Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692570

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692570

Processed Pork Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 340 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

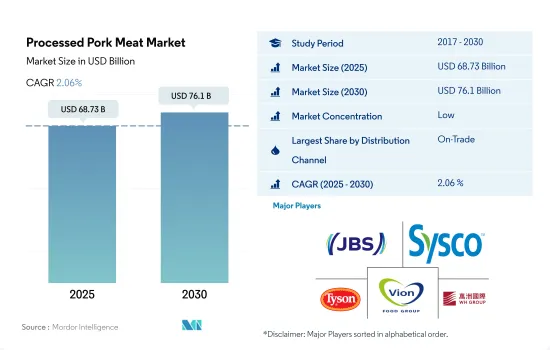

The Processed Pork Meat Market size is estimated at 68.73 billion USD in 2025, and is expected to reach 76.1 billion USD by 2030, growing at a CAGR of 2.06% during the forecast period (2025-2030).

Product innovation and expansion through supermarkets are propelling the market growth

- Sales of processed pork meat are primarily made through the on-trade channel, which is the primary market segment. It registered a growth of 8.16% by value from 2020 to 2022. Pork is particularly popular in the foodservice sector, used in bacon burgers and fast-food breakfasts. Restaurants are also introducing more dishes featuring pork belly, pork shoulder, pulled pork, and better chop cuts. Foreign demand for pork is also increasing, especially in markets such as Mexico, China, the United States, and Japan. These regions have well-established pork industries and consume a substantial amount of processed pork products like sausages, ham, and bacon.

- Off-trade is the fastest-growing channel in the processed pork market, which is projected to record a CAGR value of 2.49% during the forecast period. Key players such as JBS SA, Tyson Foods, Conagra Brands Incorporated, WH Group Limited, and Hormel Foods Corporation focus on product innovation and expansion through various retail channels, such as supermarkets and online stores. The growing working population is changing consumer food habits and spending patterns, whereas busy lifestyles are increasing the demand for processed pork.

- Online is the fastest-growing distribution channel in the processed pork market. It is projected to register a growth of 7.63% by value during the forecast period. Online grocery purchasing is highly sought after worldwide. The major international companies, including Walmart, Kroger, Amazon Fresh, and Grofers, focus on growing their current customer bases. They are extensively engaging in promotional efforts, boosting the growth of the online grocery market. They also provide specific product information, such as sourcing, certifications, processing, and manufacturing procedures.

Asia-Pacific region occupies a significant market share

- The sales of processed pork meat worldwide are growing moderately. The increase in the population, growing at 0.83% across the world in 2022 compared to the previous year, and the spike in protein demand due to increased health consciousness are fueling processed pork demand across the world. The demand for ready-to-eat food options has contributed to the sales and consumption of processed pork. Processed pork products are often found on convenience store shelves as convenient, on-the-go meal options.

- The Asia-Pacific region occupied a significant market share of processed pork sales in 2022. Most processed pork is consumed in China, with the highest per capita consumption of 24.29 kg per annum recorded in 2022. The country also has one of the world's largest populations, at 1.43 billion as of 2022, accounting for 50% of pork and processed pork meat consumption in the world. The rest of the countries in the Asia-Pacific are also increasing pork consumption due to higher disposal incomes and the increasing urban population. An increase in feed availability in Asian countries is attracting new poultry farms, which are, in turn, attracting pork processing industries.

- Europe is the second-leading region in the consumption of pork globally. The region produced 22.1 million tons of pork in 2022. Germany, Poland, and Spain are the major pork-producing countries in the region. European cuisines are diverse and rich in pork-based traditional recipes and are key ingredients in iconic dishes like German bratwurst, French charcuterie, Italian prosciutto, Spanish chorizo, and British bacon. Pork is prohibited in the Middle East region. Only a few authorized supermarkets and restaurants in the UAE and Oman are licensed to sell pork in the region.

Global Processed Pork Meat Market Trends

The prevalence of a variety of infectious diseases in the pig population affects production

- Global pork production saw varied growth during the study period, which grew by 1.55% in 2022 compared to the previous year. Asia-Pacific is the largest pork-producing region, representing 51.45% of the total global production volume in 2022. In Asia-Pacific, China produced the most pork, i.e., 52.95 million tons in 2021, accounting for over 41.78% of the total global pork production. In 2021, China's pig slaughter volume reached 609 million heads, a steep rise from the slaughter volume in 2020, which was only 469 million heads. Similarly, Vietnam produced 2.59 million tons of pork in 2021. Other leading producers are the United States (12.31 million tons), the Rest of Asia-Pacific (6.96 million tons), and Germany (5.20 million tons).

- The volume declined by 8.63% from 2018 to 2019, primarily due to the effects of ASF, which impacted global pork production. ASF is a highly contagious and deadly swine disease that can affect farm-raised and feral (wild) pigs and has high mortality rates (95-100%). In 2019, about 225 million pigs in China either died or were culled due to the outbreak, and almost 25% of the global pig population died from ASF during 2018-2019. Although the ASF virus was discovered about a century ago, no commercial vaccinations or treatments are still available. ASF also led to livestock deaths in Europe, Asia, and Oceania.

