Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550466

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550466

Japan Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

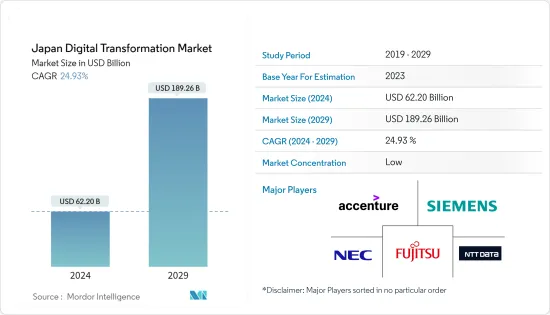

The Japan Digital Transformation Market size is estimated at USD 62.20 billion in 2024, and is expected to reach USD 189.26 billion by 2029, growing at a CAGR of 24.93% during the forecast period (2024-2029).

Key Highlights

- The market's growth is majorly due to the rising adoption of advanced technologies like cybersecurity, artificial intelligence (AI), big data analytics, business intelligence (BI), and cloud computing. These technologies have led to transformations and innovations in the business landscape, leading to increased revenues. Moreover, there's a notable shift towards conducting business through email, collaboration tools, and digital platforms.

- The market is witnessing a favorable trend as companies increasingly adopt digital experience platforms (DXPs) to boost customer experiences and foster brand loyalty. Industries like BFSI, retail, IT & telecom, and healthcare are at the forefront, integrating DXPs to enhance customer engagement and expedite product launches. Moreover, these end-use companies are forging partnerships with their industry counterparts to embed DXPs into their business strategies.

- The UK and Japanese governments have collaborated on a deal to enhance digital government transformation in 2022. The Memorandum of Cooperation (MoC) focused on bridging the UK Government Digital Service (GDS) with Japan's Digital Agency. This partnership entails a mutual exchange of insights and strategies to elevate digital government endeavors in both nations. These initiatives helped both countries share the responsibility of giving civil servants digital training and building their technical capabilities in the current scenario.

- Companies are investing in advanced technology tools to enhance the convenience of Japanese people. For instance, in May 2024, Toei Transportation pioneered the world's inaugural 2D-code system in collaboration with Denso Wave. This system was designed specifically for the Toei Subway Asakusa Line in Tokyo, enabling the seamless opening and closing of platform doors. These doors, a crucial safety feature, are instrumental in preventing passengers from falling onto the tracks or accessing restricted areas. Toei Subway, which serves approximately 2.2 million passengers daily across its four Tokyo lines, initially deployed platform doors on the Mita Line. The implementation resulted in a significant reduction in platform-related accidents.

- By the close of 2023, Japan's digital competitiveness hit a record low in global rankings. The International Institute for Management Development, a Swiss business school renowned for its yearly evaluations of nations' digital readiness, placed Japan 32nd out of the 64 economies under review. The major cause of concern was Japan's resistance to change, and concerns over data privacy and security pose major obstacles to digital transformation efforts. Moreover, the growth of data breaches, unauthorized access, and personal information misuse has increased consumer, regulator, and business concerns regarding data safety.

- Post-COVID-19 enhanced Japan's digital transformation initiatives, as organizations increased their investments in automation, AI, and IoT technologies across various sectors. There is a continuous focus on the digitalization of public services, making government services accessible online and improving efficiency.

Japan Digital Transformation Market Trends

Telecom and IT Holds the Largest Share

- The country is experiencing an expansion of 5G networks with significant investments in building the necessary infrastructure. Japan has been actively rolling out 5G infrastructure, with major telecom operators like NTT Docomo, KDDI, and SoftBank, which are involved in expanding the 5G network. As per data from the Ministry of Internal Affairs and Communications (Japan), the number of 5G subscriptions rose to 69.81 million in 2023, which is expected to grow further.

- SoftBank and KDDI, through 5G JAPAN, have collaboratively built more than 38,000 5G base stations each. This effort has notably reduced capital expenditure costs by USD 0.29 billion (JPY 45.0 billion) for each entity. Beyond bolstering network coverage and technologies, the telcos focus on standardizing construction specs, spanning both 5G and 4G base stations. Both companies have planned joint equipment procurement. Moreover, they started to initiate technology discussions and trials in fiscal year 2024, with a vision to broaden their collaborative endeavors by fiscal year 2026.

- Japan's smart cities leverage data-centric technologies such as IoT, big data, AI, automated driving, and biometric authentication. These technologies are generally used in traffic management systems, smart grids, and connected public services. Advanced traffic management systems use real-time data to optimize traffic flow, reduce congestion, and improve public transportation efficiency.

- The Smart City Expo World Congress (SCEWC) in November 2023, held in Barcelona, served as a platform for future urban living. At the event, Japan's spotlight was its "Japan Pavilion," showcasing a spectrum of projects and initiatives designed to enhance urban living, bolster efficiency, and promote environmental sustainability. The Pavilion, featuring collaborations between major Japanese corporations, startups, and representatives from local governments, facilitated discussions with global partners. The topics covered included public transport optimization and the Internet of Things (IoT) to waste management and the digital transformation of residential spaces.

- Moreover, there is increasing adoption of cloud services for data storage, computing power, and business applications, which facilitate remote work and collaboration for organizations. Companies are increasing their investments to improve efficiency, productivity, and the customer experience.

