Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693580

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693580

Asia-Pacific General Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 216 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

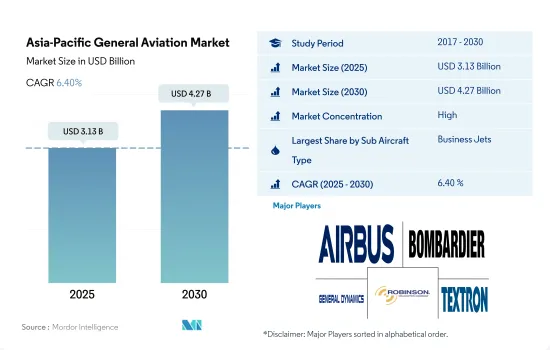

The Asia-Pacific General Aviation Market size is estimated at 3.13 billion USD in 2025, and is expected to reach 4.27 billion USD by 2030, growing at a CAGR of 6.40% during the forecast period (2025-2030).

The Increasing Number Of High Net-Worth Individuals (HNWIS) In The Region And Their Preference For Private Jet And Helicopter Travel For Personal Or Business Purposes Also Contribute To The Increased Procurement Of Business Jets And Piston Fixed-Wing Aircraft

- Asia-Pacific accounted for around 5% of the global business jet deliveries in 2022. Similarly, piston fixed-wing aircraft accounted for 10% of global deliveries in 2022.

- The rising number of HNWIs in the region and their preference for private jets and helicopters for personal or business travel are also helping boost the procurement of private jets in the general aviation sector. For instance, the HNWI population in the region increased from 8.77 million in 2017 to 13.9 million in 2022.

- The COVID-19 pandemic adversely impacted the general aviation sector in the Asia-Pacific region. Global restrictions on travel and pandemic-induced lockdown affected demand. The deliveries of business jets declined by 27% in 2020 compared to 2019. Similarly, the deliveries of turboprop aircraft declined by 19%, and the helicopters category witnessed a fall of around 14%. However, with the ease of travel restrictions, there is an increasing momentum in the number of people traveling and adopting private jets.

- Bombardier was the leading OEM, with 24% of the current operational fleet size, followed by Gulfstream and Textron, with 21.2% and 20.3%, respectively, in the Asia-Pacific business jet fleet as of July 2022. Regarding current operational fleet size in the business jet category, large jets dominated with a fleet size of 565 aircraft, followed by light jets and mid-size jets with 364 and 133 aircraft, respectively. During 2023-2030, around 4,533 general aviation aircraft are expected to be delivered in the region.

China is expected to be the major market in the Asia-Pacific general aviation market

- The overall aircraft deliveries in the general aviation sector were affected during the COVID-19 pandemic, and the growth between 2019 and 2021 was -7.8%. The reduced economic activities in Asia-Pacific, along with travel-related restrictions, affected the utilization and procurement of business jets, helicopters, and turboprop aircraft in the region.

- The rise of HNWIs and UHNWIs, who prefer private jets and helicopters for personal or business travel in Asia-Pacific, aided in the procurement of aircraft in the general aviation sector. From 2016 to 2021, the HNWI population in the region increased by 117%. In terms of the current operational fleet, China was the leading country with around 21% of the overall Asia-Pacific business jet fleet, followed by Australia, India, and Japan with around 18%, 13%, and 9% of the deliveries, respectively, as of July 2022. In the helicopter category, Australia was the leading country with around 32% of the overall helicopter fleet, followed by China, Japan, and New Zealand with around 18%, 12%, and 11% of the deliveries, respectively, as of July 2022.

- The helicopter category was dominated by single-engine helicopters, which accounted for 70% of the current operational Asia-Pacific helicopter fleet. The large-scale utilization of single-engine helicopters in corporate aviation aided in the procurement of single-engine helicopters. Approximately 1,600 aircraft are expected to be delivered in China during 2022-2028. The economic recovery in the developing economies in the region, such as China and India, is expected to aid the growth of the general aviation sector in Asia-Pacific during the forecast period.

Asia-Pacific General Aviation Market Trends

The HNWI population is booming and is expected to be the biggest growth driver for the market

- HNWIs have over USD 1 million in liquid financial assets, while UHNWIs have a net worth of at least USD 30 million. From 2017 to 2022, there was a surge of around 90% in the HNWI population in the region. In 2022, the number of HNWIs in Asia-Pacific increased by 2% compared to 2020.

- Japan witnessed a growth rate of 15% in 2022. The slow growth of the HNWI population in major countries has affected the overall wealth growth in Asia-Pacific. In China, the increase in average wealth led to more than 70% in the number of millionaires. Asia-Pacific is emerging as the leading destination for wealth management and private banking globally, driven by the growing wealth in the region, the increasing HNWI population, and its need for financial advice.

- Factors such as a change in political leadership and low consumption during the pandemic impacted the Japanese Stock market, Nikkei 225, and hampered the growth of HNWIs in the country. Developing countries such as India, Vietnam, and Thailand witnessed growth in HNWIs compared to the leading Asia-Pacific countries. In 202, India witnessed a growth of over 292% in its HNWI population. Thailand and Vietnam witnessed a growth of around 21% and 13%, respectively. High liquidity support by central banks, supportive domestic policy, and stability in the stock markets aided the growth of HNWIs in these countries. Technology, industrial conglomerates, energy, and real estate were the major sectors that accounted for most of the Asia-Pacific HNWI population.

Asia-Pacific General Aviation Industry Overview

The Asia-Pacific General Aviation Market is fairly consolidated, with the top five companies occupying 66.97%. The major players in this market are Airbus SE, Bombardier Inc., General Dynamics Corporation, Robinson Helicopter Company Inc. and Textron Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92730

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 High-net-worth Individual (hnwi)

- 4.2 Regulatory Framework

- 4.3 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Aircraft Type

- 5.1.1 Business Jets

- 5.1.1.1 Large Jet

- 5.1.1.2 Light Jet

- 5.1.1.3 Mid-Size Jet

- 5.1.2 Piston Fixed-Wing Aircraft

- 5.1.3 Others

- 5.1.1 Business Jets

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 China

- 5.2.3 India

- 5.2.4 Indonesia

- 5.2.5 Japan

- 5.2.6 Malaysia

- 5.2.7 Philippines

- 5.2.8 Singapore

- 5.2.9 South Korea

- 5.2.10 Thailand

- 5.2.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Bombardier Inc.

- 6.4.3 Cirrus Design Corporation

- 6.4.4 Dassault Aviation

- 6.4.5 General Dynamics Corporation

- 6.4.6 Honda Motor Co., Ltd.

- 6.4.7 Leonardo S.p.A

- 6.4.8 MD Helicopters LLC.

- 6.4.9 Robinson Helicopter Company Inc.

- 6.4.10 Textron Inc.

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.