Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693642

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693642

Asia Pacific Electric Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 240 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

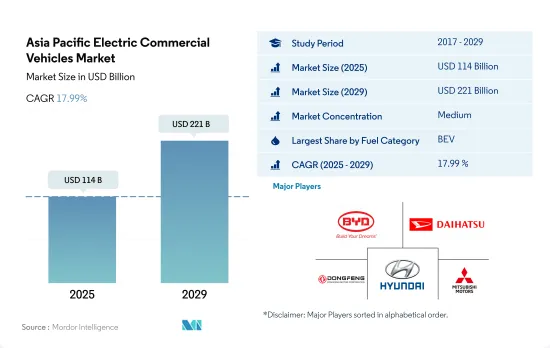

The Asia Pacific Electric Commercial Vehicles Market size is estimated at 114 billion USD in 2025, and is expected to reach 221 billion USD by 2029, growing at a CAGR of 17.99% during the forecast period (2025-2029).

The adoption of hybrid and electric commercial vehicles in Asia-Pacific is expected to be more than triple by 2030

- Asia-Pacific's transition toward greener transportation solutions has been pronouncedly evident in the hybrid and electric commercial vehicle (CV) sector between 2022 and 2023. The collective figures for hybrid and electric CV registrations rose significantly, reaching 490,958 units in 2022 from the previous 264,007 units in 2021. These numbers signify not only a rebound from the prior slump but also underline a strong preference for these cleaner technologies amid escalating environmental concerns and progressive governmental policies.

- Historical data provides an intriguing context. From 2017 to 2019, the combined registrations for hybrid and electric CVs experienced a gentle downward trend, from 260,519 units to 188,118 units. This dip might be attributed to factors like infrastructure readiness, vehicle price points, and initial hesitations. However, the next few years, especially 2022, saw a dramatic resurrection in the numbers, emphasizing the region's fast-adapting stance to combat emissions through cleaner CV solutions.

- Projecting into the future, the upward trajectory for hybrid and electric CVs in Asia-Pacific is remarkably optimistic. By 2025, it is estimated the numbers will cross the 926,761 units mark. By 2030, the total registrations are anticipated to reach an impressive 1,677,598 units. This forecasted upswing can be attributed to technological breakthroughs, a matured charging infrastructure, reduced total cost of ownership, and the realization of the critical role these vehicles play in achieving sustainability goals.

The Asia-Pacific electric commercial vehicles market is poised for rapid expansion, fueled by stringent emission regulations and a robust push for greener public and logistic transport solutions

- Asia-Pacific represents one of the most dynamic markets for electric commercial vehicles due to its diverse economies, rapidly growing urbanization, and increasing focus on reducing carbon emissions. The market landscape varies significantly by country, reflecting differences in economic development, government policies, infrastructure readiness, and industry adoption rates. China, as a global leader in electric vehicle technology, dominates the ECV market in Asia Pacific, benefiting from aggressive government policies, substantial investments in charging infrastructure, and a wide range of domestic manufacturers.

- Other countries in the region, such as Japan and South Korea, are also making significant strides in the electric commercial vehicle market. Japan, with its well-established automotive industry, is focusing on hydrogen fuel cell vehicles as part of its broader strategy for ECVs alongside BEVs. The country's commitment to creating a 'hydrogen society' complements its efforts in electrifying its commercial vehicle segment. South Korea, on the other hand, is rapidly advancing in battery technology and infrastructure development.

- In contrast, emerging economies in the region, such as India, Indonesia, and Thailand, are in the earlier stages of ECV adoption, facing challenges such as limited infrastructure and higher upfront costs. However, these countries hold significant potential for growth in the ECV market due to increasing urbanization, rising awareness of environmental issues, and government initiatives aimed at encouraging the use of electric vehicles. India, for example, has launched multiple initiatives to boost EV adoption, focusing on both improving infrastructure and offering subsidies to buyers.

Asia Pacific Electric Commercial Vehicles Market Trends

APAC's rapid electric vehicle demand and sales growth are driven by government initiatives and commercial vehicle electrification

- Electric vehicle (EV) demand and sales have surged in the APAC region in recent years. China, the dominant market, saw a 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. Factors driving this trend include mounting environmental concerns, stringent regulations, and the advantages of EVs, such as fuel efficiency, lower maintenance costs, and zero carbon emissions. Government subsidies further bolster the adoption of EVs in Asian nations.

- Conventional fuel-powered commercial vehicles, notably trucks and buses, are contributing to the escalating pollution levels in several Asia-Pacific countries. In response, many nations in the region are making substantial investments to transition their internal combustion engine (ICE) vehicles to electric ones, aiming to curb carbon emissions. For instance, in December 2020, TransJakarta, a city-owned bus operator in Indonesia, unveiled an ambitious plan to expand its electric bus (e-bus) fleet to 10,000 units by 2030. Such initiatives across the region are propelling the electrification of commercial vehicles.

- Government bodies in various APAC countries are actively proposing measures to phase out fossil fuel vehicles, a move that is poised to bolster the market for electric commercial vehicles. In a notable development, in May 2022, Tata Motors secured a government contract in India to supply 5,450 electric buses worth INR 5,000 crore under the FAME 2 scheme. Additionally, the company announced plans to deliver 20,000 light electric trucks to six major e-commerce players. These advancements in the EV space are anticipated to further fuel the demand for electric commercial vehicles in the APAC region from 2024 to 2030.

Asia Pacific Electric Commercial Vehicles Industry Overview

The Asia Pacific Electric Commercial Vehicles Market is moderately consolidated, with the top five companies occupying 48.55%. The major players in this market are BYD Auto Co. Ltd., Daihatsu Motor Co. Ltd., Dongfeng Motor Corporation, Hyundai Motor Company and Mitsubishi Motors Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93030

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Body Type

- 5.1.1 Buses

- 5.1.2 Heavy-duty Commercial Trucks

- 5.1.3 Light Commercial Pick-up Trucks

- 5.1.4 Light Commercial Vans

- 5.1.5 Medium-duty Commercial Trucks

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 South Korea

- 5.3.8 Thailand

- 5.3.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Auto Co. Ltd.

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Dongfeng Motor Corporation

- 6.4.4 Higer Bus Company Ltd.

- 6.4.5 Hino Motors Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 Mitsubishi Motors Corporation

- 6.4.9 Tata Motors Limited

- 6.4.10 Zhengzhou Yutong Bus Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.