PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630258

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630258

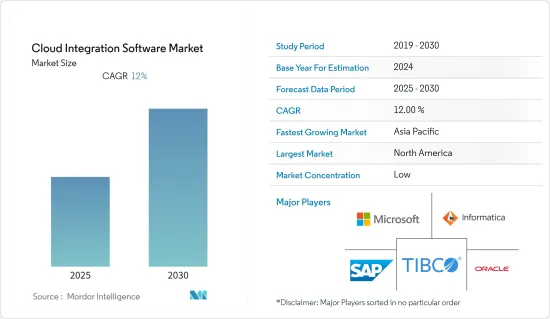

Cloud Integration Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud Integration Software Market is expected to register a CAGR of 12% during the forecast period.

Key Highlights

- Integrations platform as a service (IPAAS) is now the emerging trend for integrating cloud and premises applications. For instance, Cloud Hub is the world's first global IPASS (Integrations platform as a service), providing a fully managed, globally available, and secure cloud platform for integrating applications with no hardware to maintain.

- The factors responsible for the growth of the cloud integration software market include increasing demand for cloud-based enterprise applications and rising demand for cloud computing services. Cloud Data Integration in different industry verticals will also drive the market's growth. Advancements in industrial IT infrastructure across the globe have also led to an increase in Cloud Data Integration.

- There are various reasons which may hinder the growth of the market. Some factors that inhibit market growth are data security, integration of multiple data sources, the threat of data breaches worldwide, financial uncertainty, and macroeconomic situations such as currency exchange rates and economic difficulties.

- Many organizations have extensively adopted cloud integration solutions to modernize IT infrastructure through cost-effective and flexible solutions.

- The COVID-19 pandemic has compelled many major industries to switch to remote working environments due to the lockdown restrictions imposed by the government. The situation has increased the demand for cloud infrastructure services.

Cloud Integration Software Market Trends

BFSI Expected to Have Significant Growth

- The BFSI sector is expected to have significant growth for the forecast period. Many banking and financial services are using data integration software. For instance, many banking and wealth management firms rely on TIBCO Scribe's data integration software platforms to provide sales and service teams with a real-time, 360-degree view of their customers and prospects.

- Cloud integration technology is used in the core banking service to integrate various data and applications using the IT and business model transformation like google wallet, apple wallet, Pay pal & others. Modernizing and transforming the banking system creates a new way to maximize profitability and returns.

- The BFSI industry plays a significant role in nations' financial well-being and progress. Cloud integration is helping the BFSI sector by addressing various concerns, such as secure storage, interoperability, and confidentiality, and it provides many advantages, such as cost savings. With the help of cloud integration, the BFSI sector can avoid the enormous capital expenditure involved in establishing IT infrastructure.

- In August last year, Dashen Bank announced that it had implemented IBM Cloud Pak for Integration on Red Hat OpenShift, to modernize its cloud integration architecture. The collaboration would help the bank expand its ecosystem by accelerating digital transformation and new innovative customer offerings.

Asia-Pacific Expected to Have Significant Growth

- Asia-Pacific is expected to have significant growth over the forecast period. The high growth rate in the Asia-Pacific region is due to rising cloud-based applications, increased IT infrastructure spending, and growing demand for the automation of processes.

- According to MIT Technology Review Insights, last year, Singapore had the best digital infrastructure globally, with an index score of 8.48. Australia, New Zealand, Japan, and South Korea were the following Asia-Pacific countries that scored high, indicating a favorable ecosystem for cloud services in the last year.

- The growing BYOD (Bring your device) trend, rising awareness about iPaaS among enterprises, and an increasing focus on reducing ownership costs are the factors responsible for the market growth in this region.

- The companies' growing focus on data prevention and data security, along with increased government support in various Asian-Pacific countries responsible for driving the iPaaS market, will continue to do so during the forecast period.

- In December last year, Alibaba Cloud, a subset of Chinese e-commerce giant Alibaba, announced an integration with Avalanche blockchain to power the company's Node-as-a-Service initiatives.

Cloud Integration Software Industry Overview

The cloud integration software market is fragmented and is a highly competitive market with no dominant player present in the market. Many mergers and acquisitions are taking place in the market, further leading to the market's growth. Some major players in the market are Microsoft Corporation, Oracle Corporation, Informatica Corporation, SAP SE, and SnapLogic Inc.

In January 2023, Attentive, the conversational commerce platform, announced it had launched Attentive SMS for Salesforce Commerce Cloud on Salesforce AppExchange, empowering brands to personalize every SMS message and drive higher conversions with their e-commerce data. This new integration complements Attentive's existing integrations with Salesforce Marketing Cloud and Salesforce Service Cloud. In September 2022, Avochato announced the launch of Salesforce Marketing Cloud Integration to give marketers the ability to text consumers through Salesforce's Journey Builder marketing automation platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Cloud Computing Services

- 5.1.2 Advancements In Industrial IT Infrastructure

- 5.2 Market Restraints

- 5.2.1 Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 PaaS

- 6.1.2 IaaS

- 6.1.3 SaaS

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 IT

- 6.2.3 Retail

- 6.2.4 Education

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 TIBCO Software Inc.

- 7.1.4 Informatica Corporation

- 7.1.5 SAP SE

- 7.1.6 Mule Soft Inc.

- 7.1.7 Dell Boomi

- 7.1.8 SnapLogic Inc.

- 7.1.9 Software AG

- 7.1.10 IBM Corporation

- 7.1.11 Accenture Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS