc.

- 6.2.10 Textron Inc.

- 6.2.11 MUKAMALAH AVIATION COMPANY LIMITED

- 6.2.12 Wallan Aviation

- 6.2.13 Khayal Al Hejaz (KH Aviation)

- 6.2.14 Jordan Aeronautical-Systems Company (JAC)

- 6.2.15 Turkish Technic Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS