Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683773

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683773

Malaysia Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 60 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

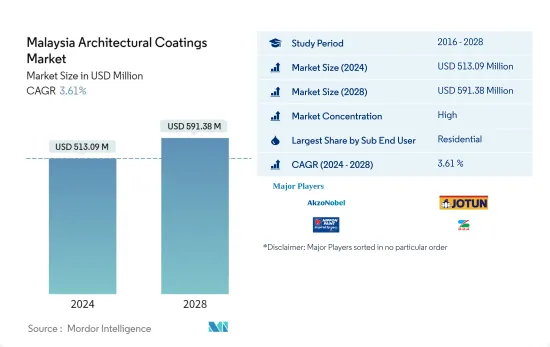

The Malaysia Architectural Coatings Market size is estimated at USD 513.09 million in 2024, and is expected to reach USD 591.38 million by 2028, growing at a CAGR of 3.61% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The residential sector dominated the architectural coating consumption due to the increase in purchasing parity and rapid growth in urbanization, which was 77.61% in 2021.

- Largest Segment by Technology - Waterborne : The waterborne coating dominates the market due to the inclining trend towards less VOC emission and the government planning for VOC regulation in forecasted period.

- Largest Segment by Resin - Acrylic : Acrylic is a leading type of resin due to its technological advantages, low VOC emissions in the architectural segment, and preference to coat the exterior wall of buildings.

Malaysia Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The architectural coating consumption in Malaysia peaked in 2016 and 2017 amid strong addition of new housing stocks and improved housing conditions. The normalizing growth till 2019 due to the continuous rise in purchasing power parity and stagnant macroeconomic factors.

- The architectural coating consumption in Malaysia peaked in 2016 and 2017 amid strong addition of new housing stocks and improved housing conditions. The normalizing growth till 2019 due to the continuous rise in purchasing power parity and stagnant macroeconomic factors.

- The increase in consumption and sales is expected to grow at a significant rate in the forecasted period due to the rising population in the country and continuous rise in the urbanization which leads to the strong consumption of coatings from urban areas. For instance, According to the world bank, Malaysia currently has urbanization rate of 77.61 % in 2021.

Malaysia Architectural Coatings Industry Overview

The Malaysia Architectural Coatings Market is moderately consolidated, with the top five companies occupying 55.94%. The major players in this market are AkzoNobel N.V., Jotun, Nippon Paint Holdings Co., Ltd., SKK(S) Pte. Ltd and TOA Paint Public Company Limited. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93092

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 DAI NIPPON TORYO CO.,LTD.

- 5.4.3 DOLPHIN PAINT (MFG) SDN. BHD

- 5.4.4 Jotun

- 5.4.5 Kansai Paint Co.,Ltd.

- 5.4.6 KCC PAINTS SDN BHD

- 5.4.7 Kossan Paints

- 5.4.8 Nippon Paint Holdings Co., Ltd.

- 5.4.9 SANCORA PAINTS INDUSTRIES SDN BHD

- 5.4.10 Seamaster Paint (Singapore) Pte Ltd

- 5.4.11 SKK(S) Pte. Ltd

- 5.4.12 TOA Paint Public Company Limited.

- 5.4.13 TRUE COLOR PAINTING SOLUTIONS SDN BHD

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.