- Europe is the second-largest pork-producing region globally, contributing over 23.05% of the total global pork production in 2022. The rest of Europe was the largest pork producer in the region in 2021, with a pork volume of 10.11 million tons, followed by Spain (5.18 million tons), Germany (4.97 million tons), Russia (4.34 million tons), France (2.20 million tons), and the Netherlands (1.71 million tons).

Rising input costs and inflation are leading to a spike in prices

- From 2017 to 2022, global pork prices grew by 8.50%. Concerns about food affordability and safety, as well as volatile and rising post-COVID-19 pandemic pork prices, are the main drivers behind the rise in retail pork prices. Significantly higher feed costs, accompanied by a 79% surge in corn prices and a 42% increase in soybean meal prices from 2020 to 2022, along with increasing fuel, transportation, packing, and retail costs, have contributed to incremental cost rises. Many of these marginal costs result in changes in farm, wholesale, and retail pork prices.

- In US retail, pork prices increased in the second half of 2021 and remained elevated until 2022. The Bureau of Labor's consumer price index showed pork prices rising 15% Y-o-Y, twice the rate of US inflation. This has been a significant leap in the last 20 years. On average, pork prices rose by 2% annually, while beef prices rose by 18.6% and chicken prices rose by 10.4%. Prices of various pork products in the United States in 2022 were USD 6,224/lb for bacon, USD 4.24/lb for pork chops, and USD 4.44/lb for ham. The hog prices may continue to grow due to the rising costs of production, transport, energy, and feed caused by the conflict in Ukraine and logistics-related issues. The liquidation of the swine population and the low supply of livestock are also leading to a lack of profitability in Europe. Therefore, a low supply of pigs may favor the higher purchase prices in the region during the forecast period. In Q1 2023, pig meat production witnessed an 11% Y-o-Y decline in the United Kingdom and an 8% drop in EU production compared to Q1 2022. Consequently, prices have remained elevated, with substantial increases observed in both the UK and European markets since the start of the year.

Processed Pork Meat Industry Overview

The Processed Pork Meat Market is fragmented, with the top five companies occupying 19.47%. The major players in this market are JBS SA, Sysco Corporation, Tyson Foods Inc., Vion Group and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92397

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Pork

- 3.2 Production Trends

- 3.2.1 Pork

- 3.3 Regulatory Framework

- 3.3.1 Canada

- 3.3.2 France

- 3.3.3 Germany

- 3.3.4 Italy

- 3.3.5 Mexico

- 3.3.6 United Kingdom

- 3.3.7 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Distribution Channel

- 4.1.1 Off-Trade

- 4.1.1.1 Convenience Stores

- 4.1.1.2 Online Channel

- 4.1.1.3 Supermarkets and Hypermarkets

- 4.1.1.4 Others

- 4.1.2 On-Trade

- 4.1.1 Off-Trade

- 4.2 Region

- 4.2.1 Africa

- 4.2.1.1 By Distribution Channel

- 4.2.1.2 By Country

- 4.2.1.2.1 Egypt

- 4.2.1.2.2 Nigeria

- 4.2.1.2.3 South Africa

- 4.2.1.2.4 Rest of Africa

- 4.2.2 Asia-Pacific

- 4.2.2.1 By Distribution Channel

- 4.2.2.2 By Country

- 4.2.2.2.1 Australia

- 4.2.2.2.2 China

- 4.2.2.2.3 India

- 4.2.2.2.4 Indonesia

- 4.2.2.2.5 Japan

- 4.2.2.2.6 Malaysia

- 4.2.2.2.7 South Korea

- 4.2.2.2.8 Rest of Asia-Pacific

- 4.2.3 Europe

- 4.2.3.1 By Distribution Channel

- 4.2.3.2 By Country

- 4.2.3.2.1 France

- 4.2.3.2.2 Germany

- 4.2.3.2.3 Italy

- 4.2.3.2.4 Netherlands

- 4.2.3.2.5 Russia

- 4.2.3.2.6 Spain

- 4.2.3.2.7 United Kingdom

- 4.2.3.2.8 Rest of Europe

- 4.2.4 Middle East

- 4.2.4.1 By Distribution Channel

- 4.2.4.2 By Country

- 4.2.4.2.1 Rest of Middle East

- 4.2.5 North America

- 4.2.5.1 By Distribution Channel

- 4.2.5.2 By Country

- 4.2.5.2.1 Canada

- 4.2.5.2.2 Mexico

- 4.2.5.2.3 United States

- 4.2.5.2.4 Rest of North America

- 4.2.6 South America

- 4.2.6.1 By Distribution Channel

- 4.2.6.2 By Country

- 4.2.6.2.1 Argentina

- 4.2.6.2.2 Brazil

- 4.2.6.2.3 Rest of South America

- 4.2.1 Africa

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 COFCO Corporation

- 5.4.2 Danish Crown AmbA

- 5.4.3 Hormel Foods Corporation

- 5.4.4 JBS SA

- 5.4.5 Muyuan Foods Co., Ltd.

- 5.4.6 Seaboard Corporation

- 5.4.7 Sysco Corporation

- 5.4.8 The Clemens Family Corporation

- 5.4.9 Tyson Foods Inc.

- 5.4.10 Tonnies Holding ApS & Co. KG

- 5.4.11 Vion Group

- 5.4.12 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.