Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693476

Africa Sorghum Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 175 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

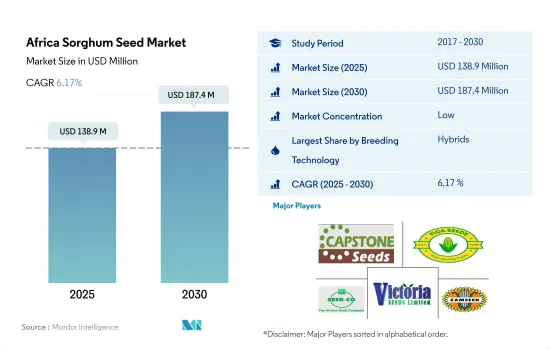

The Africa Sorghum Seed Market size is estimated at 138.9 million USD in 2025, and is expected to reach 187.4 million USD by 2030, growing at a CAGR of 6.17% during the forecast period (2025-2030).

The increasing demand for improved hybrid varieties of sorghum seeds, such as gluten-free and high antioxidants, is driving the market

- Hybrid seed varieties dominated the African sorghum seed market, which accounted for about 56.6% of the market value in 2022, while open-pollinated seeds held a share of 43.4% in the same year.

- The hybrid market is being driven by increased investment by private industries in developing new varieties to boost yield and production in the region, commercialization of hybrid seeds, and favorable government policies. The transgenic hybrids of sorghum seeds are not approved for commercial cultivation in the region, driving the non-transgenic hybrid seed market in the region.

- The market value of sorghum non-transgenic hybrids has increased by about 42.5% between 2017 and 2022. The market for non-transgenic hybrids is projected to grow due to increased demand for sorghum from the feed and processing industries, as well as consumer preference for non-GMO, gluten-free, and high-antioxidant varieties.

- The acreage of open-pollinated varieties and hybrid derivatives of sorghum has increased from 1.9 million hectares in 2017 to 2.0 million hectares in 2022. This is primarily due to the rise in demand for organic or sustainably grown sorghum in the country.

- In terms of value, Nigeria had the largest OPV seed market, with a 51.5% market share of the African open-pollinated sorghum seed market in 2022. Small-scale farmers mostly prefer the use of OPV seeds due to their lower cost compared to hybrid seeds, and the majority of small-scale farmers utilize farm-saved seeds instead of buying open-pollinated varieties.

- The unavailability of transgenic crops combined with the growing demand for non-GMO crops in the country is anticipated to drive the market during the forecast period.

Nigeria dominates the African sorghum seed market due to the increased availability of hybrid varieties and favorable government policies

- In 2022, the sorghum segment accounted for a 4.1% share value of the African seed market. The market value of this segment increased by 37.1% between 2017 and 2022. This is because of the increasing usage of sorghum in a wide range of pleasant and healthy traditional dishes in Africa, such as semi-leavened bread, couscous, and fermented and non-fermented porridges.

- Nigeria is the largest producer of sorghum in Africa. It accounted for a 51.4% share in terms of the value of the African sorghum seed market in 2022. This is because of the increased availability of hybrid varieties in the country and favorable government policies. As a result, hybrids hold a major share compared to open-pollinated varieties.

- In 2022, Ethiopia is the second-largest sorghum-producing country in Africa. It accounted for a 16.0% share of the African sorghum market value, which is estimated to grow by 44.9% during the forecast period. This is because sorghum prices are higher in Ethiopia than in any other country in the region. Thus, the volume is comparatively low.

- In 2022, Tanzania accounted for a share of 3.0% in terms of the value of the African sorghum seed market. The area under cultivation of sorghum was 753.7 thousand ha in 2017, which increased to 1.0 million ha in 2022. As a result, the quantity of sorghum utilized for industrial purposes increased by 25% in the country.

- In 2022, the rest of Africa accounted for 25.2% of the African sorghum seed market. The usage of open-pollinated varieties (59.5%) is higher than hybrid varieties (40.5%) in sorghum.

- The rise in the area under cultivation land of sorghum and the increase in the demand from domestic markets for consumption are estimated to drive the segment with a CAGR of 6.2% during the forecast period.

