PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550358

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550358

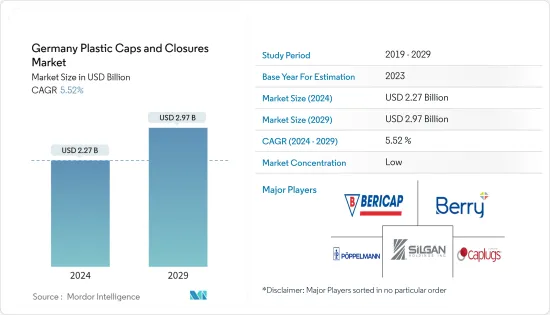

Germany Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Germany Plastic Caps And Closures Market size is estimated at USD 2.27 billion in 2024, and is expected to reach USD 2.97 billion by 2029, growing at a CAGR of 5.52% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 18.14 billion units in 2024 to 21.78 billion units by 2029, at a CAGR of 3.73% during the forecast period (2024-2029).

In Germany, advancements from solution providers and end-users drive a notable shift towards plastic packaging. Strong consumer trust in products labeled "Made in Germany" further bolsters the packaging industry's position in the country.

Key Highlights

- The food and beverage sector's surging demand and heightened food safety awareness drive innovation in cap and closure solutions to prolong product shelf life. Moreover, a rising focus on sustainability prompts manufacturers to delve into eco-friendly materials and designs, aligning with changing consumer tastes. Noteworthy technological strides further underscore the market's adaptability, priming it for sustained global growth to cater to the industry's evolving demands.

- Plastic packaging has become popular among consumers over other products, as plastic material is lightweight and unbreakable, making it easier to handle. Even major manufacturers prefer to use plastic packaging, owing to the lower cost of production. Moreover, the introduction of polymers, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), is expanding the applications of plastic caps and closures. The market has been witnessing an increasing demand for PET bottles due to the surge in the consumption of beverages.

- According to a survey conducted by Verband Deutscher Mineralbrunnen, the annual per capita consumption of mineral water and mineral soft drinks in Germany has been steadily increasing since 2010 and is expected to continue until 2023. In 2023, the average German was projected to have consumed approximately 123 liters of mineral and medicinal water.

- Well-versed and progressively adjusted to recyclability concerns, German manufacturers are pivoting their business strategies. Notably, they are ramping up the introduction of eco-friendly and recyclable plastics into the market. Also, a couple of years ago, MOL Group injected EUR 63 million (USD 73.59 million) into enhancing Slovnaft's polypropylene production, marking the sector's third-largest investment in the past 15 years. This move is set to bolster production capacity, slash emissions, elevate safety standards, and enhance customer appeal. Linde Engineering, a prominent German firm, has been tasked with overhauling Slovnaft's existing PP3 production unit.

- The plastic industry in Germany grapples with challenges. Plastics Europe reports that in 2023, surging energy prices and rising labor costs led to a notable downturn in the country's plastic manufacturing sector for the second consecutive year. Notably, sales plummeted by 21.9% in 2023, paralleled by a 16% decline in domestic demand for plastics. Plastics Europe holds a pessimistic outlook for the industry's prospects in 2024.

Germany Plastic Caps and Closures Market Trends

Polyethylene Terephthalate (PET) To Witness Growth

- Polyethylene terephthalate (PET) is widely used in food packaging. It is levered for its robust barrier properties against water vapor, gases, dilute acids, oils, and alcohol. Beyond its barrier strength, PET boasts shatter resistance and flexibility and is notably easy to recycle.

- These attributes have cemented PET's dominance in food and beverage packaging, where its enduring resistance to various elements and recyclability stand out. Its durability and steadfastness further underscore its suitability for food-grade items, including individual drink containers and closures.

- According to a study by Dutch PET Recycling, Germany recycled approximately 438,000 tonnes of PET beverage bottles, including imports. The majority, 190,500 tonnes (44.7%), was channeled into producing new bottles. Also, about 33,600 tonnes of PET were incinerated from bottle sorting and reprocessing or mistakenly directed to residual waste.

- Further, in January 2023, Revalyu Resources GmbH, headquartered in Kleinostheim, Germany, is set to invest USD 50 million in its U.S. expansion, beginning with constructing a plant in Statesboro, Georgia. The groundbreaking ceremony for the 43-acre Statesboro site is slated for the first half of 2023, with commissioning scheduled for 2024. Upon completion of the initial phase, the plant can process over 225,000 pounds per day of polyethylene terephthalate (PET) into PET polymers and recycled PET (rPET) flakes.

