PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910585

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910585

India Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

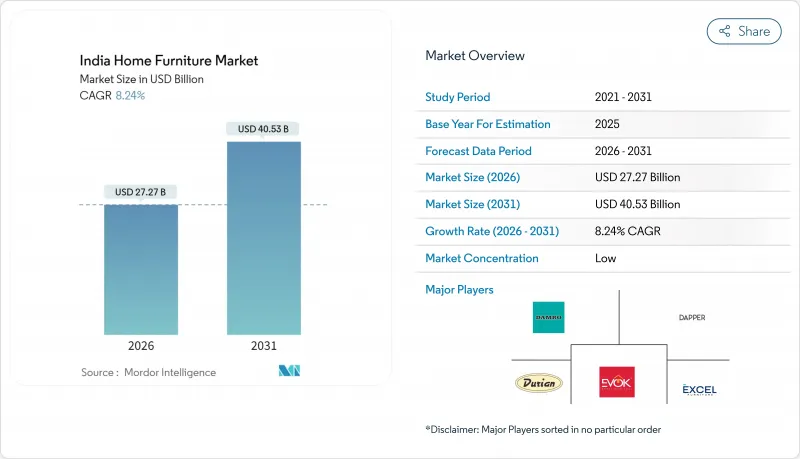

The India Home Furniture Market was valued at USD 25.20 billion in 2025 and estimated to grow from USD 27.27 billion in 2026 to reach USD 40.53 billion by 2031, at a CAGR of 8.24% during the forecast period (2026-2031).

Accelerants include the government's Production Linked Incentive scheme, the steady rise in urban households, and millennial demand for branded modular decor. Bedroom pieces remain the anchor segment as space-saving storage beds and sliding wardrobes fit shrinking apartment footprints. Specialty stores continue to secure most revenue, yet the web-to-store model is widening access in Tier-2 and Tier-3 cities. Material choices are shifting as cost-sensitive buyers weigh polymer blends, while premium shoppers reward certified sustainable wood.

India Home Furniture Market Trends and Insights

Compact Apartment Living in Metros

Average unit sizes in Mumbai, Delhi, and Bengaluru have fallen to 600-800 sq ft, roughly half the footprint of legacy homes. Families, therefore, prioritize furniture that compresses sleeping, storage, and even study zones into one module, driving uptake of hydraulic-lift beds, fold-out desks, and nesting tables. Bedroom products have responded with integrated USB-charging headboards and under-bed cabinetry that maximize every cubic inch. Vendors able to supply these compact sets are gaining shelf space at both specialty stores and quick-ship online portals. Urbanization is forecast to leap from 35% in 2025 to 50% by 2050, ensuring that such multi-functional SKUs remain a prime revenue stream for organized brands.

Omni-channel Strategies Expanding Reach

Pepperfry shows that physical studios, now 175 strong, can more than double digital conversions once shoppers test fabric and finish in person. Godrej Interio's roll-out of 104 stores in FY25 underscores the value of tactile interaction, while its mobile app lets users scan QR codes to visualize finishes at home. IKEA, meanwhile, offers click-and-collect counters inside malls to shorten lead times, boosting footfall without large footprints. The strategy is paying off fastest in Tier-2 and Tier-3 markets, where stand-alone e-commerce once struggled with last-mile costs. As a result, online revenue still grows at a 13.91% CAGR while physical outlets keep consumer trust, confirming a complementary-not cannibalistic-path to scale.

Unorganized Sector Dominance

Roughly 90% of national volume moves through local carpenters, mirroring household trust in neighbourhood artisans and looser cash-transaction norms. This fragmentation suppresses brand pricing and complicates the enforcement of quality or safety standards. Organized retailers often absorb higher GST-compliant cost structures, widening the final price gap in rural and semi-urban centres. Nonetheless, GST has started forcing compliance among roadside workshops, nudging them either to register or collaborate with large retailers for supply stability. Brands leaning on franchise or shop-in-shop formats see potential to convert these artisans into certified installers, gradually lifting quality without alienating legacy loyalties.

Other drivers and restraints analyzed in the detailed report include:

- Customization and Made-to-Order Demand

- Millennials' Preference for Rental Furniture

- Inefficient Logistics and High Freight Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, bedroom furniture dominates India's home furniture market with a 36.72% share, expanding at an 11.6% CAGR through 2031 as developers reduce master suite sizes to balance high land costs. Bestselling products include hydraulic storage beds, sliding door wardrobes, and fold-out dresser tables. The segment is also attracting significant R&D investments-The Sleep Company, for instance, raised INR 4800 million (USD 54.84 million) in 2025 to develop smart gel-layer mattresses and headboards with voice-activated lighting. Living-room furniture remains substantial, fueled by open-plan layouts that drive coordinated purchases of sofas, media units, and coffee tables. Dining sets have adapted to compact living, with bench-and-stool designs that fit neatly under tables. Meanwhile, home-office demand, born out of the pandemic, continues to shape a growing niche for ergonomic desks and task chairs, often incorporated into bedroom spaces. Child-focused safety features like rounded corners and anti-tip straps are also gaining prominence among nuclear families.

