PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642037

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642037

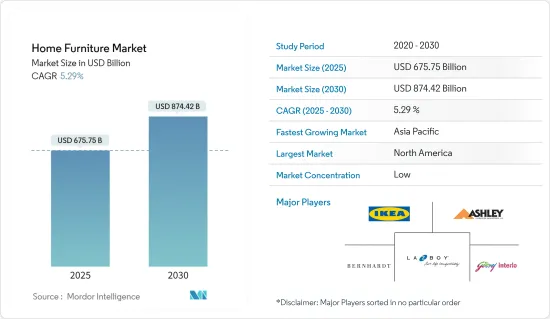

Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Home Furniture Market size is estimated at USD 675.75 billion in 2025, and is expected to reach USD 874.42 billion by 2030, at a CAGR of 5.29% during the forecast period (2025-2030).

One of the key drivers of the home furniture market is the growing residential construction market during the study period. The growing popularity of eco-friendly furniture and changes in lifestyles are driving the growth of the market. Players in the United States home furniture industry use mergers and acquisitions and the creation of new product lines as ways to grow their businesses.

There's a strong demand for furniture due to a growing population. The vast population base and rising disposable income of consumers are bolstering the development of the furniture industry as customers are willing to spend more on floor coverings and furniture. Urbanization, increasing real estate development, strong growth in GDP, and economic stability in the country are some of the other major factors attributing to the growth of the furniture industry.

Ready-to-assemble (RTA) furniture is becoming increasingly popular among homeowners and renters because of its lower costs and compact designs. RTA furniture, also known as flat-pack furniture, is not assembled by the manufacturer and is available in parts with instructions on how to assemble it. E-commerce is also fueling the market's growth, and there are many e-commerce giants such as Amazon, Wayfair, and Home Depot that offer a wide range of furniture products from many key brands as part of their product portfolios.

Home Furniture Market Trends

Living Room Furniture is Generating the Majority Revenue

Living room furniture is a significant contributor to the overall revenue generated in the furniture industry. The living room is often considered the focal point of a home, and people typically invest in high-quality and aesthetically appealing furniture for this space. Living room furniture includes essential pieces such as sofas, couches, coffee tables, and entertainment centers that are larger and more expensive than other furniture items. These key pieces have a higher price point, contributing to a larger revenue share. The living room is often seen as a showcase where people express their style and preferences through furniture and decor.

Consumers are willing to invest in visually appealing and trendy living room furniture to create an inviting, well-designed space. This emphasis on aesthetics contributes to higher-priced furniture options and revenue generation. Living room furniture is in high demand as it is a central gathering space for families and guests. People spend significant time in the living room, engaging in activities like socializing, watching TV, and relaxing. The demand for comfortable and stylish living room furniture drives sales and revenue.

United States is Generating Majority Revenue for the Segment Kitchen and Dining Furniture

The kitchen and dining furniture market in the United States is a significant segment within the overall furniture industry. It includes furniture items specifically designed for kitchen and dining spaces, such as dining tables, chairs, bar stools, kitchen islands, buffets, and cabinets.The kitchen and dining furniture market in the United States is substantial, reflecting the importance of these spaces in households. The market size is influenced by factors such as population size, consumer preferences, disposable income levels, and overall economic conditions.The demand for kitchen and dining furniture is driven by several factors, including new home construction, home renovations, changing consumer lifestyles, and evolving design trends. Consumers often seek furniture that combines functionality, durability, and aesthetic appeal.Kitchen and dining furniture is sold through various distribution channels, including furniture stores, department stores, specialty stores, online retailers, and direct-to-consumer brands. The growth of e-commerce has provided consumers with more options for purchasing furniture online, contributing to the overall revenue of the market.

Home Furniture Industry Overview

The report covers major international players operating in the global home furniture market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. The market is highly competitive and fragmented, with a mix of large multinational companies, regional players, and small-scale manufacturers.

Key players in the global home furniture market often focus on product innovation, quality, branding, and customer experience to gain a competitive edge. Online and brick-and-mortar retailers play a significant role in distributing furniture products to consumers. The List of major players are Ikea, La-Z-Boy, Godrej Interio, Bernhardt, and Ashley Furniture Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Changing Consumer Lifestyles and Preferences

- 4.2.2 Rising Disposable Income

- 4.3 Market Restraints

- 4.3.1 High Transportation and Logistics Costs

- 4.3.2 Price Volatility of Raw Materials

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of High Inflation on Credit Card Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Living Room and Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Lamps and Lighting Furniture

- 5.1.5 Plastic and Other Furniture

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online Retail Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Argentina

- 5.3.2.2 Brazil

- 5.3.2.3 Colombia

- 5.3.2.4 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 UK

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Netherlands

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 Japan

- 5.3.4.3 India

- 5.3.4.4 Australia

- 5.3.4.5 Singapore

- 5.3.4.6 South Korea

- 5.3.4.7 Rest of Asia-Pacific

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Egypt

- 5.3.5.3 UAE

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ikea

- 6.2.2 Ashley Furniture Industries Inc.

- 6.2.3 Heritage Home Group

- 6.2.4 La-Z-Boy

- 6.2.5 Godrej Interio

- 6.2.6 Stanley Furniture

- 6.2.7 Ethan Allen

- 6.2.8 Bernhardt

- 6.2.9 Flexsteel

- 6.2.10 Nitori Co. Ltd*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US