Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685936

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685936

Vietnam Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 115 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

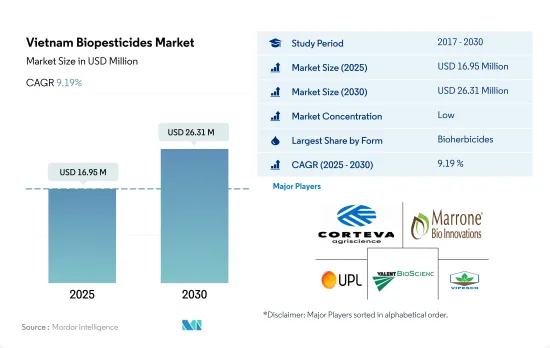

The Vietnam Biopesticides Market size is estimated at 16.95 million USD in 2025, and is expected to reach 26.31 million USD by 2030, growing at a CAGR of 9.19% during the forecast period (2025-2030).

- Biopesticides are crop protection products that are safe to use and are based on microorganisms, plant extracts, and other natural compounds. They have a variety of appealing properties for Integrated Pest Management (IPM). Biopesticides encourage the growth of beneficial microorganisms while controlling harmful pests. According to FAO, agricultural pests cause up to 40.0% of crop loss annually.

- Bioherbicides dominate the biopesticides market in the country, and they accounted for a share of 31.5% in 2022. In Vietnam, some genera used as bioherbicides are Colletotrichum, Fusarium, Alternaria, Cercospora, Puccinia, Entyloma, Ascochyta, and Sclerotinia, Agroecology policies are developed in Vietnam in order to promote particular agroecological practices like agroforestry, Integrated Pest Management (IPM), Integrated Crop Management (ICM), standardization of agricultural practices organic production, food safety control, and conservation and landscape agriculture policies.

- IPM and ICM are intended to assist farmers in understanding the field ecology, using suitable farming techniques, managing the production system effectively, growing healthy crops, and using fewer pesticides and fertilizers in fields. These policies are expected to propel the biopesticides market in the country.

- Pesticide Action Network (PAN) Asia Pacific (PANAP) is a global organization working to eliminate the harm that pesticide usage causes to people and the environment and advance ecological agriculture based on biodiversity. This program also raises awareness about the negative consequences of pesticides, which is expected to increase the domestic market value of biopesticides between 2023 and 2029 by 68.0%.

Vietnam Biopesticides Market Trends

The country plans to expand organic farming, with fruits and vegetables as the top priority due to increasing demand

- The area under organic crop cultivation in Vietnam was recorded at 38.0 thousand hectares in 2022, around 1% of the overall Asia-Pacific organic agricultural land. In Vietnam, there are currently approximately 17,000 organic agriculture producers, 555 processors, and 60 exporters.

- Vietnam has been trying to increase the export of organic farm produce as global demand is expected to rise rapidly as consumers become more health conscious. Organic cultivation in the fruit and vegetable crops is dominating the country's organic farming, and it accounted for 58.8% in 2022, followed by cash crops and row crops, accounting for 35.7% and 5.5% in the same year, respectively.

- With national policies issued since 2017 and government programs such as the National Organic Standard, the Decree on Organic Agriculture, and the National Organic Agriculture Project 2020-2030 to promote organic agriculture in Vietnam, more provinces and cities have actively developed local programs and projects to develop organic agriculture.

- Organic agriculture is thriving in Vietnam, with numerous projects funded by the government, international partners, and the private sector. Participatory Guarantee Systems (PGS) are becoming more popular and are being replicated in an increasing number of communities. The Vietnam Organic Agriculture Association (VOAA) currently has 17 PGS groups in 13 provinces, five of which are operational and the rest in the planning stages. These PGS groups' products include vegetables, rice, oranges, and grapefruits.

- Organic products from Vietnam are available in 180 countries. Vietnam has set a target of increasing the total organic land area to 2.5-3% of the total agricultural land area by 2030.

Approximately 88% of the Hanoi consumers are willing to by organic produce, leads to increase in per capita spending.

- People in Vietnam have gradually begun to pay more attention to product quality and health than they had previously. Health and fitness are still among Vietnamese consumers' top five concerns. Vietnam's per capita income has continuously increased, encouraging people to spend more on nutritious food.

- High levels of pesticides and chemical fertilizers inside vegetables are always risky for Vietnamese people. Around 30% of the area for vegetable production in Hanoi is controlled and safely certified by the government. Descriptive statistics and the results analyzed a sample of 185 respondents surveyed at four big supermarkets in Hanoi concluded that about 15% of the consumers already had the experience of using organic vegetables. However, 88% wanted to try and buy organic products if they were available in the market.

- Major reasons for the limitation in the consumption of organic foods were the lack of information about the organic market and the inconvenience of buying organic products. The average price for organic vegetables was about 70% higher than that of conventional ones. High-income customers were also concerned about the safety of vegetables, and those who previously consumed organic products were likely to pay more for organic vegetables. These findings suggest that information about organic vegetables should be widely publicized to consumers.

- The rising organic food consumption in Vietnam leads to increasing domestic demand. This requires a higher land conversion to organic farming to produce the desired product. A subsequent increase in the demand for organic protection and nutrition products is needed to ensure the quality of the product, thus determining potential growth in the biofertilizers market in the country.

Vietnam Biopesticides Industry Overview

The Vietnam Biopesticides Market is fragmented, with the top five companies occupying 3.46%. The major players in this market are Corteva Agriscience, Marrone Bio Innovations Inc., UPL, Valent BioSciences LLC and Vipesco (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49580

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Biotech Bio-Agriculture

- 6.4.2 Corteva Agriscience

- 6.4.3 Marrone Bio Innovations Inc.

- 6.4.4 UPL

- 6.4.5 Valent BioSciences LLC

- 6.4.6 Vipesco

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.