Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693448

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693448

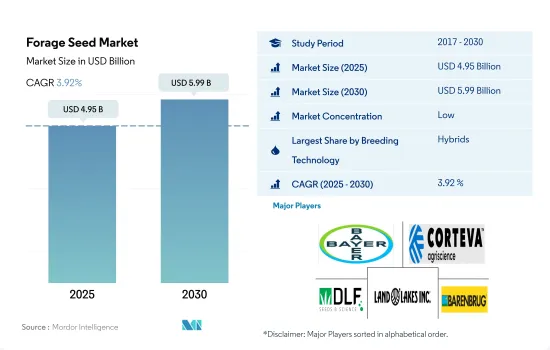

Forage Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 491 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Forage Seed Market size is estimated at 4.95 billion USD in 2025, and is expected to reach 5.99 billion USD by 2030, growing at a CAGR of 3.92% during the forecast period (2025-2030).

Hybrids dominate the forage seed market with the higher growth potential concerning the open-pollinated varieties.

- The livestock population is increasing across the regions. The increase in livestock population needs an expansion of the area under forages and demands the use of varieties with high yield potential and a high feed value. This is one of the major factors leading to the growth of the hybrid and open-pollinated seed market.

- Major companies are investing in improving seed quality due to increased demand. For instance, in 2021, DLF Seeds, the world's leading grass seed breeder, invested USD 4.6 million in new state-of-the-art mixing and distribution facilities. The investment will transform their current production facilities of OPVs and the hybrid seed of forage and bring much-needed additional capacity and efficiency to cope with the future market demands in the amenity, consumer, and environmental stewardship in the forage seed market.

- The hybrid seed segment dominates the market due to the increased adoption and awareness about its benefits. The hybrid seed market segment is estimated to increase by a CAGR of 3.9% during the forecast period due to the rise in the seed replacement rate and the availability of improved varieties in the market.

- The farmer's preference for transgenic varieties is slowly rising in various forage-growing regions due to increased crop losses due to weeds and diseases. Therefore, the transgenic segment is growing with a CAGR of 5% during the forecast period.

- The Asia-Pacific forage seed market using OPVs seeds is projected to be the fastest growing, at a CAGR of 4.3% during the forecast period because open-pollinated varieties require fewer inputs, such as fertilizer and pesticides, and are less expensive and more affordable for small holding and low-income farmers.

North America and Europe are leading forage seed markets in the world due to the large demand for forage seeds in these regions

- Globally, North America holds a major share, accounting for 42.3% of the global forage seeds market in terms of value in 2022 due to the increase in the demand for forage as feed, an increase in meat consumption, and weather conditions. In North America, the United States has the largest forage seed market, accounting for 37.0% of North America's forage seed market in 2022. This is due to the high demand for forage as feed and the increase in the cattle population in the country.

- Europe was the primary producer of forages. It contributed 26.7% to the global forage seed market in 2022. The increase in livestock production and consumption is driving the forage market in the region. Germany is the largest producer of forage crops in Europe, with a market share of 29.4% in the region's forage seed market in 2022.

- Asia-Pacific accounted for about 15.1% of the global forage seed market in 2022. India has the largest forage seed market in the region, and it accounted for 18% of the Asia-Pacific forage seed market in terms of value in 2022. The growing demand for forage crops due to the growing livestock sector in the region is anticipated to drive the region's forage seed market, registering a CAGR of 2.7% during the forecast period.

- In 2022, South America had a market share of 11.3% of the global forage seed market. Alfalfa is the major forage crop grown in South America. The availability of GM hybrids of alfalfa that are herbicide-resistant and tolerant to water stress and high lignin content for better digestibility is driving the transgenic alfalfa seed market in South America, and it is expected to register a CAGR of 4.2%.

- The increasing demand due to the increased livestock population is anticipated to drive the market during the forecast period.

Global Forage Seed Market Trends

Alfalfa dominates due to its ability to produce high forage yield under different weather and soil conditions.

- Globally, the area under forage crop cultivation reached 80.4 million ha in 2022, which increased by 4.3% between 2017 and 2022. This is due to the expansion of the global livestock industry, driven by increasing demand for meat and dairy products, which has led to a higher demand for forage crops as feed. Among the forage crops, alfalfa is a dominant crop in terms of cultivation area. It accounted for 39.2% of the global forage crop acreage in 2022. This is because of alfalfa's exceptional capacity to produce abundant protein and attractive forage under various weather and soil conditions.

- North America accounted for the major area under forage crop cultivation in the world, with a share of 29.7% in 2022. The United States alone held 59.8% of the region's forage acreage in 2022. This is mainly due to increased demand from the animal feed industry in the country.

- In the Asia-Pacific region, the total area under forage crop cultivation increased by 7.6% between 2017 and 2022. India has the largest area under forage crops, with 52.2% in 2022. The main factors increasing cultivation in the country are the high livestock population and rising demand for animal feed.

