Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692072

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692072

North America Processed Pork Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 202 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

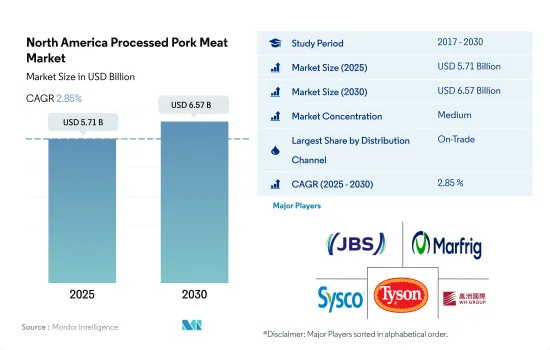

The North America Processed Pork Meat Market size is estimated at 5.71 billion USD in 2025, and is expected to reach 6.57 billion USD by 2030, growing at a CAGR of 2.85% during the forecast period (2025-2030).

Advanced technologies in retail channels are propelling the market's growth

- On-trade sales of processed pork meat dominated the market in North America in 2022. Foodservice sales for processed pork meat recalibrated to higher levels due to pork's high per capita consumption. On average, Americans spent around USD 2,994 on food away from home, such as at restaurants, in 2022. The share of food away from home increased to 58% in 2022 compared to 46% compared to the previous year. This could be primarily attributed to the increased awareness among consumers looking for nutritional menus and the growing interest in locally sourced meat.

- The off-trade channel is projected to be the fastest-growing distribution channel, registering a CAGR of 3.37% during the forecast period. This increase can be attributed to the rising demand for processed pork products, which are widely accessible in supermarkets, hypermarkets, convenience stores, and online retailers. Free checkout and the availability of more authentic processed pork meat products with clean labels in supermarkets are expected to increase the overall demand through the off-trade channel segment.

- The advancements in technology are also driving sales through restaurant channels. For instance, as of 2022, around 90% of restaurants were focused on increasing kitchen automation technology, boosting the sales of food away from home. Moreover, the rise in online delivery channels over the past three years and the rapid usage of social media have boosted the exposure of product availability in the region. For instance, in the United States, online grocery customers prefer click-and-collect services over home delivery. In 2021, customers viewed around 4.4 times more products, including meat products, and spent six times more on online sites.

Expansions by the market players increase the availability of products, thus fueling the sales

- Processed pork sales increased in North America, registering a CAGR of 2.59% by value during the forecast period. Companies are investing in product expansions within the processed pork meat market. For instance, Hormel Foods Corporation, Tyson Foods Inc., and Conagra Brands Incorporated are innovating products and offering a wide range of processed pork like sausages, bacon, and turkey through supermarkets and online stores. Furthermore, the processing of pork products has extended the product's shelf life as consumers have adopted a stockpiling nature, which, in turn, increased the per capita consumption to 23.68 kg per capita as of 2022, further boosting the sales.

- The United States holds the major share of the processed pork meat market in the North American region. During 2020-2022, the processed pork meat market registered a growth of 7.3% by value. There was robust demand for pork, and the increase in demand led to a trade surplus in 2020. Pork exports in 2020 were sevenfold higher than pork imports, increasing by more than 15%. The United States is the third-largest pork producer in the world.

- Mexico holds the second-largest share in the North American processed pork meat market after the United States. It is anticipated to register a CAGR of about 3.33% by value during the forecast period. Pork production in the country is growing due to the increased demand in domestic retail and export opportunities to China, Japan, and South Korea. From 2019 to 2022, demand for pork meat in Mexico increased due to the escalation of adverse macroeconomic conditions and the shift of retail consumers from beef to pork since the latter is a cheaper animal protein.

North America Processed Pork Meat Market Trends

Initiatives taken by the government to prevent the spread of diseases will propel the production

- The United States was the top pork producer in North America, with a 73% share in the region's pork production in 2022. Iowa accounted for about 23.8 million pigs in the United States in 2021. The United States produced roughly 74.77 million pigs and hogs in 2021, of which a significantly smaller number of pigs (6.18 million) in the country were used for breeding, and 68 million were market hogs. Some popular swine breeds include Berkshires, Chester Whites, Durocs, Hampshire, Landraces, Poland Chinas, and Spotted Pigs. The USDA's Animal and Plant Health Inspection Service (APHIS) is taking additional measures to stop the spread of African swine fever in the United States. The "Protect Our Pigs" campaign will provide information and tools to commercial pig producers in order to protect the swine population in the United States.

