Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693584

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693584

India Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 244 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

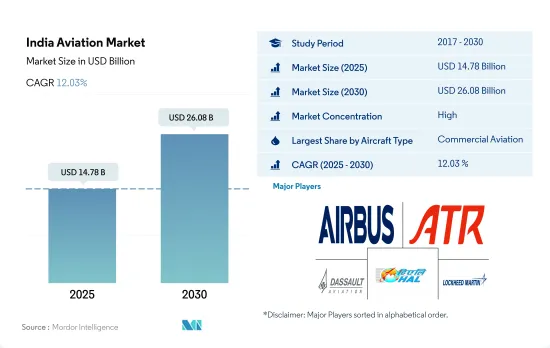

The India Aviation Market size is estimated at 14.78 billion USD in 2025, and is expected to reach 26.08 billion USD by 2030, growing at a CAGR of 12.03% during the forecast period (2025-2030).

Commercial aviation is expected to dominate the market in India during the forecast period

- The civil and military aviation industry in India emerged as one of the fastest-growing industries in the country in the past few years. According to the Indian government, the commercial aviation sector contributed USD 30 billion to India's GDP in 2021. With this growth, the domestic aviation market is projected to rank third globally by 2024.

- Air traffic has been growing rapidly in the country as compared to the global average. The air fleet number may rise from the present 600 to 1,200 during 2024. The general aviation industry in India is considered a luxury for both business and private needs and strongly drives the country's economic growth. The surge of tourist traffic into India and the rising HNWIs have driven the growth of the general aviation sector in the country.

- Despite these driving factors, challenges in ease of doing business, complications with the tax structures, inadequate infrastructure, and complicated processes to obtain operating licenses have resulted in subdued growth of the business aviation market in India. India is a critical military aircraft market, as the country has been modernizing its aerial capabilities by procuring new aircraft and indigenously developing military aircraft to defend its borders from Pakistan and China.

- HAL is the largest manufacturer of aircraft and helicopters in India and has been producing BAE Hawk Trainers and Tejas LCA. It is also developing fifth-generation Advanced Medium Combat Aircraft under the Make in India initiative, with deliveries expected to start during the forecast period.

India Aviation Market Trends

Ease of restrictions and rising air passenger travel are driving the market demand

- In 2022, nearly 123.2 million passengers traveled by air. This was 47% more than the passenger numbers in 2021. The year closed with IndiGo retaining the market share crown at almost 55%, with others trailing far behind. Vistara and Air India were both a distant second in December with a market share of 9.2% each, followed by SpiceJet and AIX Connect (AirAsia India) with 7.6% each. Go First recorded a share of 7.5%, while Akasa Air ended the year with 2.3%.

- By carrying 69 million passengers in 2022, IndiGo improved its 2019 performance by a million when it carried almost 68 million passengers. This is after the company suffered from reduced capacity following the grounding of several of its planes. Domestic air passenger traffic grew 15 percent year-on-year to around 129 lakhs in December 2022 but remained 1 percent lower than the pre-pandemic level (December 2019). According to ICRA, the domestic aviation industry operated at an estimated passenger load factor of around 91% in December 2022 against approximately 80% in December 2021 and about 88% in December 2019.

- A total of 24.8 million passengers were carried by domestic airlines in India between January and March 2022, compared to 23.38 million during the same period in 2021. In March 2022, India resumed its scheduled international flights, leading to a surge in international passenger traffic. As a result, in April 2022, Indian carriers reached 1.85 million passengers, slightly surpassing the traffic recorded in April 2019, which was 1.83 million international passengers. As of January 2022, the country had air bubble arrangements with 35 countries aimed at restarting international travel. These air bubble arrangements will provide direct/indirect connectivity to more than 100 countries.

Geopolitical threats are the driving factor for rising defense expenditure

- India is the fourth-largest defense spender in the world and the second largest in the Asia-Pacific region. In 2022, the country's defense spending was USD 81.4 billion, a growth of 6% compared to 2021. India proposed USD 72.6 billion in defense spending for the 2023-24 financial year, 13% up from the previous period's initial estimates, aiming to add more fighter jets and roads along its tense border with China. The total Indian defense budget is estimated at 2% of GDP. India plans to spend nearly INR 242 billion (USD 3 billion) for naval fleet construction and INR 571.4 billion (USD 7 billion) for air force procurements, including more aircraft.

- The country's expenditure on capital outlays, which funds equipment upgrades for the armed forces and the military infrastructure along its disputed border with China, amounted to 23% of total military spending in 2022. Personnel expenses (e.g., salaries and pensions) remained the largest expenditure category in the Indian military budget, accounting for around half of all military spending.

- Recently, allocations for specifically indigenous purchases were made. The Tejas Light Combat Aircraft (LCA) Mk-1A, Light Combat Helicopters (LCH), basic trainer HTT-40 aircraft, Arjun Mk-1A tanks, several missiles, and other weapons may receive significant funding. Increased defense production will pave the way for exports and help offset expenses. Foreign equipment manufacturers are more likely to establish joint ventures (JVs) and attract foreign direct investment in high technology fields (FDI). Some of these joint ventures are also expected to aid in defense exports.

India Aviation Industry Overview

The India Aviation Market is fairly consolidated, with the top five companies occupying 92.04%. The major players in this market are Airbus SE, ATR, Dassault Aviation, Hindustan Aeronautics Limited and Lockheed Martin Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92734

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.2 Air Transport Freight

- 4.3 Gross Domestic Product

- 4.4 Revenue Passenger Kilometers (rpk)

- 4.5 Inflation Rate

- 4.6 Active Fleet Data

- 4.7 Defense Spending

- 4.8 High-net-worth Individual (hnwi)

- 4.9 Regulatory Framework

- 4.10 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Commercial Aviation

- 5.1.1.1 By Sub Aircraft Type

- 5.1.1.1.1 Passenger Aircraft

- 5.1.1.1.1.1 By Body Type

- 5.1.1.1.1.1.1 Narrowbody Aircraft

- 5.1.1.1.1.1.2 Widebody Aircraft

- 5.1.2 General Aviation

- 5.1.2.1 By Sub Aircraft Type

- 5.1.2.1.1 Business Jets

- 5.1.2.1.1.1 By Body Type

- 5.1.2.1.1.1.1 Large Jet

- 5.1.2.1.1.1.2 Light Jet

- 5.1.2.1.1.1.3 Mid-Size Jet

- 5.1.2.1.2 Piston Fixed-Wing Aircraft

- 5.1.2.1.3 Others

- 5.1.3 Military Aviation

- 5.1.3.1 By Sub Aircraft Type

- 5.1.3.1.1 Fixed-Wing Aircraft

- 5.1.3.1.1.1 By Body Type

- 5.1.3.1.1.1.1 Multi-Role Aircraft

- 5.1.3.1.1.1.2 Training Aircraft

- 5.1.3.1.1.1.3 Transport Aircraft

- 5.1.3.1.1.1.4 Others

- 5.1.3.1.2 Rotorcraft

- 5.1.3.1.2.1 By Body Type

- 5.1.3.1.2.1.1 Multi-Mission Helicopter

- 5.1.3.1.2.1.2 Transport Helicopter

- 5.1.3.1.2.1.3 Others

- 5.1.1 Commercial Aviation

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 ATR

- 6.4.3 Bombardier Inc.

- 6.4.4 Dassault Aviation

- 6.4.5 General Dynamics Corporation

- 6.4.6 Hindustan Aeronautics Limited

- 6.4.7 Leonardo S.p.A

- 6.4.8 Lockheed Martin Corporation

- 6.4.9 Textron Inc.

- 6.4.10 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.