Africa Sorghum Seed Market Trends

Government initiatives and demand for improved varieties, along with the usage of sorghum in processing industries, are driving the acreage

- The area under cultivation of grain sorghum in Africa was 28.4 million hectares in 2022, which accounted for 22.5% of the area under the grains & cereals segment in the same year. The acreage under grain sorghum increased by 2.1% from 27.9 million hectares in 2017 to 2022. However, the acreage declined by 6.1% in 2019 compared to the previous year (2018) because farmers preferred to plant more profitable crops such as corn and oilseed. The decrease was also due to a lack of awareness about improved seed varieties and the drought during 2018-2022, which impacted the cultivation area in Africa. Developing countries such as Ethiopia and Kenya suffer from drought in the growing season, impacting the cultivation area in Africa.

- Nigeria was the major country concerning the acreage under sorghum, accounting for 20.3% of the region in 2022. The area under sorghum in 2018 declined by 3.9% compared to 2017, and it declined by 3.5% in 2019 compared to 2018. The decrease in the acreage is associated with the resurgence of Boko Haram (BH) activities in the major sorghum-producing regions in the country. Ethiopia was the second-largest country after Nigeria, occupying 5.9% of the African sorghum acreage in 2022. The cultivation area under sorghum is estimated to increase as countries such as Ghana have been providing subsidies to sorghum producers to cultivate more sorghum to satiate the demand in the country. Other countries, such as Kenya and Nigeria, are witnessing an increase in the demand for sorghum to meet the demand from industries operating in these countries.

- The demand from brewing industries and government subsidies for cultivation is estimated to drive the acreage under sorghum in the region.

Disease resistant traits are the most preferred segment in sorghum cultivation due to the rising yield losses caused by diseases

- Sorghum is an important staple food crop in Africa. In sorghum, diseases play a significant role in deciding the yield and quality of produce. Sorghum is the host of numerous fungal, bacterial, and viral pathogens that infect the crop cycle. Disease-resistant varieties help get a better yield, thus boosting their demand. In sorghum, fungal diseases are more common and cause high yield loss compared to viral and bacterial diseases. The common sorghum diseases are grain mold, ergot, smut, downy mildew, etc., which cause yield losses. Consequently, the demand for varieties with disease-resistant traits may surge in the region.

- Sudan, Nigeria, Niger, and Ethiopia are the major sorghum-producing countries in the region. The development of disease-resistant varieties and hybrids is the main focus for the management of sorghum diseases in the region. In 2020, Seed Co. company, in partnership with ICRISAT, developed a disease-resistant sorghum hybrid with a 23-34% higher yield and adaptability to diverse agroecologies in Zimbabwe and southern Africa.

- Sorghum varieties with wider adaptability to different soils, low and high tannin content, early maturity, and high uniformity are the other major popular traits that are in huge demand. Sekedo, Seso 1, and Seso 3 are insect and disease-resistant varieties developed by Victoria Seeds Limited in Uganda, Kuyuma, Sima, and ZSV 15 are some of the wider adaptable cultivars developed by Zamseeds, where the farmers prefer these varieties to get better yields.

- Therefore, to prevent increasing losses from biotic and abiotic stresses and increase productivity, the demand for sorghum seeds with advanced traits is projected to increase during the forecast period.

Africa Sorghum Seed Industry Overview

The Africa Sorghum Seed Market is fragmented, with the top five companies occupying 22.14%. The major players in this market are Capstone Seeds, FICA SEEDS, Seed Co Limited, Victoria Seeds Limited and Zambia Seed Company Limited (Zamseed) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92539

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Country

- 5.2.1 Egypt

- 5.2.2 Ethiopia

- 5.2.3 Ghana

- 5.2.4 Kenya

- 5.2.5 Nigeria

- 5.2.6 South Africa

- 5.2.7 Tanzania

- 5.2.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Capstone Seeds

- 6.4.3 Corteva Agriscience

- 6.4.4 FICA SEEDS

- 6.4.5 S&W Seed Co.

- 6.4.6 Seed Co Limited

- 6.4.7 Victoria Seeds Limited

- 6.4.8 Zambia Seed Company Limited (Zamseed)

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.