- According to Statistisches Bundesamt, the revenue of the manufacture of plastic products in Germany in 2020 for the manufacture of plastic products was valued at USD 17.89 billion, and the manufacture of other plastic products was valued at USD 37.23 billion in the same year. In 2023. the manufacture of plastic packaging goods has reached 18.24 billion, while the manufacture of other plastic products has reached USD 43.86 billion. Such a rise in plastic product manufacturing would push the need for caps and closures nationwide.

Beverage Segment is Expected to Drive the Market Growth

- The industries where plastic caps and closures are mainly used include food and beverage, cosmetics, and personal care. The beverage sector's need for caps and closures is expected to increase due to the demand for bottled water and non-alcoholic drinks.

- Polyethylene terephthalate (PET) bottles are gaining a presence in various product areas. Their low cost, low weight, and ongoing developments in printing technology have led to their popularity among premium consumers. PET bottles are mainly used for water bottles. Moreover, they are also used for packaging sodas, beverages, juices, cooking oil, shampoo, liquid hand soap, pharmaceuticals, and many more.

- Moreover, using recycled material in beverage bottles has exhibited substantial growth. According to research conducted by the Gesellschaft fur Verpackungsmarktforschung (GVM) in April 2023, the average percentage of PET recyclate employed in manufacturing beverage bottles in Germany was 44.8% in 2021. In contrast, the previous survey for 2019 showcased the usage of 34.4% PET recyclate.

- According to German Trade and Invest, the beverage industry, opportunities abound in various segments, including functional drinks, smoothies, enhanced waters, organic beverages, and sugar-free soft drinks. New entrants can achieve success, even on a smaller scale, by emphasizing health benefits or unique production methods. Within the alcoholic beverages sector, craft beer, spanning pale ale, wheat, or lager variations and alcohol-free options, are witnessing notable growth.

- Furthermore, the demand for non-alcoholic beer is rising, with the market volume projected to reach EUR 1.8 billion by 2025. Shifting consumer preferences are also fueling increased consumption of organic wines, beers, and spirits. According to Statistisches Bundesamt, the revenue of the beverage industry in Germany in 2020 was EUR 21.29 billion (USD 23.04 billion), and it will reach EUR 24.99 billion (USD 27.04 billion) in 2023. Such a rise in the beverage industry would push the market for caps and closures in the country.

Germany Plastic Caps and Closures Industry Overview

The German Plastic Caps and Closures market is fragmented, with many domestic and significant players, such as Berry Global, Inc., Bericap GmbH & Co. KG, Silgan Holdings Inc., Poppelmann GmbH & Co. KG, Caplugs, Inc., and more. Companies operating in the region are focused on expanding their business through innovations, collaborations, acquisitions, mergers, etc.

- April 2024 - Bericap GmbH & Co. KG, operating across multiple regions, including Germany, partnered with TotalEnergies to introduce a new closure for 20-liter lubricant packaging. This innovative design incorporates 50% post-consumer recycled plastic (PCR) and meets the stringent DIN 60 lubricant standards. The closure will be featured on TotalEnergies Lubrifiants' 20-liter premium lubricant cans, produced in France and Belgium, showcasing the commitment to sustainability by utilizing 50% PCR material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Inreasing Adoption of Lighweight and Recyclable Plastics

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns Owing to Plastics

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded

- 7.2.2 Dispensing

- 7.2.3 Unthreaded

- 7.2.4 Child-Resistant

- 7.3 By End-User Industry

- 7.3.1 Food

- 7.3.2 Bevrage

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices & Energy Drinks

- 7.3.2.5 Others

- 7.3.3 Personal Care & Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-use Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Berry Global, Inc.

- 8.1.2 Bericap GmbH & Co. KG

- 8.1.3 Silgan Holdings Inc.

- 8.1.4 Poppelmann GmbH & Co. KG

- 8.1.5 Caplugs, Inc.

- 8.1.6 Aptar Group

- 8.1.7 United Caps

- 8.1.8 Tetra Pak International SA

9 RECYCLING & SUSTAINABILITY LANDSCAPE

10 MARKET FUTURE OUTLOOK