Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693615

North America Van - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 202 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

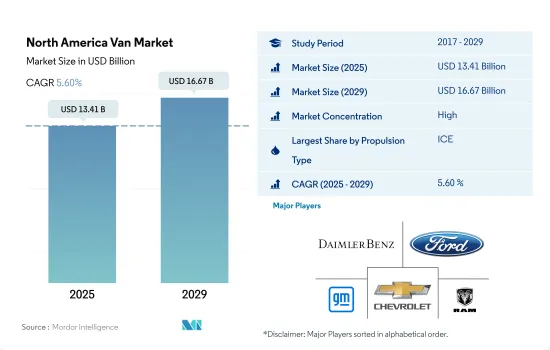

The North America Van Market size is estimated at 13.41 billion USD in 2025, and is expected to reach 16.67 billion USD by 2029, growing at a CAGR of 5.60% during the forecast period (2025-2029).

Steady growth is anticipated in North America's LCV market, fueled by economic development, evolving logistics needs, and a focus on sustainable transportation

- In 2023, the North American market for LCVs across all propulsion types exhibited a slight increase, with sales volumes reaching 4,055,770 units from 4,046,122 units in 2022. This growth, albeit modest, indicates a stabilizing market that continues to play a crucial role in supporting various sectors, including logistics, retail, and services, amid evolving economic and environmental landscapes. In 2024, sales are expected to reach 4,058,449 units, indicating a steady demand for LCVs in North America. This steady market performance underscores the essential role of LCVs in facilitating commerce and trade, reflecting the region's economic resilience and the diverse needs of its commercial sectors.

- The North American LCV market's modest growth aligns with broader trends, including economic recovery, a surge in e-commerce, and a heightened focus on sustainability. While the spotlight often falls on electric and hybrid vehicles, the demand for LCVs spans a spectrum of propulsion types, signaling a balanced shift toward cleaner transportation.

- From 2024 to 2030, the North American LCV market is poised for gradual expansion, with projections pointing to sales potentially reaching 4,473,267 units by the end of 2030. This growth is propelled by economic expansion, urbanization, and the surging demands of e-commerce, necessitating robust logistics. Moreover, as environmental concerns and advancements in vehicle efficiency gain traction, the market for electric and hybrid LCVs is poised for a notable increase, further shaping the commercial transportation landscape in North America.

The North American van market is witnessing significant growth, with distinct trends in each country pointing toward a rising preference for versatile and efficient transportation solutions

- Automakers are proactively exploring alternative fuel sources for their vehicles, driven by the dwindling petroleum supplies and escalating gasoline costs. The 2022 Russia-Ukraine conflict further exacerbated the already doubled petroleum prices over the past few decades, prompting a global push towards electric vehicles (EVs) for more economical everyday transportation. Tax rates also play a role in global fuel costs, with the US having the lowest fuel tax at 19% and India imposing a hefty 69% tax. These factors, combined with the rising fuel prices over the last two decades, underscore the appeal of EVs, which boast significantly lower operating costs compared to traditional internal combustion engine (ICE) vehicles.

- Electrifying their vehicle portfolios has become a paramount objective for automakers. Volvo aims for EVs to constitute 50% of its global sales by 2025. Subaru plans to introduce hybrid or electric versions for all its models by 2035. Ford is planning to invest a substantial USD 29 billion in EVs by 2025, while GM is allocating USD 27 billion, with a vision to electrify its entire light-duty vehicle lineup by 2035. Other manufacturers have set similar ambitions, albeit with varying timelines and targets, all united by their commitment to electrification.

- North America is set to witness the launch of 12 new electric vans between 2020 and 2028. Notably, the majority will be entirely new models, including the ELMS UD-1, Rivian R1A, and BrightDrop EV600. Additionally, established van lines like the Mercedes-Benz eSprinter and Ford Transit are also gearing up to introduce all-electric variants in the future.

North America Van Market Trends

Growing demand for electric vehicles in North America driven by government support and growing environmental concerns

- The CVP in Russia has experienced significant fluctuations in recent years. It climbed steadily from USD 208.2 million in 2017, peaking in 2019. However, it dipped to USD 193.9 million in 2020, largely due to the economic challenges brought on by the COVID-19 pandemic. Notably, the market rebounded sharply in 2022, reaching USD 269.8 million. This resurgence highlights both the resilience of the Russian automotive sector and the potential impact of economic stimulus measures and heightened consumer demand.

- Government incentives and subsidies are proving to be a strong draw for customers, particularly logistics and e-commerce firms, in their adoption of electric commercial vehicles. A case in point is Canada and North America, where, in April 2022, the government unveiled federal rebates of USD 5000 for electric light- and medium-duty vehicles. These initiatives are expected to significantly bolster the demand for electric commercial vehicles in North America from 2024 to 2030.

- Government initiatives, including plans for EV deployment, attractive incentives, and foreign investment allowances, are set to propel the electric vehicle market across North American nations. In a notable move, in March 2022, Volkswagen committed a staggering USD 7 billion to establish an electric car manufacturing facility in North America. By 2030, the automaker plans to roll out 25 new EV models, catering to customers in the US, Mexico, and Canada. As a result, the demand for electric vehicles is projected to witness a notable surge across various North American countries from 2024 to 2030.

North America Van Industry Overview

The North America Van Market is fairly consolidated, with the top five companies occupying 93.82%. The major players in this market are Daimler AG (Mercedes-Benz AG), Ford Motor Company, General Motors Company, GM Motor (Chevrolet) and Ram Trucking, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92999

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.1.1 By Fuel Category

- 5.1.1.1.1 BEV

- 5.1.1.1.2 PHEV

- 5.1.2 ICE

- 5.1.2.1 By Fuel Category

- 5.1.2.1.1 Diesel

- 5.1.2.1.2 Gasoline

- 5.1.1 Hybrid and Electric Vehicles

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 US

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daimler AG (Mercedes-Benz AG)

- 6.4.2 Fiat Chrysler Automobiles N.V

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 GM Motor (Chevrolet)

- 6.4.6 Nissan Motor Co. Ltd.

- 6.4.7 Peugeot S.A.

- 6.4.8 Ram Trucking, Inc.

- 6.4.9 Toyota Motor Corporation

- 6.4.10 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.