Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687087

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687087

Commercial Aircraft Cabin Seating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 193 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

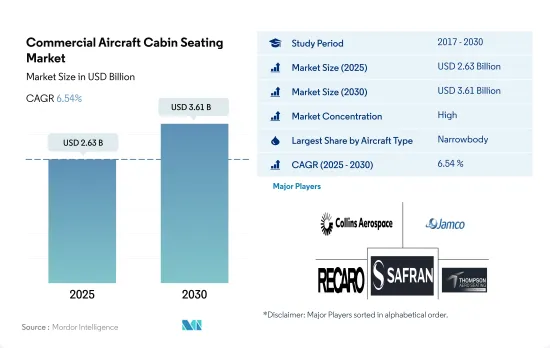

The Commercial Aircraft Cabin Seating Market size is estimated at 2.63 billion USD in 2025, and is expected to reach 3.61 billion USD by 2030, growing at a CAGR of 6.54% during the forecast period (2025-2030).

Fleet expansion strategies globally are anticipated to facilitate the acquisition of narrowbody and widebody aircraft and stimulate the expansion of commercial aircraft seating during the forecast period

- An enhanced seating structure with more developed space than economy-class seats is becoming highly essential due to rising preferences from travelers. The narrowbody aircraft dominated the number of deliveries, with 83% of the overall deliveries during 2017-2022. In terms of cabin class, economy and premium economy seats accounted for 93% of the overall seats of the aircraft delivered in 2022 for narrowbody aircraft and 86% for widebody aircraft.

- The overall passenger aircraft category, including narrowbody and widebody aircraft, witnessed a decline of 30% in 2020, which affected the demand for aircraft seats globally. In the narrowbody segment, the share of economy and premium economy seats globally was 94% in 2022, while their share was 86% in widebody aircraft. The surge in regional aviation has aided the economy seating category, where most seats belong to economy class.

- Airlines are using narrowbody aircraft more frequently on longer routes, facilitating the introduction of ergonomic seats in the market. For instance, Asiana Airlines and Korean Air are working to improve the level of comfort and overall experience during the flight by implementing ergonomic design, individually adjustable calf rests, and privacy features.

- Aviation operators and OEMs across the world are stepping up their efforts to reduce weight and improve the comfort features in seats by implementing ergonomics. The adoption of narrowbody aircraft in the longer haul routes airlines worldwide has increased, thus aiding the deployment of aircraft seats in narrowbody aircraft. Around 13,358 aircraft are expected to be delivered between 2023 and 2030. The fleet expansion plans in the region are expected to aid the procurement of both narrowbody and widebody aircraft.

The North market is projected to remain the largest in the world, while Asia-Pacific is anticipated to the most lucarative market during the forecast period.

- Customer experience is always the top priority for airlines. Passengers must have a positive experience with travel. Thus, to provide the best experience, airlines worldwide focus on modernized cabin seats that comfort passengers.

- The increased passenger traffic may eventually drive new aircraft procurements and orders, thus boosting the aircraft seating market. As of October 2022, a total of 534 Boeing and Airbus planes were ordered by various airlines globally, such as Emirates, Qatar Airways, Etihad Airways, Delta Airlines, American Airlines, Lufthansa, Turkish Airlines, Air France, Singapore Airlines, Japan Airlines, ANA, and Air China.

- Various major airlines worldwide started adopting lighter seats to reduce the aircraft's weight and improve cabin space efficiency and utilization. For instance, Asia-Pacific, Korean Air, and Asiana Airlines are working to improve passenger experience by adopting ergonomic seat designs, individually adjustable calf rests, and privacy-featured seats. The Canadian airline Porter Airlines integrated lightweight seats in its regional aircraft in North America. In Europe, airline seat manufacturers have started introducing titanium and carbon fiber seats for the higher-end classes. Such innovations to improve passenger comfort and privacy are expected to drive the global commercial aircraft cabin seating market in the future.

- Around 13,358 aircraft are expected to be delivered between 2023 and 2030. The North is expected to be the largest market globally, while the Asia-Pacific region is expected to be the most lucrative market in the forecast period.

