Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693660

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693660

Electric Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 408 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

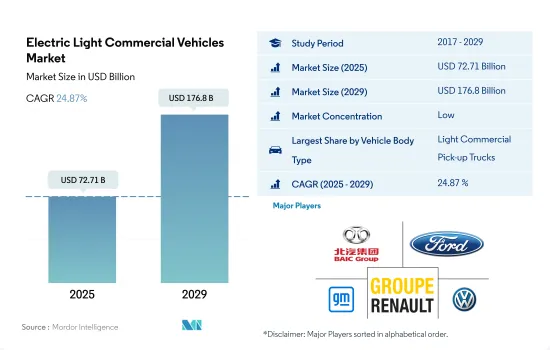

The Electric Light Commercial Vehicles Market size is estimated at 72.71 billion USD in 2025, and is expected to reach 176.8 billion USD by 2029, growing at a CAGR of 24.87% during the forecast period (2025-2029).

The surge in online retail and e-commerce worldwide, fueled by increased internet and smartphone access, is leading to a rise in light commercial vehicle purchases globally

- The e-commerce and logistics industries are the primary drivers of the global electric light commercial vehicles market. The surge in online retail and e-commerce worldwide, fueled by increased internet and smartphone access, is leading to a rise in light commercial vehicle purchases globally. In 2021, global light commercial vehicle production reached 18,593.85 thousand units, up from 17,217.99 thousand units in the previous year.

- The COVID-19 pandemic propelled online sales, resulting in a significant boost in both revenue and user base for the global e-commerce market. This trend is expected to continue as internet shopping gains further traction. The global e-commerce market witnessed a rapid expansion in 2020, which continued over the next year, generating USD 26.7 trillion in revenue in 2021. The number and proportion of online shoppers have been steadily rising worldwide, with the largest surge seen in 2020, driven by the pandemic-induced shift to online shopping.

- The e-commerce and logistics industries are experiencing robust growth in major economies, including Europe, the United States, and China, driving the need for modernized distribution networks. Prominent light commercial vehicle manufacturers, such as Daimler, Nissan, Ford, and Renault, have witnessed a significant uptick in e-commerce sales, bolstering the logistics industry. Traditionally, pickup trucks and vans have been the go-to vehicles for e-commerce logistics and consumer deliveries, further bolstering the global light commercial vehicle market.

The rising demand for clean energy in the automotive industry and policies to promote the adoption of EVs are the key drivers for electric commercial vehicles globally

- Several governments worldwide have proactively implemented policies to promote the adoption of electric vehicles in recent years. Notably, China, India, France, and the United Kingdom have set targets to phase out the petrol and diesel vehicle industries by 2040.

- The rising demand for clean energy in the automotive industry is a key driver for the market's growth. Major OEMs are reshaping their strategies for electric vehicles. For example, in March 2022, Kia Motors unveiled plans to enter the electric pickup truck segment, with two models slated for release by 2027. One of these models will directly compete with established rivals like the Tesla Cybertruck, Ford F-150 Lightning, Rivian R1T, and GMC Hummer EV. Similarly, in March 2022, Ford announced its intention to introduce a new lineup of four commercial electric vehicles by 2024. This lineup included the all-new Transit Custom one-tonne van and Tourneo Custom multi-purpose vehicle launched in 2023, followed by the next-generation Transit Courier van and Tourneo Courier multi-purpose vehicle in 2024.

- North America, with its high internet and smartphone penetration, presents lucrative opportunities for e-commerce companies to tap into the retail e-commerce market. This digital landscape not only facilitates broader business expansion for e-commerce players but also plays a pivotal role in driving the global electric light commercial vehicles market as well as its truck segment. Consequently, automakers are ramping up their R&D investments in the truck segment, further fueling the growth of electric trucks.

Global Electric Light Commercial Vehicles Market Trends

The rising global demand and government support propel electric vehicle market growth

- Electric vehicles (EVs) have become indispensable in the automotive industry, driven by their potential to enhance energy efficiency and reduce greenhouse gas and pollution emissions. This surge is primarily attributed to growing environmental concerns and supportive government initiatives. Notably, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021. Projections indicate that annual sales of electric passenger cars will surpass 5 million by the end of 2025, accounting for approximately 15% of total vehicle sales.

- Leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, have been actively pursuing their electric mobility strategies. For instance, they have set a target of a zero-emission fleet by 2025, with a goal of electrifying 40% of their vans by 2030 and achieving full electrification by 2040. Similar trends are expected globally, with the period from 2024 to 2030 witnessing a surge in demand and sales of electric vehicles.

- Asia-Pacific and Europe are poised to dominate electric vehicle production, driven by their advancements in battery technology and vehicle electrification. In May 2020, Kia Motors Europe unveiled its "Plan S," signaling a strategic shift toward electrification. This decision came on the heels of record-breaking sales of Kia's EVs in Europe. Kia has ambitious plans to introduce 11 EV models globally by 2025, spanning various segments like passenger vehicles, SUVs, and MPVs. The company aims to achieve annual global EV sales of 500,000 by 2026.

Electric Light Commercial Vehicles Industry Overview

The Electric Light Commercial Vehicles Market is fragmented, with the top five companies occupying 22.60%. The major players in this market are BAIC Motor Corporation Ltd., Ford Motor Company, General Motors Company, Groupe Renault and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93053

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.1.1 Africa

- 4.1.2 Asia-Pacific

- 4.1.3 Europe

- 4.1.4 Middle East

- 4.1.5 North America

- 4.1.6 South America

- 4.2 GDP Per Capita

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.3.1 Africa

- 4.3.2 Asia-Pacific

- 4.3.3 Europe

- 4.3.4 Middle East

- 4.3.5 North America

- 4.3.6 South America

- 4.4 Inflation

- 4.4.1 Africa

- 4.4.2 Asia-Pacific

- 4.4.3 Europe

- 4.4.4 Middle East

- 4.4.5 North America

- 4.4.6 South America

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.8.1 Africa

- 4.8.2 Asia-Pacific

- 4.8.3 Europe

- 4.8.4 Middle East

- 4.8.5 North America

- 4.8.6 South America

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.10.1 Africa

- 4.10.2 Asia-Pacific

- 4.10.3 Europe

- 4.10.4 Middle East

- 4.10.5 North America

- 4.10.6 South America

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Light Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 South Africa

- 5.3.1.2 Rest-of-Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 Australia

- 5.3.2.2 China

- 5.3.2.3 India

- 5.3.2.4 Indonesia

- 5.3.2.5 Japan

- 5.3.2.6 Malaysia

- 5.3.2.7 South Korea

- 5.3.2.8 Thailand

- 5.3.2.9 Rest-of-APAC

- 5.3.3 Europe

- 5.3.3.1 Austria

- 5.3.3.2 Belgium

- 5.3.3.3 Czech Republic

- 5.3.3.4 Denmark

- 5.3.3.5 Estonia

- 5.3.3.6 France

- 5.3.3.7 Germany

- 5.3.3.8 Ireland

- 5.3.3.9 Italy

- 5.3.3.10 Latvia

- 5.3.3.11 Lithuania

- 5.3.3.12 Norway

- 5.3.3.13 Poland

- 5.3.3.14 Russia

- 5.3.3.15 Spain

- 5.3.3.16 Sweden

- 5.3.3.17 UK

- 5.3.3.18 Rest-of-Europe

- 5.3.4 Middle East

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 Rest-of-Middle East

- 5.3.5 North America

- 5.3.5.1 Canada

- 5.3.5.2 Mexico

- 5.3.5.3 US

- 5.3.5.4 Rest-of-North America

- 5.3.6 South America

- 5.3.6.1 Argentina

- 5.3.6.2 Brazil

- 5.3.6.3 Rest-of-South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BAIC Motor Corporation Ltd.

- 6.4.2 BYD Auto Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Dongfeng Motor Corporation

- 6.4.5 Ford Motor Company

- 6.4.6 General Motors Company

- 6.4.7 Groupe Renault

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Rivian Automotive Inc.

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.