Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636448

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636448

North America Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

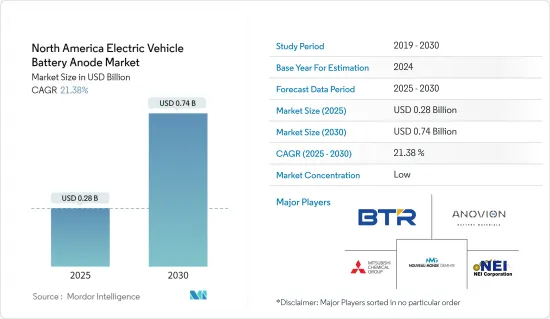

The North America Electric Vehicle Battery Anode Market size is estimated at USD 0.28 billion in 2025, and is expected to reach USD 0.74 billion by 2030, at a CAGR of 21.38% during the forecast period (2025-2030).

Key Highlights

- In the forecast period, the market is poised for growth, driven by the rising adoption of electric vehicles, supportive government initiatives, and declining prices of lithium-ion batteries.

- Conversely, the market may face challenges due to the limited domestic manufacturing of battery components.

- However, ongoing research and advancements in anode materials and efficient electrolytes present promising opportunities for market expansion.

- With increasing demand from the automotive sector, the United States is set to lead the market, bolstered by its growing application of anode materials.

North America Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Type is Expected to Have a Major Share

- Historically, lithium-ion batteries powered consumer electronics, from mobile phones to personal computers. However, their role has expanded, becoming the preferred power source for hybrid and fully electric vehicles (EVs) in North America. This shift is primarily attributed to the environmental benefits of EVs, which produce no CO2, nitrogen oxides, or other greenhouse gases.

- In North America, lithium-ion batteries are outpacing other battery types in popularity due to their favorable capacity-to-weight ratio. Their adoption is further fueled by superior performance, extended shelf life, and declining costs. With high energy density and long cycle life, lithium-ion batteries have become the go-to choice for EV manufacturers. As countries in North America ramp up EV production, there's a growing demand for advanced manufacturing equipment tailored to lithium-ion technology, thereby driving the demand for battery anode material.

- A significant driver of lithium-ion batteries' market dominance in North America is their decreasing prices. Over the last decade, technological advancements, economies of scale, and refined manufacturing processes have led to a significant drop in lithium-ion battery costs.

- In 2023, the price of lithium-ion battery packs decreased by 14% compared to the previous year to USD139/kWh. As battery prices drop, EVs become more affordable, leading to increased adoption and a larger market share for electric vehicles. This surge in demand will drive higher consumption of battery components, including the anode, and encourage technological advancements to improve battery performance.

- In the future, due to the region's heightened emphasis on boosting the production of lithium-ion battery manufacturing components, such as anode and cathode materials, the market for lithium-ion battery anodes is projected to grow during the forecast period.

- For instance, in April 2024, Sicona Battery Technologies, based in Australia, is set to establish its inaugural production facility for silicon-carbon anode materials in the Southeastern United States. Silicon-carbon anodes are increasingly being used in the manufacturing of electric vehicle (EV) batteries. Traditional lithium-ion batteries typically use graphite anodes, but silicon-carbon anodes offer several advantages, particularly in terms of energy density. By 2030, the company plans to expand its U.S. production to a total output of 26,500 tons annually.

- Thus, owing to the increasing use of lithium-ion batteries in electric vehicles and decreasing prices, the lithium-ion battery anode segment is expected to grow significantly in the forecast period.

United States of America is Expected to Dominate the Market

- In recent years, the United States EV battery anode market has rapidly expanded, fueled by the rising adoption of electric vehicles and the demand for cutting-edge battery technologies.

- As electric vehicle sales surge in the United States, battery manufacturers are increasingly investing in domestic production, thereby driving up demand for EV battery anodes. The International Energy Agency reported that U.S. EV car sales reached 1.39 million units in 2023, a notable rise from 0.99 million in 2022.

- With strong government support, battery manufacturers are setting up new plants for electric vehicles (EVs) in the United States. This expansion is set to significantly elevate the demand for materials, especially battery anodes, used in EV production. For example, in January 2024, the U.S. Department of Energy allocated USD 131 million to projects aimed at advancing research and development in EV batteries and charging systems.

- Looking ahead, as EV adoption continues to rise, the battery anode market is poised for growth, bolstered by the nation's R&D efforts in battery technology. Notably, the innovative silicon-carbon composite anodes, which promise higher energy density than traditional graphite anodes, are pivotal for extending the EV range. Major players like Panasonic and LG Energy Solution, alongside newcomers like Sila Nanotechnologies, are pouring resources into R&D to boost anode performance and stability.

- Moreover, Nouveau Monde Graphite is pioneering the development of a carbon-neutral battery anode material in Quebec, Canada, targeting the burgeoning lithium-ion and fuel cell markets.

- Given the trajectory of EV adoption and technological advancements, the U.S. is poised to lead the market during the forecast period.

North America Electric Vehicle Battery Anode Industry Overview

The North America electric vehicle battery anode market is semi-fragmented. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Mitsubishi Chemical Group Corporation, Anovion LLC, Nouveau Monde Graphite Inc, and NEI Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003715

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Limited Domestic Manufacturing of Battery Components

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1

BTR New Material Group Co., Ltd

- 6.3.2 Anovion LLC

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Nouveau Monde Graphite Inc

- 6.3.5 NEI Corporation

- 6.3.6 Targray Industries Inc.

- 6.3.7 Nexeon Lid.

- 6.3.8 LG Chem Ltd

- 6.3.9 Tokai Carbon Co., Ltd.

- 6.3.10 Nippon Carbon Co., Ltd.

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.