Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693473

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693473

South America Forage Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 209 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

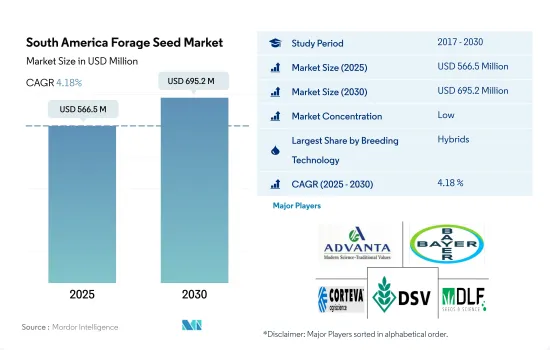

The South America Forage Seed Market size is estimated at 566.5 million USD in 2025, and is expected to reach 695.2 million USD by 2030, growing at a CAGR of 4.18% during the forecast period (2025-2030).

Increasing forage crop cultivation area and cattlemen preferring non-transgenic seeds with ethanol processing are expected to help in increasing the demand for hybrid seeds in the region

- In South America, the area under the cultivation of forage crops in 2022 was 8.7 million hectares, which was about 7.8 million hectares in 2017. It is an increase of 11.5% from 2017 to 2022 due to an increase in the demand for animal feed.

- In 2022, South America accounted for 9.3% of the global forage seed market due to the increase in the production for export to neighboring countries as a raw material for feed production.

- Brazil is the largest user of hybrid seeds for forage cultivation, which accounted for 59.7% of the region's hybrid forage production area in 2022. However, transgenic hybrid penetration is more prevalent in Argentina.

- Some cattlemen have a preference for forage crops produced using non-transgenic hybrid seeds because they are easily digestible by the cattle. Corn silage is being used for corn ethanol production in Brazil, which led to forage corn becoming the fastest-growing crop in the region.

- The share of forage crops cultivated using open-pollinated varieties and hybrid derivative seeds in the country was 26.1% in 2022. It is largely contributed by native grasses of the Brachiaria genus.

- The Brachiaria grasses are grown either wild or as cover crops or rotation crops for extra for farmers between two seasons, which helps in nutrient cycling. Therefore, OPVs are expected to grow over the forecast period owing to those factors. However, commercial cultivation is done by hybrids and GM varieties that require lesser inputs and more productivity, which is expected to register a CAGR of 2.4% in South America during the forecast period.

Brazil holds the largest share of the South American forage seed market due to government support programs for forage cultivation and robust demand from the livestock industry

- Brazil is the largest country in the South American forage seed market due to the increased demand for beef production, the growing livestock population, and government support programs for the cultivation of forage crops.

- According to the USDA, beef production in Brazil is estimated to grow from 2023 to 2030 due to the increasing availability of cattle and improved margins for slaughterhouses. For instance, the number of cattle in Brazil was 372.8 million in 2021, an increase of 4.2% from 2017. The increasing livestock will likely increase the demand for meat in the country and boost the production of forage crops.

- Argentina is anticipated to register a CAGR of 4.6% during the forecast period as it is globally the second-highest consumer of beef, with a yearly consumption of 55 kg per person. In 2019, Argentina had about 400 slaughter plants. Over the past several years, industry investments have grown to increase slaughter capacity due to increasing consumption. Therefore, the demand for feed is expected to increase and boost the market's growth in South America during the forecast period.

- The Rest of South American market held the smallest share in the region because of the low-quality seeds available in these countries, but the Lianos of Colombia and Venezuela are major commercial centers for livestock in South America. Therefore, the demand for seeds is anticipated to grow during the forecast period.

- Therefore, government support in funding the cultivation of forage crops, an increase in the livestock population, and increasing meat consumption in the region may boost the growth of the forage seed market during the forecast period.

South America Forage Seed Market Trends

An increase in the demand for healthy animal feed, growing livestock farming and meat industry are driving the cultivation area for forage crops

- The area cultivated under forage crops has increased by about 13.6% between 2017 and 2022 because of the increase in the demand by cattlemen, the meat industry, and the increase in livestock in the South American region. In 2022, the cultivated area for alfalfa was about 50.1% of the total cultivated area of forage crops. This domination of alfalfa is mainly attributed to the crop's high protein content, which provides healthy feed for livestock.

- Argentina held the largest area under forage crops, with 4.7 million hectares in 2022, which accounted for 53.9% of the region's forage crop area. This is followed by Brazil with 40.2% in the same year. Despite Argentina holding the largest area under forage cultivation, the commercial forage cultivation area is less in Argentina compared to Brazil. For instance, the commercial cultivation area of forage crops in Argentina was 0.5 million hectares compared to Brazil, which had 1.1 million hectares in 2022. This variation is mainly attributed to the large area of natural pastures in Argentina. Furthermore, the forage area in Brazil has increased by about 14.3% between 2017 and 2022. This increase is mainly attributed to the growing demand for the forage crops from the livestock industry. Moreover, Brazil had about 12.0 million hectares of degraded pasture land as of 2021, and the conversion of this pasture to cultivated pastures could generate an additional production of 17.7 million bovines while reducing the need for new agricultural land. This may drive the overall forage crop area in the country during the forecast period.

- The increasing demand for forage crops from the livestock industries is anticipated to drive the overall forage crop area in the region during the forecast period.

Different climatic conditions and higher weed concentrations are driving the demand for wider adaptability and herbicide-tolerant alfalfa seed traits

- Alfalfa is the primary forage crop in the South American region, predominantly grown in Argentina and Brazil. In South America, over 50% of the alfalfa varieties cultivated possess disease resistance, herbicide tolerance, and adaptability to various growing conditions. In 2019, Argentina began cultivating genetically modified (GM) alfalfa to mitigate yield losses caused by weed infestations. These GM alfalfa varieties, developed by Bioceres, are tolerant to glyphosate herbicides. These herbicide-tolerant cultivars help reduce weed infestations, resulting in a 20-30% reduction in crop losses. Currently, herbicide-tolerant varieties are widely offered in the region by Bayer AG, Corteva Agriscience, and Limagrain.

- Similarly, there is a growing demand for alfalfa varieties with wider adaptability and disease-resistant traits. These traits enable crops to withstand various growing conditions and provide resistance to root and crown diseases. Companies such as DLF, S&W, Limagrain, and Bayer offer varieties with these multiple traits in their seeds. Some commercially available varieties with these traits from DLF include PGW 931, ACA 903, and Crioula, while S&W offers SW 3407, SW 6330, and SW 10.

- Other popular alfalfa traits in the region include dormant and non-dormant cultivars suitable for different seasons, lodging resistance, and high dry matter content. Consequently, the increasing prevalence of diseases, weed populations, and changing climatic conditions are major factors driving the demand for these traits to combat these challenges, and this demand is anticipated to continue growing during the forecast period.

South America Forage Seed Industry Overview

The South America Forage Seed Market is fragmented, with the top five companies occupying 32.07%. The major players in this market are Advanta Seeds - UPL, Bayer AG, Corteva Agriscience, Deutsche Saatveredelung AG and DLF (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92536

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Alfalfa

- 5.2.2 Forage Corn

- 5.2.3 Forage Sorghum

- 5.2.4 Other Forage Crops

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Deutsche Saatveredelung AG

- 6.4.5 DLF

- 6.4.6 Groupe Limagrain

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Peman

- 6.4.9 Royal Barenbrug Group

- 6.4.10 S&W Seed Co.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.