Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693442

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693442

Sorghum Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 379 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

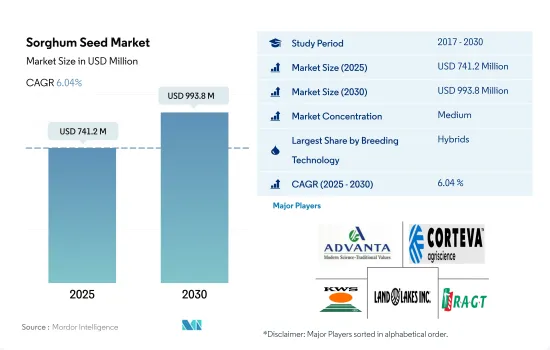

The Sorghum Seed Market size is estimated at 741.2 million USD in 2025, and is expected to reach 993.8 million USD by 2030, growing at a CAGR of 6.04% during the forecast period (2025-2030).

Hybrid seed sales are driven by the growers' preference to have higher resistance to diseases and lodging and stress resistance

- In 2022, sorghum hybrid seeds held a major share of 70.2% of the global sorghum seed market, while open-pollinated varieties and hybrid derivatives had a 29.8% share. The hybrid segment is estimated to grow by 52.4% in terms of value during 2023-2030. Hybrids contributed significantly to increased grain yields. Grain productivity has increased by 40% in Asia.

- Due to the high cost of hybrid seeds, the open-pollinated varieties and hybrid derivatives of sorghum are estimated to increase by 37.2% during the forecast period. Nigeria holds Africa's largest land under open-pollinated varieties and hybrid derivatives, accounting for about 20% of overall OPV acreage.

- Only non-transgenic sorghum seeds are available in the global hybrid sorghum seed market. Non-transgenic sorghum seeds account for approximately 70% of the global sorghum seed market. The non-transgenic sorghum seeds segment is estimated to grow, registering a CAGR of 6.8% during the forecast period.

- North America is the leading producer of hybrid sorghum. Hybrid varieties accounted for more than 80% of the sorghum grown in the region. Introducing hybrid sorghum varieties is driven by the rising export demand and the region's growing population. The United States holds a major share in using hybrid varieties in North America, accounting for 98% of sorghum cultivated in the country.

- Large-scale farmers do not use open-pollinated seed varieties, as they have lower yields, are more susceptible to disease, and need a lot of areas to grow compared to hybrid seeds. Thus, the hybrid segment is estimated to grow because of the various benefits associated with hybrids.

North America dominated the market due to higher adoption of hybrids and commercial seeds

- North America is one the largest sorghum producers in the world. The region accounted for 45.6% of the global sorghum seed market in 2022. The sorghum was the third-largest cereal grain grown in the United States, accounting for nearly 30% of all sorghum production worldwide. The area under sorghum cultivation in the United States increased by 30% between 2017 and 2022 because of the increased demand for various uses such as livestock feed and biofuel generation.

- In 2022, Africa accounted for an 18.9% share of the global sorghum seed market which showed a significant growth of 37.1% between 2017 and 2022. Nigeria is the largest sorghum producer in Africa, accounting for 51.4% of the African sorghum seed market in 2022.

- In Asia-Pacific, sorghum is one of the major cereal crops. The region accounted for 16.4% of the global sorghum seed market in 2022. The acreages under sorghum cultivation were 7.1 million ha in 2022, 15.6% more than the previous year. China holds a major share of 21.6% in the global sorghum seed market in 2022.

- In 2022, Brazil and Argentina accounted for 9.5% of the global sorghum seed market. The country's government is providing financial support to sorghum growers to meet the domestic demand due to the increasing demand from China to import sorghum from Brazil and Argentina.

- France is a major sorghum grower and exporter, accounting for 42.7% of the market for sorghum seeds in Europe in 2022. France's cultivation area increased by almost 50% between 2017 and 2022.

- The Middle East has a market share of 1.9% of the global sorghum seed market in 2022, which is comparatively significantly less despite the crop requiring less water.

Global Sorghum Seed Market Trends

Africa dominated the area under cultivation for sorghum due to its climatic conditions and water scarcity

- Sorghum is an important cereal crop grown globally for food and feed. It is most widely grown in the semi-arid tropics, where water availability is limited and frequently subjected to drought. The global sorghum cultivation area decreased by 8.2% from 2016 to 2022. Farmers prefer rice, wheat, and other cash crops over sorghum due to the high return on investment, leading to a decline in the acreage for sorghum.

- Africa has the largest area under cultivation for sorghum, which accounted for 69.5% of the global sorghum cultivation area in 2022. The acreage showed a decline of 6.2% between 2016 and 2022 due to the farmer's shift toward other crops, including corn, due to higher demand.

- In Asia-Pacific, the acreage under sorghum cultivation was 5.4 million hectares in 2022, representing 13.3 % of the global sorghum cultivation area. A factor driving the acreage under sorghum is its ability to yield and grow in dry and marginal land more than other crops. Its distinct genetics and composition allow it to grow in various climatic conditions where other crops cannot.

