Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636544

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636544

North America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

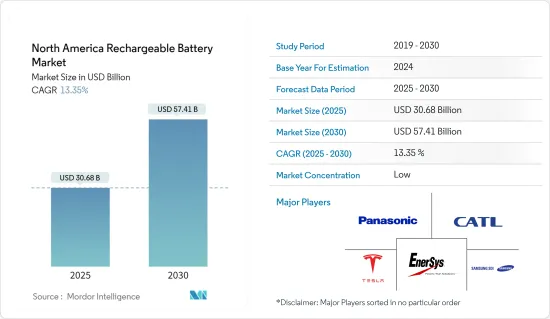

The North America Rechargeable Battery Market size is estimated at USD 30.68 billion in 2025, and is expected to reach USD 57.41 billion by 2030, at a CAGR of 13.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the North American rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create significant opportunities for the North America rechargeable battery market.

- The United States is expected to dominate the market in the upcoming years due to the expansion of the electric vehicle industry and the increasing adoption of batteries as energy storage systems in various renewable energy projects.

North America Rechargeable Battery Market Trends

Automotive Application to Witness Significant Growth

- In the coming years, automotive applications, especially electric vehicles (EVs), are poised to be a dominant segment for rechargeable batteries, predominantly lithium-ion batteries. North America's rechargeable battery industry is set to experience significant growth, largely driven by the rising adoption of electric vehicles.

- Additionally, lead-acid batteries play a crucial role in the automotive industry's starting, lighting, and ignition (SLI) accessories. These SLI batteries provide the essential initial power burst needed to start a vehicle's engine, and they are generally smaller and lighter than deep-cycle batteries.

- The United States stands out as a leading market for electric vehicles in the region. For instance, the International Energy Agency (IEA) reported that battery electric vehicle (BEV) sales in the United States reached approximately 1.1 million units in 2023, marking a 37% increase from 2022. In comparison, Canada and Mexico recorded BEV sales of about 130 thousand and 13 thousand units, respectively. This surge in EV adoption is set to boost the demand for rechargeable batteries across North America.

- Moreover, the Office of Energy Efficiency and Renewable Energy highlighted that in early 2023, the United States government announced plans for electric vehicle battery plants in North America. Manufacturing capacity in the region is projected to soar from 55 gigawatts per year (GWh/year) in 2021 to a staggering 1000 GWh/year by 2030. Most of the upcoming projects are slated to commence production between 2025 and 2030, underscoring the anticipated growth of the rechargeable battery market for automotive applications.

- In July 2023, the Canadian government partnered with car manufacturer Stellantis to establish an electric vehicle battery plant in Windsor, Ontario. Under the agreement, the Canadian government is set to provide Stellantis with approximately USD 11 billion in incentives, aimed at bolstering the clean energy supply chain. This move is expected to further solidify the rechargeable battery market for automotive applications in Canada.

- In early 2023, BMW, the German automaker, declared an investment of EUR 800 million in San Luis Potosi, Mexico. This investment is aimed at producing high-voltage batteries and the fully electric "Neue Klasse" models. BMW's expansion plans allocate over half of the investment to Mexico, with USD 539 million dedicated to the battery assembly center at the existing plant and the remaining USD 323 million for adapting the body shop and establishing a new assembly line for battery pack installation. Such initiatives are expected to bolster the rechargeable battery market growth in North America's automotive sector.

- Furthermore, as lithium-ion battery prices decline and battery technologies advance, the market is likely to see the emergence of price-competitive electric vehicles, further fueling the demand for rechargeable batteries.

The United States to Dominate the Market

- Driven by the surging demand for consumer electronics, electric vehicles (EVs), and battery-based energy storage projects, coupled with an expanding renewable power infrastructure and a robust industrial base, the United States has emerged as a global hotspot for rechargeable batteries. These dynamics solidify the United States' position as North America's leading market for rechargeable batteries.

- In recent years, the battery energy storage system (BESS) in the United States has witnessed significant growth, bolstered by government initiatives and rising investments in renewable energy. The United States stands out as a global leader in renewable energy, with the International Renewable Energy Agency (IRENA) reporting that from 2014 to 2023, the nation's renewable energy capacity more than doubled, reaching over 385 GW by 2023.

- With the rapid growth in renewable power generation, the United States faces challenges in grid stability due to high renewable integration. Given the intermittent nature of solar and wind energy, it's crucial to store this energy during peak demand. This need bolsters the demand for BESS in the United States, subsequently driving the growth of rechargeable batteries.

- According to the United States Energy Information Administration (EIA), the nation's battery storage capacity, which has been on the rise since 2021, is projected to grow by 89% by the end of 2024, contingent on developers meeting their commercial operation dates. Developers aim to push the United States battery capacity beyond 30 GW by the end of 2024, surpassing capacities of petroleum liquids, geothermal sources, wood waste, and landfill gas.

- As of 2023, California leads with the highest installed battery storage capacity at 7.3 GW, followed by Texas at 3.2 GW, while other states collectively hold around 3.5 GW. The EIA notes that the combined United States utility-scale battery capacity reached about 16 GW at the end of 2023, with plans for an additional 15 GW in 2024 and 9 GW in 2025. This trajectory indicates a burgeoning demand for rechargeable battery technologies in the coming years.

- As electronic components shrink and processing power escalates, the popularity of consumer electronics is on the rise. These advanced devices demand lightweight, sophisticated battery packs. The surge in smartphone and laptop consumption, highlighted by the Consumer Technology Association's report of United States smartphone sales jumping from USD 33.7 billion in 2012 to approximately USD 74.7 billion in 2022, underscores the growing demand for lithium-ion batteries in portable devices.

- Given these factors, the United States is poised to lead North America's rechargeable battery market, buoyed by urbanization, rising consumer spending, and a shift towards advanced devices and vehicles.

North America Rechargeable Battery Industry Overview

The North America rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Tesla Inc., EnerSys, and Samsung SDI Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004020

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Tesla Inc.

- 6.3.4 EnerSys

- 6.3.5 Samsung SDI Co. Ltd

- 6.3.6 Duracell Inc.

- 6.3.7 Exide Technologies

- 6.3.8 Clarios, LLC.

- 6.3.9 LG Chem Ltd.

- 6.3.10 Johnson Controls International PLC

- 6.3.11 BYD Co.Ltd.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.