Analytics, Artificial Intelligence and Machine Learning is Expected to Witness Growth

- The manufacturing sector's deployment of analytics, Artificial Intelligence, and Machine Learning is growing. This helps with predictive maintenance, quality control, and optimizing supply chains. Smart factories and Industry 4.0 concepts are gaining traction in Japan. Thus, businesses are increasingly adopting AI for process automation, reducing operational costs and improving efficiency. As per the data by Internet Initiative Japan, around 43.4 manufacturing companies planned to make investments in smart factories to detect signs of malfunction in production equipment

- In March 2024, Cisco Systems, Mitsui Information, and KDDI Engineering announced a collaboration to roll out a private 5G network tailored for smart factories. The trio planned for the establishment of an "Industry 4.0 Testbed" at the Shinwa Komaki SFiC Lab, situated in Komaki City, Aichi Prefecture, Japan. This initiative aimed to provide manufacturers with a platform to test and validate various industrial applications leveraging private 5G technology. Envisioned applications span from automated guided vehicles (AGVs) to industrial robots, machine vision systems, and other facets of advanced factory automation.

- The Japanese government is actively promoting AI research and development through various initiatives and funding programs. The establishment of the Digital Agency aims to foster AI adoption in public services and streamline digital transformation efforts across sectors.

- In March 2024, Digital Realty, a provider of cloud-and carrier-neutral data centers, announced the initiation of construction on its third data center on the NRT campus in Inzai, Chiba Prefecture, Japan. Dubbed NRT14, this center is a pivotal addition to Digital Realty's global data center platform, PlatformDIGITAL(R), which is planned to open in December 2025. Its launch aims to significantly bolster the availability of advanced, AI-ready infrastructure in Japan.

- Moreover, retailers are leveraging AI for enhanced customer insights, supply chain optimization, and dynamic pricing strategies. E-commerce platforms are using AI to provide personalized shopping experiences and improve customer retention.

Japan Digital Transformation Industry Overview

The Japanese digital transformation market is fragmented, with many players present in the market, such as Fujitsu Japan Limited, NEC Corporation, Siemens AG, IBM Corporation, and NTT DATA Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In July 2024, Fujitsu and Cohere announced a strategic partnership to offer generative AI solutions tailored for enterprises. Their collaboration centers on crafting an advanced Japanese large language model (LLM) specifically designed for private cloud applications, utilizing Fujitsu's Kozuchi AI services. This joint effort is planned to empower enterprises with top-tier Japanese language capabilities, enhancing both customer interactions and employee experiences.

- In July 2024, SoftBank Corp and NEC Corp unveiled a strategic alliance centered on biometric authentication, with the goal of propelling digital transformation (DX) within Japanese enterprises and governmental bodies. This partnership merges NEC's renowned biometric authentication suite, notably its "Bio-IDiom Services," with the robust 5G network and security offerings of SoftBank. The firms strive to deliver customized solutions to a broad spectrum of industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002992

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS (Detailed Coverage of Key Stakeholders in Digital Transformation Industry Product/Solution Providers, System Integrators/VARs, Connectivity Providers, Regulatory Bodies, End-users, Service Providers, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the adoption of big data analytics and other technologies in the country

- 5.1.2 The rapid proliferation of mobile devices and apps

- 5.2 Market Restraints

- 5.2.1 Concerns about the Privacy and Security of Information

6 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

7 KEY METRICS

- 7.1 Technology Spending Trends

- 7.2 Number of IoT Devices

- 7.3 Total Cyberattacks

- 7.4 Technology Staffing Trends

- 7.5 Internet growth and penetration in the Country

- 7.6 Digital Competitiveness Ranking

- 7.7 Fixed and Mobile Broadband Coverage

- 7.8 Cloud adoption

- 7.9 AI adoption

- 7.10 E-commerce Penetration

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Use Case Analysis

- 8.1.1.4 Market Outlook

- 8.1.2 Extended Reality (XR)

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Use Case Analysis

- 8.1.2.4 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Use Case Analysis

- 8.1.3.4 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Use Case Analysis

- 8.1.4.4 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Outlook

- 8.1.6 Additive Manufacturing/3D Printing

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Use Case Analysis

- 8.1.6.4 Market Outlook

- 8.1.7 Cybersecurity

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Use Case Analysis

- 8.1.7.4 Market Outlook

- 8.1.8 Cloud and Edge Computing

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Use Case Analysis

- 8.1.8.4 Market Outlook

- 8.1.9 Others (digital twin, mobility, and connectivity)

- 8.1.9.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.9.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.3 Market Breakdown by Type (Digital Twin, Mobility and Connectivity)

- 8.1.9.4 Use Case Analysis

- 8.1.9.5 Market Outlook

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.2 By End-User Industry

- 8.2.1 Manufacturing

- 8.2.2 Oil, Gas and Utilities

- 8.2.3 Retail & e-commerce

- 8.2.4 Transportation and Logistics

- 8.2.5 Healthcare

- 8.2.6 BFSI

- 8.2.7 Telecom and IT

- 8.2.8 Government and Public Sector

- 8.2.9 Others (Education, Media & Entertainment, Environment etc)

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Fujitsu Japan Limited

- 9.1.2 NEC corporation

- 9.1.3 Accenture PLC

- 9.1.4 Siemens AG

- 9.1.5 IBM Corporation

- 9.1.6 NTT DATA Group

- 9.1.7 SAP SE

- 9.1.8 Oracle Corporation japan

- 9.1.9 Cisco Systems Inc.

- 9.1.10 Salesforce.com Inc.

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.