Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636531

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636531

South America Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

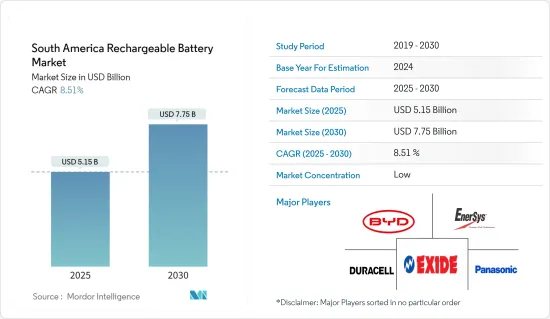

The South America Rechargeable Battery Market size is estimated at USD 5.15 billion in 2025, and is expected to reach USD 7.75 billion by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the South America recmhargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

- Brazil is antcicpated to dominate the South American rechargeable battery market during the forecast period.

South America Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, celebrated for their myriad advantages, find extensive applications across diverse sectors. Their high energy density allows them to pack substantial power into a compact, lightweight form, making them a favored choice for efficient electrical energy storage.

- In January 2023, the US Geological Survey (USGS) reported global lithium reserves, highlighting Bolivia's 21 million tonnes, Argentina's 19.3 million tonnes, and Chile's 9.6 million tonnes out of a total of 86 million tonnes identified worldwide.

- In 2023, battery prices saw a notable decline, dropping over 13% to USD 139/kWh. With the ramp-up of extraction and refining capacities, lithium prices are projected to ease, aiming for USD 100/kWh by 2026.

- Recognizing the potential for economic growth and technological strides, both governments and private investors are ramping up funding for research facilities and forging partnerships with global battery manufacturers. This momentum is poised to bolster the demand for rechargeable lithium batteries in South America.

- For instance, in June 2023, Argentina's government unveiled a hefty USD 1.7 billion investment in lithium production, underscoring its ambition to emerge as a key global supplier. The Economy Ministry highlighted commitments from Chinese firm Tibet Summit Resources to boost production in Salta Province, eyeing yields between 50,000 to 100,000 tonnes of lithium. Such initiatives are set to amplify lithium-ion battery production in the region in the years ahead.

- Moreover, the global pivot towards cleaner energy and transportation has ignited a surge in demand for electric vehicles (EVs). This burgeoning appetite for EVs directly amplifies the need for lithium batteries. As automakers pour investments into expanding EV production, the urgency to secure consistent lithium supplies becomes paramount. This scenario has cast a spotlight on South American nations, spurring exploration, mining ventures, and collaborations to forge resilient lithium supply chains, fueling the EV revolution during the forecast period.

- For instance, in April 2023, BYD Co Ltd, the world's foremost electric vehicle manufacturer, unveiled plans for a USD 290 million lithium factory in Chile's Antofagasta region. This move, highlighted by Chile's economic development agency CORFO, comes on the heels of the government recognizing BYD Chile as a certified lithium producer. Such investments are poised to not only boost lithium production in the region but also elevate the output of lithium-ion rechargeable batteries in the forecast period.

- In summary, South America's burgeoning lithium production and strategic investments position it as a pivotal player in the global rechargeable battery market during the forecast period.

Brazil Expected to Dominate the Market

- Brazil's rechargeable battery market is set for substantial growth, fueled by the increasing adoption of electric vehicles (EVs), the integration of renewable energy sources, and a surging demand for energy storage solutions. This growth is further bolstered by government incentives, stringent environmental regulations, and rapid technological advancements.

- Brazil is steadily embracing electric vehicles. By the end of 2023, Brazil registered an impressive 93,927 electric vehicles, surpassing forecasts. This marks a significant 91% increase from the 49,245 units sold in 2022. December 2023 alone saw a record 16,279 EV sales, almost tripling the 5,587 units sold in December 2022, showcasing a remarkable 191% year-on-year growth.

- In a clear pivot towards sustainable transportation, numerous Brazilian companies are heavily investing in electric vehicle production. Highlighting this trend, General Motors Co. announced in January 2024 its plan to invest USD 1.4 billion over the next five years to bolster its electric vehicle production in Brazil, a move set to significantly boost the local demand for lithium-ion batteries.

- Brazil, rich in renewable energy resources like solar and wind, is increasingly recognizing the importance of energy storage solutions. Rechargeable batteries are essential for harnessing excess energy during peak production and releasing it during high demand or when renewable sources are offline.

- In January 2023, Brazil's largest battery storage project, with a capacity of 33.5MW/67MWh, began operations. Kehua Tech, investing around USD 27 million for a 2,000 square meter area, provided the integrated PCS solution. Designed to discharge during peak demand, the system enhances the electricity network's reliability. With a two-hour discharge capability, it boasts a total capacity of 60MWh. Such projects underscore the viability of rechargeable battery solutions, likely spurring further investment and innovation in Brazil's battery technology landscape.

- Brazil is also witnessing a surge in battery manufacturing capabilities. Both local and international firms are either setting up production facilities or collaborating with established manufacturers to cater to the rising demand for rechargeable batteries across diverse sectors.

- In February 2023, WEG announced its plans to boost the production capacity of lithium battery packs in Brazil. In addition to expanding its current facility, WEG is set to build a new factory to meet the growing demands of electric transportation and energy storage.

- Given these developments, the demand for rechargeable batteries in Brazil is poised to rise significantly in the coming years.

South America Rechargeable Battery Industry Overview

The South American rechargeable battery market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003926

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Application

- 5.2.1 Automobile

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 Clarios

- 6.3.9 FIAMM Energy Technology SpA

- 6.3.10 Fedco Batteries

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.