Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693456

North America Forage Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 213 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

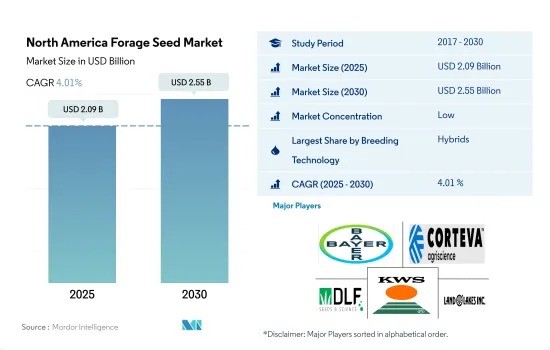

The North America Forage Seed Market size is estimated at 2.09 billion USD in 2025, and is expected to reach 2.55 billion USD by 2030, growing at a CAGR of 4.01% during the forecast period (2025-2030).

Application of forages in different industries and the rapid hybrid development are driving the forage seed market in North America

- In 2022, the non-transgenic hybrid forage seed was the largest sub-segment which accounted for 96.8% of the hybrid forage seeds market in the region. This is because of the perceived effect of transgenic traits on livestock and animal health. Additionally, the cost associated with transgenic hybrids is also one of the major factors to discourage farmers from adopting GM hybrids.

- However, there is a change in the trend as farmers cultivate transgenic forage crops with traits that make feed easy to digest. Therefore, in the future, the transgenic segment is anticipated to see growth along with non-transgenic hybrids.

- Alfalfa and corn are the most hybridized among the forage crops which accounted for 16.9% and 4.3% of the hybrid forage seed market in 2022 respectively as they have more demand in the processing industry in pellet feeds and ethanol production, respectively in the region.

- The United States was the major country concerning the North American hybrid forage seed market which accounted for 55% in 2022. The dominant share of the country was because of the high replacement rate and higher demand from farmers. Moreover, farmers in the country can afford to buy hybrid seeds owing to their large farm sizes. However, Canada was the most significant country concerning the usage of OPVs as Canada is relatively against the usage of transgenic hybrids and the majority of farmers see forage crops as rotational crop and prefers farm-saved and OPVs.

- Therefore, the shift in farmers' perception towards transgenic hybrids realizing the benefits associated with it, and the development of new hybrids to improve yield to meet demand from dairy and processing industries are estimated to drive the hybrid segment in the region at a CAGR of 3.8% during the forecast period.

Canada dominates the market as it is the fastest-growing country, with increasing support from the government

- The forage seed segment accounted for 8.1% of the North American seed market in 2022 due to increased demand for forage as feed, meat consumption, and weather conditions. In the region, forage crops are preferred for benefits such as providing nutrients and restoring soil vigor, less water required for irrigation, and investments in cultivation using advanced technologies.

- The demand for forage seeds was higher in Canada, accounting for USD 863.6 million in 2022. The higher share of the country was due to the high demand for forage as feed and the increase in the cattle population in the country. Moreover, the area under commercial forage seeds in the country was 3.1 million ha in 2022 compared to other North American countries.

- In Canada, alfalfa was the major forage crop, which accounted for 23% of the forage seed market in 2022 due to factors such as the government's support and an increase in the demand for feeding animals by the dairy and meat processing industries. For instance, in 2021, the Canadian government invested about USD 2.6 million to equip alfalfa growers with advanced technologies that help produce higher yields and improve alfalfa's winter survival rates.

- The United States was also one of the major countries, registering USD 686 million in 2022 and a rising cattle population. For instance, according to FAO, the number of cattle in the United States increased from 93.6 million in 2017 to 93.8 million in 2021.

- Therefore, the increasing demand for forages from processing and dairy industries, the ability to cultivate in less water conditions, and higher profits are estimated to drive the forage seed market in the region at a CAGR of 4.1% during the forecast period.

North America Forage Seed Market Trends

Rising cattle populations and growing demand from the forage seed market have led to an increase in the cultivation area

- The major forage crops grown in North America include alfalfa, forage corn, and forage sorghum. Forage crops accounted for about 13.9% of the region's total cultivation area in 2022. The total forage area increased by about 6.6% between 2017 and 2022. This increase could be mainly attributed to the increased demand for the quality forage requirement from dairy farmers or other livestock sectors.

- The United States held the largest area under forage crops in North America, with about 14.3 million hectares, accounting for about 60.1% of the region's forage crop area in 2022. This was mainly attributed to the high demand for the forage crops in the country due to the large livestock sector. For instance, there were about 89.3 million heads of cattle and calves in US farms as of 2022. This large livestock population is anticipated to drive the overall forage cultivation in the country.

- Alfalfa is the major forage crop cultivated in the region; it had a cultivation area of about 11.5 million hectares in 2022. The large cultivation area of alfalfa was mainly due to the well-suitable soil and climatic conditions for the crop and higher returns. Moreover, the commercial cultivation of transgenic (GM) alfalfa with various improved traits such as herbicide tolerance, antibiotic resistance, and altered lignin content in countries such as the United States, Canada, and Mexico has been approved. This is anticipated to encourage the farmers to cultivate alfalfa crops in the region.

- The increasing demand for the various livestock industries and the large livestock population in countries such as the United States are the major factors anticipated to drive the overall forage crop acreage during the forecast period.

The adoption of disease-resistant, insect-resistant, and drought-resistant alfalfa seeds for high yield during adverse climatic conditions is rising

- Alfalfa is a major forage crop cultivated in North America. The high-demand traits of alfalfa are disease resistance, insect resistance, and wider adaptability for improving the quality of the feed/silage for the livestock industry. Wider adaptability was the largest trait adopted by growers as there have been changes in weather conditions and demand for high yields with early maturity. Furthermore, other traits such as increasing protein content, growing throughout the seasons, and reducing lignin content are expected to gain popularity in the future, increasing forage quality.

- Popular traits of Alfalfa include disease resistance to wilts and root rots, wider adaptability to different seasons and soil conditions, drought tolerance, and resistance to insects and nematodes. For instance, major companies offering and marketing the traits of alfalfa varieties are Ampac Seed Company (Attention II), KWS SAAT SE & Co. KGaG (HarvXtra, Standfast), Bayer Crop Science (Roundup-Ready), Syngenta AG (NEXGROW), and DLF (Fortune) for resistance to diseases such as Colletotrichum trifolii and Verticillium wilt.

- Drought tolerance is the second-most popular trait among growers, as states such as Nebraska, Kansas, Oklahoma, Texas, New Mexico, and Oregon have been experiencing severe drought since 2022. About 12% of the land in these states was experiencing extreme drought in 2023. Therefore, the drought-tolerant trait is expected to gain popularity during the forecast period.

- Factors such as the increased demand for improving animal feed and a large number of benefits such as resistance to diseases and increasing yield are expected to drive the market's growth in the region.

North America Forage Seed Industry Overview

The North America Forage Seed Market is fragmented, with the top five companies occupying 37.48%. The major players in this market are Bayer AG, Corteva Agriscience, DLF, KWS SAAT SE & Co. KGaA and Land O'Lakes Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92518

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Alfalfa

- 5.2.2 Forage Corn

- 5.2.3 Forage Sorghum

- 5.2.4 Other Forage Crops

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Ampac Seed Company

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 Groupe Limagrain

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Land O'Lakes Inc.

- 6.4.9 Royal Barenbrug Group

- 6.4.10 S&W Seed Co.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.