Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692076

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692076

United States Textured Vegetable Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 181 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

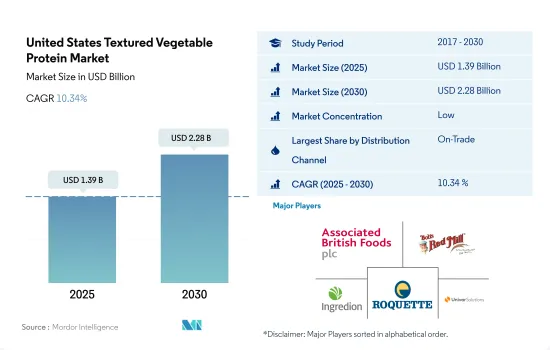

The United States Textured Vegetable Protein Market size is estimated at 1.39 billion USD in 2025, and is expected to reach 2.28 billion USD by 2030, growing at a CAGR of 10.34% during the forecast period (2025-2030).

Rising health-conscious consumers across the country drive demand for TVP through various distribution channels

- In the United States, the sales value of textured vegetable protein increased at a growth rate of 14.90% from 2019 to 2022 through the off-trade distribution channel. As consumers search for meat alternatives, ready-to-eat TVP products have been in high demand. With the region's increasing student population hitting 17.9 million in 2022, supermarket sales rose as some stores also offered delivery options. The number of supermarkets is growing rapidly to meet the needs of consumers.

- The on-trade channel is projected to be the fastest-growing distribution channel, registering a CAGR of 9.86% during the forecast period, mainly due to the growing number of vegan restaurants in the country. It was also the major distribution channel in the base year, registering a value of 19.35% from 2019 to 2022. In order to cater to the ongoing demand, major companies such as Beyond Meat, Sysco Corporation, and Impossible Food are providing textured vegetable protein to restaurants and food service sectors in the United States.

- Online grocery customers in the United States have started preferring to click-and-collect over home delivery. In 2022, customers viewed around 4.4 times more products, including textured vegetable protein products, and spent six times more time on online sites. Thus, the online channel is becoming the fastest-growing channel, projected to register a CAGR value of 15.76% during the forecast period. However, the advanced technology at supermarkets, such as free checkout, auto-billing, and the availability of more authentic and clean-label alternative meat products, is increasing the overall demand for TVP through the off-trade channel.

United States Textured Vegetable Protein Market Trends

The growing popularity of plant-based diets has led to an influx of TVP prices

- Textured vegetable protein (TVP) prices increased by 1.92% during 2017-2022. TVP prices increased due to more companies entering the plant-based foods industry, and the growing popularity of plant-based diets led to an influx of TVPs. Thus, the competition among brands and their different pricing strategies influenced the prices of TVPs.

- The prices of soybean, wheat, corn, and peas also played a key role in the prices of TVP. The prices of TVP reached USD 23.4/kg in 2021 due to the need to alleviate the low grain prices in 2020. Similarly, soybean prices went from as high as USD 12.04/kg in 2017 to USD 9.40/kg in 2022. This fluctuation in prices was due to unfavorable weather conditions lowering the cultivation of summer crops in 2019. At the same time, the cost of corn and soybeans was quite high in 2021. With a 25% increase to USD 33 per bushel in September, from USD 25 per bushel in 2018, the price of conventional soybeans reached a seven-year high in 2021. During 2021-2022, the average corn price increased by 21% Y-o-Y to USD 5.45 per bushel.

- Rising prices have affected consumers and food service professionals alike. Rising prices are a top concern in purchasing food products, especially when it comes to plant-based protein, which is not a staple. An increasing number of consumers have altered their shopping behavior and actively look for more affordable retailers and brands. The war in Ukraine, interest rates, weather patterns, and conditions in China all affect the soybean market. Soybean is currently trading at near-record highs. However, it is weather-dependent. La Nina and El Nino patterns are major factors impacting US soybean yields. They affect soybean prices more than 70% of the time.

United States Textured Vegetable Protein Industry Overview

The United States Textured Vegetable Protein Market is fragmented, with the top five companies occupying 8.90%. The major players in this market are Associated British Foods PLC, Bob's Red Mill Natural Foods, Ingredion Inc., Roquette Freres and Univar Solutions Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90381

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Textured Vegetable Protein

- 3.2 Regulatory Framework

- 3.2.1 United States

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Distribution Channel

- 4.1.1 Off-Trade

- 4.1.1.1 Convenience Stores

- 4.1.1.2 Online Channel

- 4.1.1.3 Supermarkets and Hypermarkets

- 4.1.1.4 Others

- 4.1.2 On-Trade

- 4.1.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 AGT Food & Ingredients Inc.

- 5.4.2 Associated British Foods PLC

- 5.4.3 Axiom Foods Inc.

- 5.4.4 Bob's Red Mill Natural Foods

- 5.4.5 Bunge Limited

- 5.4.6 Cargill Inc.

- 5.4.7 CHS Inc.

- 5.4.8 Dixie Foods

- 5.4.9 Ingredion Inc.

- 5.4.10 International Flavors & Fragrances Inc.

- 5.4.11 MGP Ingredients Inc.

- 5.4.12 NOW Health Group, Inc.

- 5.4.13 Roquette Freres

- 5.4.14 The Scoular Company

- 5.4.15 Univar Solutions Inc.

- 5.4.16 Wholesome Provisions Inc.

6 KEY STRATEGIC QUESTIONS FOR MEAT SUBSTITUTES INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.