Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693576

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693576

Europe General Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 230 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

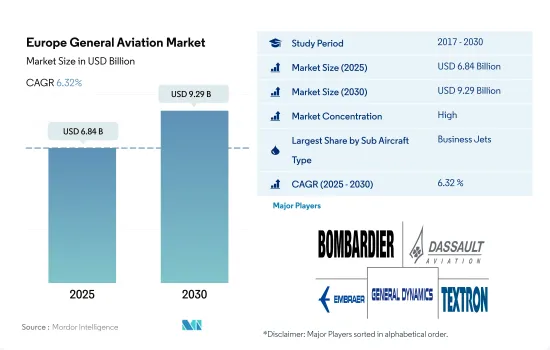

The Europe General Aviation Market size is estimated at 6.84 billion USD in 2025, and is expected to reach 9.29 billion USD by 2030, growing at a CAGR of 6.32% during the forecast period (2025-2030).

Increase In Business Travel Flight Hours After The Pandemic Generated A High Demand For Business Jets

- Business jets offer European executives and corporations direct access to smaller airports and avoid the time-consuming processes associated with commercial flights. These jets enable busy executives to maximize their productivity and reduce travel-related disruptions. As of December 2022, Europe accounted for around 16% of the global business jet fleet. Germany led the region with 18% of the total European business jet fleet, followed by the United Kingdom and France, with around 12% and 7%, respectively.

- The COVID-19 pandemic adversely impacted business jet deliveries in the region, with a decline of 26% in 2020 compared to 2021. There has been a shift toward private flying as a safer mode of transportation among the HNWI population in the region, aiding in procuring business jets. However, the market gradually recovered from the pandemic, and in 2022, the region recorded 34% growth compared to 2020.

- In terms of deliveries, during 2017-2022, the large jet segment dominated the region with 53% of the share, followed by light and mid-size jets with 35% and 12%, respectively. During the same period, the OEM that delivered most of the business jets was Embraer, with 11% of the total jets delivered in the region, followed by Cessna with 10% of jets delivered, Bombardier delivered 9% of the jets, and Gulfstream delivered 7% of the jets. Cessna was the leading OEM, with 30% of the current operational fleet size, followed by Bombardier and Dassault, with 19% and 14%, respectively, in the European business jet fleet as of December 2022. The surge in UHNWI individuals in the region is expected to aid the business jet segment. Around 1,244 aircraft are expected to be delivered between 2023 and 2030

The Demand For Business Aviation In The Region Is Expected To Aid The European General Aviation Sector

- The rise of HNWIs and UHNWIs, who prefer private jets and helicopters for personal or business travel in Europe, aided in the procurement of aircraft in the general aviation sector. From 2017 to 2022, the HNWI population in the region increased by 67%. The surge in the HNIW population has also aided in the growth of the general aviation sector in the region. In 2022, the number of UHNWIs in Europe increased by 5% compared to 2021. This was because the Eurozone utilities, tech stocks, and luxury goods sectors performed well, registering solid gains. Europe recorded the third significant rise in the ultra-wealthy population, which recorded 67% of the global HNWI population during 2017-2022.

- In 2021, air charter service providers witnessed high demand across Europe with the surge in new memberships for business aviation. For instance, in 2021, a major Europe-based air charter service provider, VistaJet, registered a growth of around 53% in new memberships during H1 2021 compared to H1 2020. Out of the new memberships, more than 50% belong to the European region.

- According to the major charter service providers in Europe, demand increased significantly toward the end of 2021 and managed to surpass 2019 levels of traffic. Business aviation traffic has been approximately 20-30% more than in 2019 since August 2021. Due to such strong demand, charter jet service companies are expanding their fleets to meet the growing demand.

- Regarding the current operational fleet, Germany is the leading country with around 18% of the European business jet fleet. The United Kingdom and France accounted for approximately 11% and 9%, respectively, of the European fleet as of December 2022. During 2023-2030, around 5,062 general aviation aircraft are expected to be delivered.

Europe General Aviation Market Trends

Rise in the HNWI population acting as the major growth driver for the market

- HNWIs and UHNWIs often own private jets for personal or business travel. Europe is home to a multitude of scenic and exclusive destinations that may not be easily accessible through commercial flights. Business jets provide the opportunity for HNWIs to fly directly to remote locations, avoiding congested airports and time-consuming connections. In 2022, the number of UHNWIs in Europe increased by 5% compared to 2021. This was because the Eurozone utilities, tech stocks, and luxury goods sectors performed well, registering solid gains. Europe recorded the third significant rise in the ultra-wealthy population, which recorded 67% of the global HNWI population during 2017-2022.

- The leading position of Europe in terms of the number and assets of HNWIs is mainly attributed to Germany, France, and the United Kingdom. In 2022, these three countries alone recorded 67% of the total HNWIs in Europe. Germany led the HNWI population with 3.5 million HNWIs, followed by France with 3.07 million and the United Kingdom with 2.9 million. The United Kingdom attracts a steady stream of high-net-worth individuals from Africa, Asia, and the Middle East. Russia saw the least growth in the HNWI population, which recorded 2%. This was because well-off people have been moving out of Russia every year for the past 10 years, a sign of the current issues the country is facing. The crisis in Ukraine posed risks to the global economy, especially to inflation and financial markets. However, the market is expected to recover during the forecast period. In 2030, the HNWI population is expected to grow by 18.4 million.

Europe General Aviation Industry Overview

The Europe General Aviation Market is fairly consolidated, with the top five companies occupying 74.10%. The major players in this market are Bombardier Inc., Dassault Aviation, Embraer, General Dynamics Corporation and Textron Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92725

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 High-net-worth Individual (hnwi)

- 4.2 Regulatory Framework

- 4.3 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Business Jets

- 5.1.1.1 Large Jet

- 5.1.1.2 Light Jet

- 5.1.1.3 Mid-Size Jet

- 5.1.2 Piston Fixed-Wing Aircraft

- 5.1.3 Others

- 5.1.1 Business Jets

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Italy

- 5.2.4 Netherlands

- 5.2.5 Russia

- 5.2.6 Spain

- 5.2.7 Turkey

- 5.2.8 UK

- 5.2.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Bombardier Inc.

- 6.4.3 Cirrus Design Corporation

- 6.4.4 Daher

- 6.4.5 Dassault Aviation

- 6.4.6 Diamond Aircraft

- 6.4.7 Embraer

- 6.4.8 General Dynamics Corporation

- 6.4.9 Leonardo S.p.A

- 6.4.10 PIAGGIO AERO INDUSTRIES S.p.A

- 6.4.11 Pilatus Aircraft Ltd

- 6.4.12 Robinson Helicopter Company Inc.

- 6.4.13 Tecnam Aircraft

- 6.4.14 Textron Inc.

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.