Beyond interiors, outdoor furniture is growing as high-rise balconies inspire demand for weatherproof polymer-wicker lounge sets. Smaller segments such as bathroom vanities and entryway organizers are projected to grow faster than the market average through 2031 as aspirational buyers seek complete home upgrades. Suppliers are also enhancing margins and customer loyalty by integrating multifunctional features-such as charging hubs, hidden mirrors, and adjustable shelves-into single SKUs, aligning with the compact-living ethos.

Wood captured 61.95% of the 2025 value, aided by cultural affinity for teak and sheesham in premium sets. Yet India imported USD 2.3 billion of timber last year as domestic plantations met barely half of the demand. Rising raw-wood prices and the 2025 Mandatory Timber Standard have opened room for engineered boards, bamboo veneers, and recyclable polymer composites. Nilkamal's "E-wood" range blends plastic with rice-husk fibers, delivering a termite-proof, water-resistant panel that ships 35% lighter, cutting freight bills. FSC or PEFC certifications are becoming hygiene factors in metro showrooms, justifying 8-10% price premiums among conscious consumers.

Metal furniture, once confined to institutional dorms, now features powder-coated pastel frames that match mid-century modern aesthetics. Outdoor aluminum and steel sets withstand monsoon corrosion, expanding their regional uptake in coastal South and East India. Recycled composites made from PET bottles are entering kids' furniture, aligning with ESG narratives of large retailers. As circular-economy regulations tighten, supply-chain traceability tools-blockchain tags and QR-encoded certificates-will separate compliant exporters from gray-market suppliers.

The India Home Furniture Market Report is Segmented by Product (Living Room and Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, and More), and Geography (North, South, East, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Damro Furniture

- Dapper Furniture

- Durian Furniture

- Evok

- Excel Furniture

- FabIndia

- Furlenco

- Godrej Interio

- Hometown

- Hulsta

- IKEA India

- Livspace

- Nilkamal Furniture

- Pepperfry

- Royal Oak

- Urban Ladder

- Usha Lexus Furniture

- Wipro Furniture

- WoodenStreet

- Zuari

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Compact apartment living in metros is driving demand for modular, space-saving furniture.

- 4.2.2 Omni-channel strategies (online + offline experience stores) are accelerating furniture adoption.

- 4.2.3 Growing demand for customized and made-to-order furniture is boosting premium sales.

- 4.2.4 Millennials are increasingly opting for rental furniture platforms to match flexible lifestyles.

- 4.2.5 Government's "Make in India" push and local sourcing are lowering costs and strengthening supply.

- 4.2.6 Rising preference for eco-friendly and sustainable materials is shaping consumer choices.

- 4.3 Market Restraints

- 4.3.1 Unorganized sector dominance weakens brand pricing power and standardization.

- 4.3.2 Inefficient logistics and high transportation costs limit nationwide scalability.

- 4.3.3 Low penetration and affordability in Tier-2/3 cities constrain expansion.

- 4.3.4 Dependence on imported raw materials creates vulnerability to price volatility.

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Living Room and Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets and local stores from the unorganized sector)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 North

- 5.5.2 South

- 5.5.3 East

- 5.5.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Damro Furniture

- 6.4.2 Dapper Furniture

- 6.4.3 Durian Furniture

- 6.4.4 Evok

- 6.4.5 Excel Furniture

- 6.4.6 FabIndia

- 6.4.7 Furlenco

- 6.4.8 Godrej Interio

- 6.4.9 Hometown

- 6.4.10 Hulsta

- 6.4.11 IKEA India

- 6.4.12 Livspace

- 6.4.13 Nilkamal Furniture

- 6.4.14 Pepperfry

- 6.4.15 Royal Oak

- 6.4.16 Urban Ladder

- 6.4.17 Usha Lexus Furniture

- 6.4.18 Wipro Furniture

- 6.4.19 WoodenStreet

- 6.4.20 Zuari

7 Market Opportunities & Future Outlook

- 7.1 Rising Omni-Channel Furniture Retail Integration in India

- 7.2 Expansion of Domestic Manufacturing and Local Sourcing