Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683761

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683761

United Kingdom Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 60 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

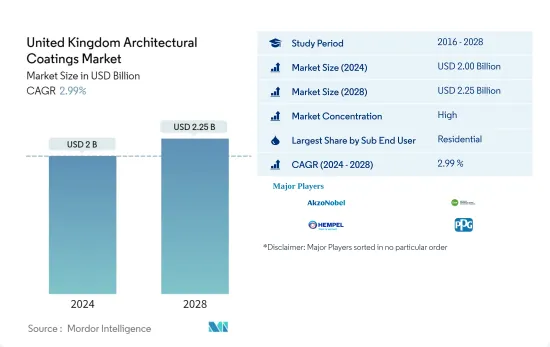

The United Kingdom Architectural Coatings Market size is estimated at USD 2 billion in 2024, and is expected to reach USD 2.25 billion by 2028, growing at a CAGR of 2.99% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The rise in the country's housing stock, accompanied by strong sales in the do-it-yourself (DIY) and repaint segments, has increased the consumption of residential coatings.

- Largest Segment by Technology - Waterborne : The strict VOC regulations and growing awareness of LEED-certified buildings and low-VOC, eco-friendly waterborne coatings contributed to waterborne coating consumption.

- Largest Segment by Resin - Acrylic : The lower price of acrylic coatings than solvent-based coatings, after the UK's exit from the European Union, and low VOC emissions have increased their consumption levels.

UK Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- In the United Kingdom, architectural paint consumption from 2016 to 2021 recorded a CAGR of . This increase was seen due to a 4% increase in investment in 2017 compared to 2% in 2016. Significant growth in the private housing sector and mixed growth in the commercial sector also contributed to this increase.

- The slow growth in the architectural coating consumption in 2020 was followed by a growth recovery in 2021 due to the recovery in new constructions in the residential and commercial sectors. However, in 2020, there was a decline in new construction in the DIY segment from the residential sector.

- The consumption recovered in 2021 due to a rebound from the residential and commercial sectors. The government announced policies such as tax cuts on food and hospitality, which may add to the construction sector's growth in the coming years.

UK Architectural Coatings Industry Overview

The United Kingdom Architectural Coatings Market is fragmented, with the top five companies occupying 36.87%. The major players in this market are AkzoNobel N.V., DAW SE, Hempel A/S, PPG Industries, Inc. and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93078

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Bailey Paints

- 5.4.3 Beckers Group

- 5.4.4 Bedec Products Ltd

- 5.4.5 DAW SE

- 5.4.6 DGH Manufacturing Ltd (Andura Coatings)

- 5.4.7 GLIXTONE

- 5.4.8 Hempel A/S

- 5.4.9 Jotun

- 5.4.10 PPG Industries, Inc.

- 5.4.11 RPM International Inc.

- 5.4.12 SACAL INTERNATIONAL GROUP LTD

- 5.4.13 The Sherwin-Williams Company

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.