PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630360

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630360

Japan Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

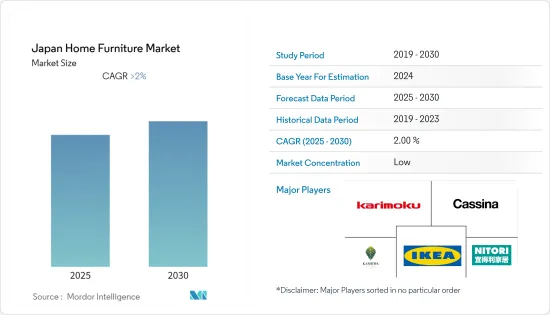

The Japan Home Furniture Market is expected to register a CAGR of greater than 2% during the forecast period.

The Post-COVID pandemic had a major impact on home furniture markets and also seriously affected the sales of home furniture. It caused supply-chain disruptions. And when consumers couldn't find their preferred product at their preferred retailer, they changed their shopping behavior: many consumers tried a different brand or shopped with a different retailer during the crisis. Value, availability, and quality were the main drivers for consumers to try a different brand.

All over the country, there is more construction going on, which has led to more residential real estate and a big rise in the number of families. As a result, demand for furniture such as living room and bedroom furniture is increasing. The country is also seeing a growth in demand for office furniture goods as a result of expanding office space utilization, which is boosting market demand. When it comes to starting a family, Japan is seeing an increase in demand for exquisite and long-lasting high-end solid wood furniture, which is fueling the market's growth.

Imported furniture's market share in Japan has increased dramatically in recent years. Wooden furniture accounts for the majority of imported furniture, followed by furniture accessories, metal furniture, plastic furniture, and so on. China has surpassed the United States as Japan's top furniture importer, accounting for approximately 40% of all Japanese wooden furniture imports. Thailand, Vietnam, Malaysia, the Philippines, Indonesia, Germany, and Italy are some of the other furniture importers in Japan.

Japan Home Furniture Market Trends

Expansion of Single Person Homes

The way people live has a big impact on the future of the furniture manufacturing industry in Japan. A growing trend in the country is an increase in the number of one-person homes. This is one of the main changes in culture and lifestyle that are driving up the demand for furniture in the country.

Single-person homes are the fastest-growing household type in Japan, and they may soon surpass them as the country's largest. Because singles use less room, they can save money on rent and home construction. Furniture must be both aesthetically beautiful and functional due to the restricted area. Storage cabinets are popular among singles in tiny houses, and demand for a variety of other movable furniture may expand. Japanese furniture market sectors have the potential to develop, particularly for low-cost goods meant for singles in small spaces, such as drawers, cabinets, fold-away dining tables, and dining chairs, which are predicted to boost demand for furniture in the nation.

Living Room and Dining Room Furniture Segment Driving the Market

Furniture for the living room and dining room, as well as bedroom and kitchen furniture, is in great demand in Japan at the moment. With new housing units being created around the country and a rise in per capita disposable income for consumers, the demand for home furnishings is increasing.

An increase in the number of household units and population migration are additional factors driving this expansion. Spending on dining room furniture is also pretty consistent in the country, but it's not as much as spending on bedroom furniture. China, Vietnam, and other Southeast Asian countries supply virtually all of Japan's bedroom furniture.

Japan Home Furniture Industry Overview

The report covers major international players operating in the Japanese home furniture market. In terms of market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, midsize to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Some major players are Karimoku, Cassina IXC Ltd., IKEA Kobe, Kashiwa, and Nitori Furniture.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Trends in Furniture Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Kitchen Furniture

- 5.1.2 Living Room and Dining Room Furniture

- 5.1.3 Bedroom Furniture

- 5.1.4 Other Furniture

- 5.2 Distribution Channel

- 5.2.1 Supermarkets & Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Karimoku

- 6.2.2 SanKou Group

- 6.2.3 Cassina Ixc Ltd.

- 6.2.4 IKEA

- 6.2.5 Kashiwa

- 6.2.6 Nitori Furniture

- 6.2.7 Muji

- 6.2.8 Shimachu

- 6.2.9 Sunmore Co., Ltd.

- 6.2.10 Oliver Co., Ltd.*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US