- Mexico is also a major pork producer, producing 10.36% of the region's pork. The production increased by 2.19% in 2022 compared to the previous year, owing to factors such as the highly competitive consumer prices of pork throughout 2022 compared to those of beef and chicken, thus influencing household purchasing decisions during high inflation. In addition, the growth of processed pork, which requires increasingly more pork, and the production of specialized domestic cuts that compete with imported cuts contributed to the growth in production.

- The pork industry is the 4th largest farming industry in Canada. In 2021, the country had around 7,330 farms producing 14.17 million hogs, with Quebec (31%), Ontario (26%), and Manitoba (24%) accounting for 81% of Canada's inventory. Around 21,656,185 hogs were slaughtered in federally and provincially inspected establishments in Canada in 2021.

Lower rate of production leading to supply shortage is leading to price spikes

- The price of pork grew 8.80% in 2022 from 2017. The second quarter of 2023 saw a price hike ranging from USD 1 per hundredweight (cwt) to USD 57 per cwt of pork, which was almost 25% lower than the price at the same time in 2022 in the US. Prices in June and July are typically 8-10% higher than average. This seasonal peak occurs throughout the US summer when consumers are more likely to purchase foods like bratwursts and pork chops for grilling. As per Farm Credit Canada, margins in the eastern region will drop for the second year due to softening prices and relatively higher feed costs compared to the western region. The margins of western farrow-to-finish will stay positive.

- A shortage of pigs and inflation are driving record-high pork prices. However, inflation is not catching up with the price of pork. Between April 2021 and 2022, inflation increased by 8.5%, while pork prices increased by 16.1%. The increased demand for bacon is a major factor responsible for increased pork prices in retail. Sliced bacon's average retail cost increased by 23.1% in March 2022, whereas the prices for boneless pork chops and boneless ham increased by just 4.5% and 7.5%, respectively. These last two cuts recorded growth at a slower rate than inflation.

- Pork prices in the region may continue to rise due to the lower-than-expected growth in pork production. The number of pigs slaughtered in 2021 decreased by 1.96% from 2020. Persistently high retail prices limit the consumption of all proteins. Consumers continue to conserve income by shifting everyday purchases to lower-value protein options, switching channels, and moving to smaller pack sizes.

North America Processed Pork Meat Industry Overview

The North America Processed Pork Meat Market is moderately consolidated, with the top five companies occupying 53.16%. The major players in this market are JBS SA, Marfrig Global Foods S.A., Sysco Corporation, Tyson Foods Inc. and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90376

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Pork

- 3.2 Production Trends

- 3.2.1 Pork

- 3.3 Regulatory Framework

- 3.3.1 Canada

- 3.3.2 Mexico

- 3.3.3 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Distribution Channel

- 4.1.1 Off-Trade

- 4.1.1.1 Convenience Stores

- 4.1.1.2 Online Channel

- 4.1.1.3 Supermarkets and Hypermarkets

- 4.1.1.4 Others

- 4.1.2 On-Trade

- 4.1.1 Off-Trade

- 4.2 Country

- 4.2.1 Canada

- 4.2.2 Mexico

- 4.2.3 United States

- 4.2.4 Rest of North America

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Conagra Brands Inc.

- 5.4.2 Hormel Foods Corporation

- 5.4.3 Industrias Bachoco SA de CV

- 5.4.4 JBS SA

- 5.4.5 Maple Leaf Foods

- 5.4.6 Marfrig Global Foods S.A.

- 5.4.7 OSI Group

- 5.4.8 Seaboard Corporation

- 5.4.9 Sysco Corporation

- 5.4.10 The Kraft Heinz Company

- 5.4.11 Tyson Foods Inc.

- 5.4.12 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.