Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692073

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692073

United States Processed Pork Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 167 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

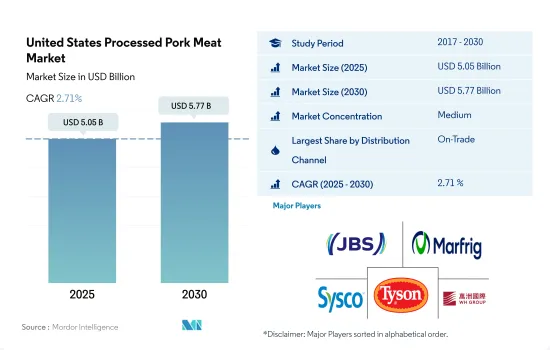

The United States Processed Pork Meat Market size is estimated at 5.05 billion USD in 2025, and is expected to reach 5.77 billion USD by 2030, growing at a CAGR of 2.71% during the forecast period (2025-2030).

The incorporation of advanced technologies is improving the shopping experience, thereby increasing sales in off-trade channels

- On-trade dominates the distribution channel for processed pork meat by value. The consumption of pork meat increased through the on-trade channel, accounting for around 15 kg per year. Restaurants and foodservices offer processed pork in the form of deli meats, cooked ham, and rolls with additional flavors and smooth texture, attracting consumer interest. As of 2022, there were more than 45,000 Chinese restaurants across the United States, and pork is an integral part of the menu in Cantonese restaurants, including Pork Chops and Char Siu.

- The off-trade channel is expected to be the fastest-growing distribution channel and register a CAGR of 3.33% by value during the forecast period. Doorstep delivery of processed pork products and easy ordering options, along with the rising demand for processed pork products, are encouraging the use of online channels and supermarkets/hypermarkets. The consumption of processed pork is increasing, as US consumers who prefer beef and fowl are now eating more pork than ever due to its lower price, which is more than 50% less than the beef price per kg.

- Online grocery customers in the United States prefer click-and-collect over home delivery as their preferred fulfillment option. Customers viewed 4.4 times more products, including processed meat products, and spent six times more time on internet sites in 2022, making online grocery channels the fastest-growing. During the forecast period, the online channel is expected to record a CAGR of 18.22% in terms of value. However, modern supermarket technologies such as free checkout, artificial intelligence, and auto-billing with clean-label meat goods are projected to boost the total demand for red meat through the off-trade channel.

United States Processed Pork Meat Market Trends

Increased domestic production is driving market growth

- Globally, the United States is the third-largest pork producer. It is also the leading pork producer in the region, accounting for around 73% of the region's pork production in 2022. Pork production in the country has a substantial impact on the US economy. About 140 million market hogs are raised on the 66,000 pig farms in the United States each year, the vast majority of which are family-run, and nearly 27 billion pounds of pork are produced by the hundreds of packing facilities. Hog and pork farming supports more than 610,000 employees and more than USD 57 billion in GDP through value-added activity. Pork production is expected to expand as a result of US hog growers' greater supply of pork meat due to higher farm-level productivity.

- In 2021, more than 66,000 pork producers sold over 140 million hogs worth more than USD 28 billion in gross cash revenue. However, hog production rose from 59.11 million heads in 2000 to 74.15 million heads in December 2021, including 68.02 million market hogs and 6.12 million breeding hogs. About 93% of the hogs in the United States are raised on farms with 2,000 or more hogs, whereas only 7% are raised on farms with fewer than 2,000 animals. Family farms account for 96% of all hog farms and 80% of hog inventories in the United States.

- Despite the declining herd population, hogs slaughtered from January 2021 to May 2021 were up by 1.39 million heads or 2.6% compared to the same period the previous year. Pork production was up by as much as 3.2% to 5.3 million. However, due to the pandemic, there were numerous slaughterhouse closures or capacity restrictions in the United States.

Inflation is expected to affect the prices of pork in the country

- In the United States, pork prices grew by 11.74% between 2017 and 2022 due to rising labor expenses across the pork supply chain, supply bottlenecks, and delays. Other issues included a 2.5% decrease in hog packing capacity as a result of a federal court decision prohibiting faster harvesting line speeds, an increase of 23.9% in total costs, a 35.5% increase in feed costs, and, most critically, a labor scarcity that hampered productivity and increased salaries.

- Pork production slightly went down by 2% in 2022. Imports grew by 20%, while exports declined by 9% in the same year. Thus, the per capita pork supply was 0.3 pounds more in 2022 than in 2021. However, the high price of pork in 2022 compared to the previous year was mainly due to the effect of inflation. In October 2022, the retail price of pork averaged USD 5.047 per pound, an increase of 23.1 cents from the previous year. In November 2021, the high average for retail pork was around USD 4.823 per pound.

- The price of pork in the country is expected to stay stable in the coming years, although the domestic supply of pork is anticipated to expand. Compared to around USD 67/cwt in 2021, the average price on a live equivalent basis was USD 71/cwt in 2022, which was anticipated to stay relatively stable at about USD 71/cwt in 2023. Domestic production was expected to increase by 1% in 2023 compared to 2022 due to the consistently rising pig harvests and higher animal weights. Due to a drop in demand from important importers like Mexico and China, US exports were projected to decline in 2023. These factors may coalesce to stability in pork prices in the next few years.

United States Processed Pork Meat Industry Overview

The United States Processed Pork Meat Market is moderately consolidated, with the top five companies occupying 46.04%. The major players in this market are JBS SA, Marfrig Global Foods SA, Sysco Corporation, Tyson Foods Inc. and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90377

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Pork

- 3.2 Production Trends

- 3.2.1 Pork

- 3.3 Regulatory Framework

- 3.3.1 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Distribution Channel

- 4.1.1 Off-Trade

- 4.1.1.1 Convenience Stores

- 4.1.1.2 Online Channel

- 4.1.1.3 Supermarkets and Hypermarkets

- 4.1.1.4 Others

- 4.1.2 On-Trade

- 4.1.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 BRF SA

- 5.4.2 Hormel Foods Corporation

- 5.4.3 JBS SA

- 5.4.4 Johnsonville LLC

- 5.4.5 Marcangelo Foods Inc.

- 5.4.6 Marfrig Global Foods SA

- 5.4.7 NH Foods Ltd

- 5.4.8 Sysco Corporation

- 5.4.9 Tyson Foods Inc.

- 5.4.10 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.