Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693614

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693614

United States Vans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 187 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

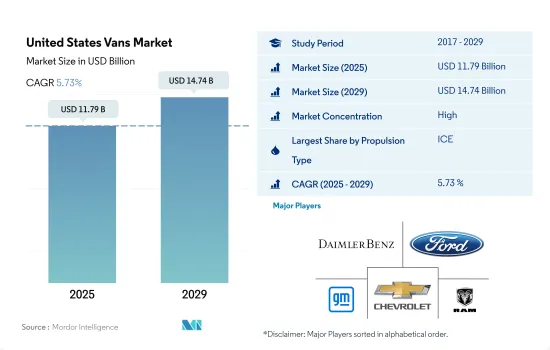

The United States Vans Market size is estimated at 11.79 billion USD in 2025, and is expected to reach 14.74 billion USD by 2029, growing at a CAGR of 5.73% during the forecast period (2025-2029).

US light commercial van market grew from 410,000 units in 2017 to 330,000 in 2022, with a rebound to 346,949 units expected by 2024

- In 2022, the sales of light commercial vans in the United States dipped to 330,000 units, continuing the downward trend from the 2021 figure of 340,000 units. This decline, observed over the past few years, reflects shifting dynamics in business logistics and urban planning, resulting in reduced demand for these vehicles, particularly in densely populated areas. However, the market appears to be stabilizing. Projections for 2023 indicated sales of around 332,665 units. A rebound is anticipated in 2024, with sales forecasted to reach approximately 346,949 units, signaling a potential resurgence in demand for light commercial vans.

- Back in 2017, the US light commercial van market boasted a robust figure of 410,000 units. Sales remained relatively steady until 2019, but a notable decline set in from 2020. The initial stability can be attributed to sectors heavily reliant on these vans for their transportation and logistics needs. However, the subsequent drop aligns with the challenges posed by urban congestion and evolving business models, favoring more compact and efficient transport solutions.

- Looking beyond 2024, the US light commercial van market is poised for a gradual recovery. Sales volumes are projected to exhibit slight fluctuations but maintain an upward trajectory, culminating in an estimated 380,500 units by 2030. Factors such as advancements in vehicle design, a growing appetite for door-to-door delivery services, and the evolution of urban infrastructure are expected to fuel this growth.

United States Vans Market Trends

Rapid growth in electric vehicle sales driven by government initiatives and increasing demand in the US

- The United States has witnessed a significant surge in the adoption of electric vehicles (EVs) in recent years. This uptick can be attributed to a heightened awareness of EVs, growing environmental concerns, and the implementation of government regulations. Notably, in 2016, California introduced the Zero-Emission Vehicle (ZEV) program aimed at curbing carbon emissions and improving air quality. This initiative has not only spurred the growth of electric cars within California but has also influenced other states to adopt similar ZEV regulations. Consequently, the nation saw a remarkable 634% surge in demand for battery electric vehicles (BEVs) from 2017 to 2022.

- The demand for electric commercial vehicles in the United States is also on the rise. Factors such as the booming e-commerce industry, increased logistics activities, and governmental initiatives for cleaner transportation have fueled this growth. In a significant move, the governor of New York signed the Advanced Clean Truck (ACT) Rule in September 2021. This rule sets a target for all new light-duty vehicles to be zero-emission by 2035 and the same for medium- and heavy-duty vehicles by 2045. As a result, the United States witnessed a 21% surge in demand for electric commercial vehicles in 2022 compared to the previous year.

- Governmental efforts, including rebates, subsidies, and strategic plans, are further bolstering the electrification of vehicles nationwide. In May 2022, President Biden unveiled a USD 3 billion plan to expedite domestic battery manufacturing, with the aim of transitioning gas-powered vehicles to electric ones. This push is expected to significantly boost electric mobility in the country, particularly during 2024-2030, thereby amplifying the demand for battery packs.

United States Vans Industry Overview

The United States Vans Market is fairly consolidated, with the top five companies occupying 79.21%. The major players in this market are Daimler AG (Mercedes-Benz AG), Ford Motor Company, General Motors Company, GM Motor (Chevrolet) and Ram Trucking, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92998

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Hybrid and Electric Vehicles

- 5.1.1.1 By Fuel Category

- 5.1.1.1.1 BEV

- 5.1.1.1.2 HEV

- 5.1.2 ICE

- 5.1.2.1 By Fuel Category

- 5.1.2.1.1 Diesel

- 5.1.2.1.2 Gasoline

- 5.1.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daimler AG (Mercedes-Benz AG)

- 6.4.2 Fiat Chrysler Automobiles N.V

- 6.4.3 Ford Motor Company

- 6.4.4 General Motors Company

- 6.4.5 GM Motor (Chevrolet)

- 6.4.6 IVECO S.p.A

- 6.4.7 Nissan Motor Co. Ltd.

- 6.4.8 Ram Trucking, Inc.

- 6.4.9 Volkswagen AG

- 6.4.10 Workhorse Group Inc.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.