Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693507

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693507

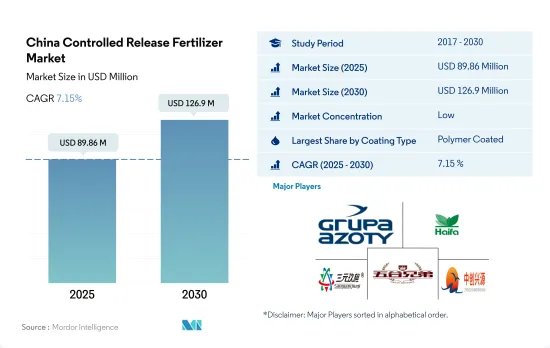

China Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 131 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The China Controlled Release Fertilizer Market size is estimated at 89.86 million USD in 2025, and is expected to reach 126.9 million USD by 2030, growing at a CAGR of 7.15% during the forecast period (2025-2030).

Polymer-coated urea is the most adopted CRF in the country due to its higher content

- In 2022, controlled-release fertilizers (CRFs) represented a mere 0.6% of China's specialty fertilizer market. However, the market value of CRFs exhibited a consistent upward trajectory in the past and is projected to maintain a robust CAGR of 6.9% from 2023 to 2030.

- Among CRFs, polymer-coated urea stands out as the dominant variant in China. This is primarily due to its high nitrogen (N) content, thin coating, easy degradability, and extended release period. It finds extensive use as a basal fertilizer for staple crops like rice, corn, and wheat. Polymer-coated fertilizers, including urea, commanded a significant 75.9% share of the CRF segment in 2022. Notably, the specific technologies employed in polymer coatings vary across manufacturers, influenced by the choice of coating material and process.

- Polymer-sulfur-coated fertilizers, enriched with sulfur, are preferred for their positive impact on crop quality and resilience. The synergistic effect of sulfur and nitrogen enhances crop nitrate levels and overall quality. Nitrogenous fertilizers, a subset of polymer-sulfur-coated fertilizers, held a dominant 59.7% share in this segment in 2022.

- Besides chemical coatings, there is a rising trend of biobased coatings on fertilizers, including biobased polyurethane, epoxy resin, and polyolefin wax composites. These coatings, driven by heightened demand from governments, particularly stand out in the "others" category. In 2022, the "others" segment accounted for 5.4% of China's controlled-release fertilizer market.

- Given these distinct advantages and evolving trends, the demand for coated controlled-release fertilizers is poised for significant growth in the coming years.

China Controlled Release Fertilizer Market Trends

The expansion of the cultivation area is driven by increasing demand for food and the country's goal to achieve self-sufficiency in staple food

- The cultivation area of field crops in China increased from 130.5 million ha in 2017 to 127.8 million ha in 2021, accounting for 71.4% of the total area under cultivation. Among field crops, corn occupied the maximum share of 34.2%, followed by rice and wheat, accounting for 23.6% and 18.3%, respectively. The rising area under cultivation is expected to increase the need for fertilizer usage in the country.

- The country usually grows field crops in two seasons: summer/spring (April-September) and winter. Spring crops mainly include early corn, early rice, early wheat, and cotton. Winter crops include winter wheat and rapeseed. However, rice and corn are the most important crops grown in China, accounting for one-third of the grain production in China. It is the world's largest rice producer and utilized 30 million hectares of land for rice farming in 2022, producing a harvest of 210 million tonnes. The major rice-producing regions in China include Heilongjiang, Hunan, Jiangxi, Hubei, Jiangsu, Sichuan, Guangxi, Guangdong, and Yunnan. Corn production in China for 2022-23 was expected to reach 277.2 million tonnes, which was 4.6 million tonnes higher than last year due to a better harvest. The major corn-growing regions are in the Northeast provinces of Heilongjiang, Jilin, and Inner Mongolia.

- Although spring is the main cropping season in the country, it is slightly affected by high heat in June and July. For instance, rice is the staple food for millions in China. High temperatures and low precipitation increase the loss of minerals in the soil, leading to the need for a higher application of fertilizers to the soil. These dry weather conditions may also limit the yield of the crops.

About 28% of nitrous oxide emissions from cropland in the world are from Chinese agricultural lands

- Primary nutrients enhance biochemical processes such as enzyme activity in plants and promote plant cell growth. Deficiencies in primary nutrients can affect plant health, development, and crop production output. The average application rate of nitrogen, potassium, and phosphorus combined in field crops was 159.9 kg/hectare in 2022. The average primary nutrient application in field crops accounted for 65.23% nitrogen, 28.07% phosphorous, and 6.68% potassium.

- Nitrogen ranks first among primary nutrients, as it is essential for plant metabolism and is a component of chlorophyll and amino acids. Nitrogen had an average application rate of 279.65 kg/hectare. Potash followed with 105.3 kg/hectare and phosphorous with 94.9 kg/hectare in 2022. The contamination of surface and groundwater with nitrogen and phosphorus has been considered a result of inadequate advice given to farmers regarding fertilizer application rates. About 28% of nitrous oxide emissions from cropland in the world are from China's agricultural lands.

- In 2022, crops with the highest average nutrient application rates were cotton (255.41 kg/hectare), wheat (232.25 kg/hectare), corn (198.44 kg/hectare), and rice (157.76 kg/hectare). In 2022, cotton production accounted for 6.4 million metric tons, making China the world's largest producer, consumer, and importer of cotton. Around 20% of the cotton consumed worldwide is produced in China, and 84% of that production comes from Xinjiang.

- To meet the demands of a growing population, boosting crop production is essential; as a result, the application of primary nutrients in field crops is expected to grow between 2023 and 2030.

China Controlled Release Fertilizer Industry Overview

The China Controlled Release Fertilizer Market is fragmented, with the top five companies occupying 19.69%. The major players in this market are Grupa Azoty S.A. (Compo Expert), Haifa Group, Hebei Sanyuanjiuqi Fertilizer Co., Ltd., Hebei Woze Wufeng Biological Technology Co., Ltd and Zhongchuang xingyuan chemical technology co.ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92571

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Grupa Azoty S.A. (Compo Expert)

- 6.4.2 Haifa Group

- 6.4.3 Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- 6.4.4 Hebei Woze Wufeng Biological Technology Co., Ltd

- 6.4.5 Zhongchuang xingyuan chemical technology co.ltd

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.