- In North America, the area under cultivation of sorghum increased by 13% between 2017 and 2022, which reached 4.1 million hectares in 2022. The United States alone accounted for 64.6% of North America's sorghum acreage in 2022. The rising export demand for sorghum, especially from the massive Chinese feed industry, is boosting seed sales from the commercially operated sorghum farms in the country. Thus, the acreage is expected to increase during the forecast period. South America and Europe have moderate markets for sorghum, and the cultivation area is low in these regions.

Sorghum seeds with traits such as wider adaptability, disease resistance, and early maturity are witnessing high growth to meet the demand of processing industries

- Sorghum is mainly cultivated in Africa and North America as a grain and forage for cattle feed. It is one of the staple foods in Africa, where water scarcity is high. It is also one of the grain crops that can withstand low water conditions. With the increase in the cattle population and changes in weather conditions over the past five years in the region (such as droughts in Africa), varieties tolerant to drought are becoming popular. Furthermore, with the changing weather and soil conditions, there has been an increase in biotic and abiotic stress, which has led to the growth of broader adaptability varieties being adopted by the growers to earn high profits by producing high-quality crops in adverse conditions. Companies such as Advanta Seeds, KWS Saat & Co., and Land O' Lakes are providing wider adaptability traits to meet this high demand.

- Disease-resistant traits, as well as resistance to downy mildew, root rots, downy mosaic virus, and other diseases, are other major traits that are very popular and widely cultivated. These diseases cause significant yield losses during field conditions. Therefore, these varieties resist these diseases and increase the productivity of the crops. Additionally, other traits such as resistance to pests (stem borers, shoot-fly, and midge fly), low and high tannin content, early-medium matured varieties, and the color of the grains (red, white, pearl white, etc.) are primarily used globally. KWS Fenixus and BRS 310 - Graniferous by KWS are the products that help in the early maturity of the crop.

- The demand for advanced traits is expected to increase in the future due to increased demand from consumers, the processing industry, and dairy farmers.

Sorghum Seed Industry Overview

The Sorghum Seed Market is moderately consolidated, with the top five companies occupying 48.04%. The major players in this market are Advanta Seeds - UPL, Corteva Agriscience, KWS SAAT SE & Co. KGaA, Land O'Lakes Inc. and RAGT Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92504

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.2 Most Popular Traits

- 4.3 Breeding Techniques

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Region

- 5.2.1 Africa

- 5.2.1.1 By Breeding Technology

- 5.2.1.2 By Country

- 5.2.1.2.1 Egypt

- 5.2.1.2.2 Ethiopia

- 5.2.1.2.3 Ghana

- 5.2.1.2.4 Kenya

- 5.2.1.2.5 Nigeria

- 5.2.1.2.6 South Africa

- 5.2.1.2.7 Tanzania

- 5.2.1.2.8 Rest of Africa

- 5.2.2 Asia-Pacific

- 5.2.2.1 By Breeding Technology

- 5.2.2.2 By Country

- 5.2.2.2.1 Australia

- 5.2.2.2.2 Bangladesh

- 5.2.2.2.3 China

- 5.2.2.2.4 India

- 5.2.2.2.5 Myanmar

- 5.2.2.2.6 Pakistan

- 5.2.2.2.7 Philippines

- 5.2.2.2.8 Thailand

- 5.2.2.2.9 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 By Breeding Technology

- 5.2.3.2 By Country

- 5.2.3.2.1 France

- 5.2.3.2.2 Germany

- 5.2.3.2.3 Italy

- 5.2.3.2.4 Romania

- 5.2.3.2.5 Russia

- 5.2.3.2.6 Spain

- 5.2.3.2.7 Ukraine

- 5.2.3.2.8 Rest of Europe

- 5.2.4 Middle East

- 5.2.4.1 By Breeding Technology

- 5.2.4.2 By Country

- 5.2.4.2.1 Iran

- 5.2.4.2.2 Saudi Arabia

- 5.2.4.2.3 Rest of Middle East

- 5.2.5 North America

- 5.2.5.1 By Breeding Technology

- 5.2.5.2 By Country

- 5.2.5.2.1 Mexico

- 5.2.5.2.2 United States

- 5.2.5.2.3 Rest of North America

- 5.2.6 South America

- 5.2.6.1 By Breeding Technology

- 5.2.6.2 By Country

- 5.2.6.2.1 Argentina

- 5.2.6.2.2 Brazil

- 5.2.6.2.3 Rest of South America

- 5.2.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Capstone Seeds

- 6.4.3 Corteva Agriscience

- 6.4.4 Kaveri Seeds

- 6.4.5 KWS SAAT SE & Co. KGaA

- 6.4.6 Land O'Lakes Inc.

- 6.4.7 RAGT Group

- 6.4.8 Royal Barenbrug Group

- 6.4.9 S&W Seed Co.

- 6.4.10 Seed Co. Limited

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.