Global Commercial Aircraft Cabin Seating Market Trends

Growing demand for air travel in African countries is driving the demand for new aircraft deliveries

- Rising air passenger traffic plays a vital role in driving airlines to procure new aircraft to meet the demand from various domestic and international routes. In 2021, air passenger traffic in Africa reached 104 million, a growth of 191% compared to 2020 and 3% compared to 2019. Airlines are looking to expand their fleet sizes to cater to the growing demand for air travel, which is generating significant demand for new aircraft across African nations. Major countries, such as South Africa, Egypt, and Algeria, accounted for 40% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other countries across Africa.

- A total of 36 new aircraft were delivered across African countries between the years of 2017 and 2022, and the new jet deliveries in the region during the historic period accounted for less than 1% of the total worldwide passenger aircraft deliveries. The demand generated by air passenger traffic may eventually lead to an increase in aircraft procurements. Some of the major airlines in Africa are Ethiopian Airlines, Egyptair, Royal Air Maroc, Air Algerie, and Kenya Airways. As of September 2022, some other airlines had a backlog of over 86 aircraft. Of the 86 jets, 52 are expected to be narrowbody aircraft. The increasing adoption of fuel-efficient, long-range aircraft and the growing success of low-cost carriers are the major factors driving the narrowbody segment. Such factors may boost the African cabin interior market in the forecast period.

An increase in international passenger traffic post the COVID-19 pandemic is driving market demand

- As cross-border travel was progressively restored in 2022 post the COVID-19 pandemic, the carriers in Asia-Pacific raced to increase their flights to meet runaway demand, stimulated by people's desire to travel and cash in on savings accumulated in the two years of isolation. As a result, in 2022, the air passenger traffic in the region recovered more rapidly from the pandemic than in the other regions. For instance, in 2022, air passenger traffic in the whole of Asia-Pacific was recorded at 1.9 billion, a growth of 6% compared to 2021 and 151% compared to 2020. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other Asia-Pacific countries.

- Airlines in Asia-Pacific also witnessed a good recovery in international air passenger markets as travel demand continued to fuel growth despite increasingly challenging global economic conditions. For instance, in August 2022, the region recorded 13.1 million international air passenger traffic, an 836% increase compared to August 2021, when it was recorded at 1.4 million. The healthy growth in international passenger traffic in the first eight months of the year showed strong travel demand from business and leisure consumers. The rapid increase in air passenger traffic in the region is expected to drive the air transport industry in the future.

Commercial Aircraft Cabin Seating Industry Overview

The Commercial Aircraft Cabin Seating Market is fairly consolidated, with the top five companies occupying 82.68%. The major players in this market are Collins Aerospace, Jamco Corporation, Recaro Group, Safran and Thompson Aero Seating (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54854

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.1.1 Asia-Pacific

- 4.1.2 Europe

- 4.1.3 Middle East

- 4.1.4 North America

- 4.2 New Aircraft Deliveries

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 GDP Per Capita (current Price)

- 4.3.1 Asia-Pacific

- 4.3.2 Europe

- 4.3.3 Middle East

- 4.3.4 North America

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 By Country

- 5.2.1.1.1 China

- 5.2.1.1.2 India

- 5.2.1.1.3 Indonesia

- 5.2.1.1.4 Japan

- 5.2.1.1.5 Singapore

- 5.2.1.1.6 South Korea

- 5.2.1.1.7 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 By Country

- 5.2.2.1.1 France

- 5.2.2.1.2 Germany

- 5.2.2.1.3 Spain

- 5.2.2.1.4 Turkey

- 5.2.2.1.5 United Kingdom

- 5.2.2.1.6 Rest of Europe

- 5.2.3 Middle East

- 5.2.3.1 By Country

- 5.2.3.1.1 Saudi Arabia

- 5.2.3.1.2 United Arab Emirates

- 5.2.3.1.3 Rest of Middle East

- 5.2.4 North America

- 5.2.4.1 By Country

- 5.2.4.1.1 Canada

- 5.2.4.1.2 United States

- 5.2.4.1.3 Rest of North America

- 5.2.5 Rest of World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Collins Aerospace

- 6.4.3 Expliseat

- 6.4.4 Jamco Corporation

- 6.4.5 Recaro Group

- 6.4.6 Safran

- 6.4.7 STELIA Aerospace (Airbus Atlantic Merginac)

- 6.4.8 Thompson Aero Seating

- 6.4.9 ZIM Aircraft Seating GmbH

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.