- Europe is one of the largest producers of Forages in the world. The total forage cultivation area in the region reached 9.1 million ha in 2022, which increased by 4.6% between 2017 and 2022 due to rising feed demand from livestock. Forage corn and alfalfa have the largest area under cultivation, accounting for 63.5% and 35.4% of the overall European forage cultivation area in 2022. Therefore, increased demand from the animal feed industry and the growing livestock population are estimated to drive the expansion of forage cultivation.

Increasing demand for fodder in livestock farming is driving the usage of forage seeds with disease resistance, wider adaptability, and early maturity traits

- Alfalfa and forage corn are the major forage crops because of their benefits to livestock rearing, such as more digestibility and high protein. They also allow farmers to attain higher yields with good quality. Wider adaptability for alfalfa was the largest adopted trait as there have been weather changes, increased demand for early maturity, and low lignin content in a single product to minimize the usage of different inputs. Additionally, wider adaptability was the most adopted trait in the global market, especially in South America, as it had a regional market share of 35.4% in 2022. It is the most adopted crop because of the changing agro-climatic conditions, field stress, and growing crop cultivation in different regions.

- Companies such as Bayer, DLF, and Barenbrug have introduced many varieties of alfalfa and forage corn, such as Alfalfa (DKC 3218, DKC 3204, Debalto, and Marcamo), as well as forage corn (Daisy, Fado, and Power 4.2). These varieties can withstand diverse environmental conditions, adapt to various soil types, and withstand field stress and heat conditions. The EU Commission's REFORMA project (2016-2020) aimed to develop advanced breeding techniques and introduce new alfalfa cultivars.

- There is an increase in the demand for seeds with early maturity and high starch content traits as they offer a shorter growing period, allowing farmers to harvest earlier. High starch content in forage corn enhances its nutritional value for animal feed. Therefore, the companies are expected to produce such varieties in larger quantities during the forecast period.

- To prevent the increasing losses from diseases and increase productivity in a shorter period, the seeds with traits such as disease resistance and early maturity drive the market.

Forage Seed Industry Overview

The Forage Seed Market is fragmented, with the top five companies occupying 33.65%. The major players in this market are Bayer AG, Corteva Agriscience, DLF, Land O'Lakes Inc. and Royal Barenbrug Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92510

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Alfalfa & Forage Corn

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Alfalfa

- 5.2.2 Forage Corn

- 5.2.3 Forage Sorghum

- 5.2.4 Other Forage Crops

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Breeding Technology

- 5.3.1.2 By Crop

- 5.3.1.3 By Country

- 5.3.1.3.1 Egypt

- 5.3.1.3.2 Ethiopia

- 5.3.1.3.3 Ghana

- 5.3.1.3.4 Kenya

- 5.3.1.3.5 Nigeria

- 5.3.1.3.6 South Africa

- 5.3.1.3.7 Tanzania

- 5.3.1.3.8 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Breeding Technology

- 5.3.2.2 By Crop

- 5.3.2.3 By Country

- 5.3.2.3.1 Australia

- 5.3.2.3.2 Bangladesh

- 5.3.2.3.3 China

- 5.3.2.3.4 India

- 5.3.2.3.5 Indonesia

- 5.3.2.3.6 Japan

- 5.3.2.3.7 Myanmar

- 5.3.2.3.8 Pakistan

- 5.3.2.3.9 Philippines

- 5.3.2.3.10 Thailand

- 5.3.2.3.11 Vietnam

- 5.3.2.3.12 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Breeding Technology

- 5.3.3.2 By Crop

- 5.3.3.3 By Country

- 5.3.3.3.1 France

- 5.3.3.3.2 Germany

- 5.3.3.3.3 Italy

- 5.3.3.3.4 Netherlands

- 5.3.3.3.5 Poland

- 5.3.3.3.6 Romania

- 5.3.3.3.7 Russia

- 5.3.3.3.8 Spain

- 5.3.3.3.9 Turkey

- 5.3.3.3.10 Ukraine

- 5.3.3.3.11 United Kingdom

- 5.3.3.3.12 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Breeding Technology

- 5.3.4.2 By Crop

- 5.3.4.3 By Country

- 5.3.4.3.1 Iran

- 5.3.4.3.2 Saudi Arabia

- 5.3.4.3.3 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Breeding Technology

- 5.3.5.2 By Crop

- 5.3.5.3 By Country

- 5.3.5.3.1 Canada

- 5.3.5.3.2 Mexico

- 5.3.5.3.3 United States

- 5.3.5.3.4 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Breeding Technology

- 5.3.6.2 By Crop

- 5.3.6.3 By Country

- 5.3.6.3.1 Argentina

- 5.3.6.3.2 Brazil

- 5.3.6.3.3 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Ampac Seed Company

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 KWS SAAT SE & Co. KGaA

- 6.4.7 Land O'Lakes Inc.

- 6.4.8 RAGT Group

- 6.4.9 Royal Barenbrug Group

- 6.4.10 S&W Seed Co.

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.