PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687359

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687359

Aviation Maintenance Repair And Overhaul (MRO) Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

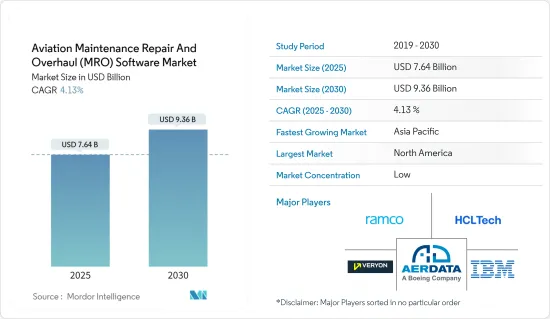

The Aviation Maintenance Repair And Overhaul Software Market size is estimated at USD 7.64 billion in 2025, and is expected to reach USD 9.36 billion by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

The rise in global aircraft deliveries, driven by increased air passenger traffic, has heightened the demand for maintenance, repair, and overhaul (MRO) services. This surge in demand is primarily to extend the operational life cycle of aircraft. Various MRO software solutions are available, including Foreflight, TRAX Maintenance, Quantum MX, Flightdocs, Airlabs, and WinAir. Airlines can use artificial intelligence (AI) and its cognitive technologies to streamline analytics, automate machinery maintenance, enhance customer service, and optimize internal processes, underscoring AI's pivotal role in airline operations.

The emergence of AI has revolutionized precision repair and predictive maintenance, prompting aircraft maintenance engineers to rely on MRO software increasingly. This growing interest in MRO software has seen airlines worldwide investing in advanced solutions, setting a positive trajectory for market growth in the forecast period.

However, challenges persist. The market faces hurdles such as high implementation and maintenance costs, the need for specialized personnel training, and the complexity of integrating new software with existing systems. Additionally, varying regulatory requirements across regions pose further obstacles to widespread adoption. Yet, the promise of enhanced operational efficiency and reduced maintenance errors remains a compelling long-term driver for the MRO software market.

The aviation MRO software market is poised for further expansion, with emerging technologies like blockchain and augmented reality (AR) taking center stage. Blockchain, for instance, bolsters maintenance log security and transparency, instilling confidence and compliance in maintenance operations. These technological advancements reshape traditional maintenance practices, promising greater efficiency and reduced error rates, propelling market growth.

Aviation MRO Software Market Trends

The MRO Segment Dominated the Market During the Forecast Period

Forecasted for the coming years, the MRO segment is set to dominate the Aviation MRO Software market. MRO software, crucial for managing maintenance schedules, repair tracking, and regulatory compliance, is gaining prominence. The aging aircraft fleet and the escalating global air traffic primarily drive this shift. With modern aircraft systems growing in complexity, advanced maintenance capabilities, and exceptionally robust data analysis are paramount to ensure operational efficiency and safety.

Pivotal technologies like predictive analytics and artificial intelligence are spearheading the MRO segment. By enhancing the software's ability to predict system failures, these technologies pave the way for substantial reductions in downtime and maintenance costs through proactive strategies. Additionally, as the aviation industry emphasizes eco-friendly practices, MRO operations increasingly adopt software solutions to boost fuel efficiency and manage emissions.

With the global aircraft fleet expanding alongside the rise in air traffic, new MRO facilities are rising to cater to this growing fleet, propelling the market's growth. For instance, in November 2022, HCLTech, a global technology company, inked a multi-year deal with SR Technics, a leading MRO service provider in civil aviation. This partnership aims to transform SR Technics' operations digitally. Notably, SR Technics boasts a wide-reaching network, with partners and business development offices spanning Europe, the Americas, Asia, and the Middle East.

Asia-Pacific is Expected to Show the Highest Growth During the Forecast Period

Asia Pacific is positioned as the global leader in the growth of aviation MRO software, driven by its robust aviation sector. Factors such as rising air traffic, expanding middle-class demographics, and domestic and international fleet expansions fuel this growth. Notably, economies like China and India, among the world's fastest-growing, are investing significantly in their aviation infrastructures.

Key drivers in Asia Pacific's MRO software market include the rise of Low-Cost Carriers (LCCs) and an increase in international routes. These carriers rapidly expand their fleets to meet growing travel demands, necessitating advanced MRO software for efficient fleet management and maintenance scheduling.

With the region's economies and travel demands rising, the need for cutting-edge MRO capabilities to ensure optimal aircraft availability and reliability becomes paramount. For example, in June 2023, Ramco Systems, a global enterprise aviation software provider, announced the implementation of its Aviation Suite V5.9 for Skytek Pty Ltd. This move aims to integrate and automate Skytek's operations, bolstering their business growth with a modern solution. Ramco's Aviation Suite encompasses modules for Engineering & CAMO, Maintenance, Supply Chain, MRO & Part Sales, Employee Management, Finance & Accounting, Compliance Reporting, and Journey Log Entries. Additionally, digital enablers like HUBs and workflows within Ramco's suite are set to enhance productivity and streamline processes for Skytek, positioning them for greater operational effectiveness and growth in the competitive aviation engineering sector.

Asia Pacific's aircraft MRO software market is on a growth trajectory, driven by a rapidly expanding aviation sector, technological innovations, and strategic governmental directives. As regulations evolve, the region's demand for sophisticated MRO software solutions, ensuring operational efficiency and compliance is only set to intensify.

Aviation MRO Software Industry Overview

The market is fragmented, with several players holding significant shares. Veryon, Ramco Systems Ltd., IBM Corporation, HCL Technologies Ltd., and AerData B.V. are the leading market players.

Anticipated market growth is being fueled by heightened R&D investments and the rollout of cutting-edge aircraft MRO software by industry leaders. MRO firms are broadening their reach, with many forging partnerships with local service providers as they expand. A prime example is the collaboration between Ramco Systems, a major aviation software provider, and Nova Systems, a leading engineering services company. In February 2022, the two entities inked a deal, with Ramco's Aviation M&E MRO Suite V5.9 set to be integrated into Nova Systems' UK operations. Nova Systems is eyeing the suite's advanced workflows and reporting tools to streamline its Part 21J, Part 21G, and Part 145 operations. The primary goal? Boosting material management efficiency and unlocking crucial operational insights.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 Cloud-based

- 5.1.2 On-premises

- 5.2 End User

- 5.2.1 Airlines

- 5.2.2 MROs

- 5.2.3 OEMs

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AerData B.V.

- 6.2.2 IBM Corporation

- 6.2.3 Ramco Systems Ltd.

- 6.2.4 Rusada

- 6.2.5 IBS Software Private Limited

- 6.2.6 HCL Technologies Limited

- 6.2.7 IFS Aktiebolag

- 6.2.8 Oracle Corporation

- 6.2.9 SAP SE

- 6.2.10 Swiss AviationSoftware Ltd. (Swiss-AS)

- 6.2.11 Communications Software (Airline Systems) Limited

- 6.2.12 Flatirons Solutions, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS