Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693636

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693636

Europe Electric Light Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 258 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

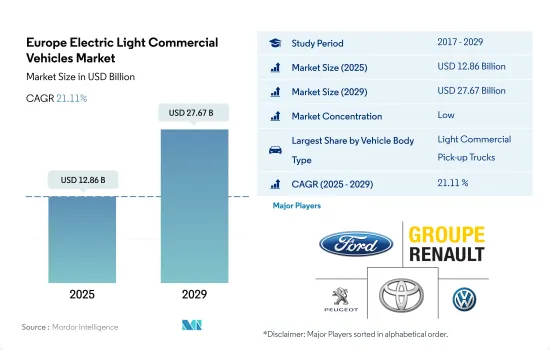

The Europe Electric Light Commercial Vehicles Market size is estimated at 12.86 billion USD in 2025, and is expected to reach 27.67 billion USD by 2029, growing at a CAGR of 21.11% during the forecast period (2025-2029).

Europe has a pioneering role in driving the adoption of electric light commercial vehicles with configurations suited to various business needs

- The European electric light commercial vehicles (ELCVs) market, characterized by cargo trucks and vans, is undergoing significant transformations driven by a shift toward sustainability and electrification. The van segment, in particular, has seen notable activity, with major automotive players introducing electric variants to cater to the rising demand for zero-emission vehicles. For example, Nissan's introduction of the all-new Townstar van represents a strategic move to replace the e-NV200, offering a fully electric option designed to accelerate the transition to zero-emission motoring.

- The European market's dynamics are influenced by various factors, including technological advancements, regulatory frameworks, and the growth of e-commerce, which has increased the demand for efficient last-mile delivery solutions. However, the market has faced challenges, such as the overall decline in commercial vehicle registrations and the specific downturn in van sales, attributed partly to the economic impact of the pandemic and the changing regulatory landscape aimed at reducing emissions.

- The ELCV market in Europe presents several opportunities, underpinned by the growing emphasis on reducing greenhouse gas emissions and improving urban air quality. Initiatives like Volkswagen's plan to set up six battery factories across Europe by 2030 underscore the industry's commitment to expanding the electric vehicle ecosystem. Additionally, collaborations and innovations in the sector, such as Punch Powertrain's agreement with Gruau to develop sustainable ELCVs, signal a future where electric vans and trucks play a central role in commercial transportation.

Country-specific developments in the European electric light commercial vehicles market are showcasing the continent's leadership in electrification efforts

- Globally, sales of commercial vehicles reached a total of 17.7 million each year. With more than 2.9 million new vans, trucks, and buses, Europe accounts for 16.4% of global registrations. Consumer purchasing habits have shifted in favor of electric vehicles due to increasing environmental concerns, the government's plan to ban internal combustion engines by 2030, and a general understanding of the benefits of eco-friendly vehicles, such as fuel efficiency and zero emissions.

- The COVID-19 pandemic has had unparalleled repercussions on culture and the economy. The automobile industry has experienced significant effects, and the recovery process is still expected to be drawn out and challenging. Despite this, the Italian government continues to predict that starting in 2025, the use of electric vehicles will significantly expand. Additionally, the European Commission approved public financing of EUR 3.2 billion in December 2019 from seven Member States for pan-European research and innovation projects. This promotes the development of highly innovative and sustainable technologies for lithium-ion batteries, involving R&I activities up to the first industrial deployment along the entire battery value chain.

- The government has prioritized the development of batteries, vehicles, charging stations, digital mobility apps, ICT, smart mobility, and energy services to accelerate the adoption of electric vehicles in the coming years. The demand for electric commercial vehicles is anticipated to increase due to the growth of e-commerce and logistical activities.

Europe Electric Light Commercial Vehicles Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Electric Light Commercial Vehicles Industry Overview

The Europe Electric Light Commercial Vehicles Market is fragmented, with the top five companies occupying 32.16%. The major players in this market are Ford Motor Company, Groupe Renault, Peugeot S.A., Toyota Motor Corporation and Volkswagen AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93024

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Configuration

- 5.1.1 Light Commercial Vehicles

- 5.2 Fuel Category

- 5.2.1 BEV

- 5.2.2 FCEV

- 5.2.3 HEV

- 5.2.4 PHEV

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Latvia

- 5.3.11 Lithuania

- 5.3.12 Norway

- 5.3.13 Poland

- 5.3.14 Russia

- 5.3.15 Spain

- 5.3.16 Sweden

- 5.3.17 UK

- 5.3.18 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADDAX MOTORS NV.

- 6.4.2 ARRIVAL LTD.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Fiat Chrysler Automobiles N.V

- 6.4.5 Ford Motor Company

- 6.4.6 Groupe Renault

- 6.4.7 Maxus

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Peugeot S.A.

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

- 6.4.12 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.