PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698337

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698337

Commercial Vehicle Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

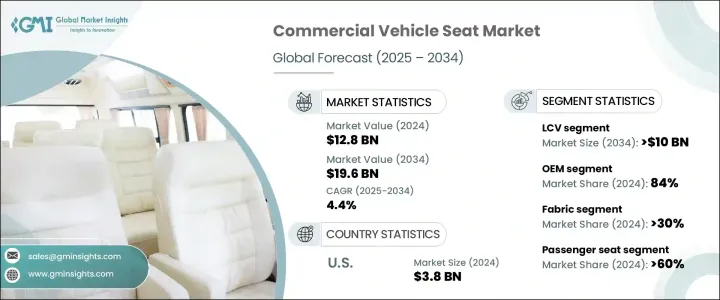

The Global Commercial Vehicle Seat Market reached USD 12.8 billion in 2024, with projections indicating steady growth at a CAGR of 4.4% from 2025 to 2034. The increasing demand for commercial vehicles, particularly within the logistics and transportation sectors, continues to drive the need for durable, ergonomic seating solutions. Automakers and fleet operators prioritize high-quality seats that enhance comfort, safety, and longevity, ensuring vehicles meet the evolving expectations of drivers and passengers alike.

The market is undergoing a transformation fueled by advancements in materials, design, and safety regulations. Lightweight and energy-efficient seat solutions are gaining traction, particularly as the industry pivots toward electric and autonomous vehicles. Manufacturers are integrating high-performance materials, smart cushioning, and adaptive designs to improve user experience while optimizing vehicle weight and fuel efficiency. The adoption of modular seating structures is also rising, allowing for greater flexibility and customization based on application needs. Additionally, stringent safety standards necessitate continuous innovation, compelling automakers to develop impact-resistant, ergonomic seating that complies with global regulatory frameworks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.8 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 4.4% |

The Light Commercial Vehicle (LCV) segment remains a dominant force in the commercial vehicle seat market, accounting for a 55% share in 2024. This segment is projected to generate USD 10 billion by 2034, driven by the surging demand for compact, fuel-efficient vehicles used in urban transport and last-mile delivery services. As urbanization accelerates, businesses and logistics providers seek agile transportation solutions capable of navigating congested cityscapes with ease. LCVs offer a compelling combination of maneuverability, fuel efficiency, and cost-effectiveness, making them the preferred choice for delivery fleets, ride-sharing services, and rental operations. Expanding small business activities and the growth of e-commerce further reinforce the need for advanced seating solutions, with manufacturers focusing on enhanced lumbar support, improved seat adjustability, and sustainable materials to meet the rising consumer expectations.

The commercial vehicle seat market is segmented into OEM and aftermarket sales channels, with OEMs securing an 84% market share in 2024. Automakers overwhelmingly favor factory-installed seats that align with brand identity, quality benchmarks, and evolving safety regulations. OEMs invest heavily in premium seating solutions featuring ergonomic designs, high-durability fabrics, and advanced features such as climate-controlled seating, memory functions, and adjustable lumbar support. These innovations not only enhance driving comfort but also improve vehicle efficiency and longevity. As automakers face mounting pressure to offer superior interior features, seat manufacturers are developing cutting-edge solutions that cater to both driver and passenger needs while ensuring compliance with stringent safety standards.

North America Commercial Vehicle Seat Market accounted for 36% of the global revenue, with the United States generating USD 3.8 billion in 2024. This leadership position stems from the country's expansive production capabilities, robust vehicle sales, and ongoing investment in research and development. Automakers and suppliers continuously enhance seat functionality, incorporating heating, ventilation, and memory settings to meet shifting consumer preferences. The US remains a critical driver of market trends, influencing quality standards and shaping innovation in commercial vehicle seating. As domestic demand continues to evolve, industry players focus on delivering technologically advanced, safety-compliant, and comfort-enhancing seating solutions to maintain a competitive edge in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Material providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Cost breakdown analysis

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight and ergonomic seating

- 3.6.1.2 Stringent safety and emission regulations

- 3.6.1.3 Growth in e-commerce and logistics

- 3.6.1.4 Advancements in sustainable materials

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of advanced seating technologies

- 3.6.2.2 Supply chain disruptions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Seat, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Driver seat

- 5.3 Passenger seat

- 5.4 Rear seat

- 5.5 Folding seat

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Vinyl

- 6.4 Leather

- 6.5 Synthetic materials

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Light Commercial Vehicles (LCV)

- 7.3 Heavy Commercial Vehicles (HCV)

- 7.4 Buses & Coaches

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Standard/conventional seats

- 8.3 Powered/electric seats

- 8.4 Heated & ventilated seats

- 8.5 Memory seats

- 8.6 Massage seats

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Adient

- 11.2 Brose Fahrzeugteile

- 11.3 Daimler

- 11.4 Faurecia

- 11.5 Hyundai Dymos

- 11.6 Iveco

- 11.7 Kongsberg Automotive

- 11.8 Kongsberg Gruppen

- 11.9 Lear

- 11.10 Magna International

- 11.11 RECARO Automotive Seating

- 11.12 Seoyon E-Hwa

- 11.13 Sogefi Group

- 11.14 Sumitomo Riko

- 11.15 Sundaram Clayton

- 11.16 Tachi-S

- 11.17 Toyota Boshoku

- 11.18 TS Tech

- 11.19 Yanfeng Automotive Interiors

- 11.20 Zhejiang Panyu-Jeep Vehicle