PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550346

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1550346

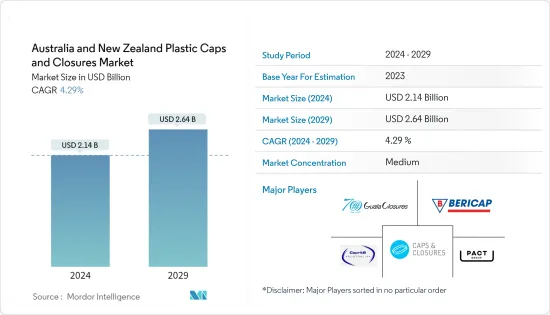

Australia And New Zealand Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Australia And New Zealand Plastic Caps And Closures Market size is estimated at USD 2.14 billion in 2024, and is expected to reach USD 2.64 billion by 2029, growing at a CAGR of 4.29% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 12.78 billion units in 2024 to 15.21 billion units by 2029, at a CAGR of 3.54% during the forecast period (2024-2029).

Key Highlights

- Australia and New Zealand are witnessing a surge in demand for plastic caps and closures, driven by sectors like food, beverage, personal care, cosmetics, pharmaceuticals, and industry. In Australia, the food and beverage (F&B) manufacturing sector bolsters scalability and competitiveness and underpins the nation's supply chain resilience. Notably, Australia's food processing industry, the largest in the country, accounts for a significant one-third of all manufacturing activities, further fueling the need for diverse plastic closures.

- Concurrently, New Zealand's beverage sector is propelling the demand for plastic caps, reflecting the nation's evolving consumer preferences and heightened consumption. Data from the New Zealand Beverage Council (NZBC) reveals that Kiwi households collectively spend nearly USD 700 million annually on soft drinks and juices, with a breakdown of around USD 284 million on soft drinks, USD 143 million on fruit and vegetable juices, and USD 20 million on energy drinks.

- Key players like Bericap Holding GmbH, Guala Closures SPA, and Pact Group Holdings Ltd are at the forefront, focusing on crafting lightweight closures tailored for various applications, be it in food, beverages, cosmetics, or personal care. Their product offerings span from dispensing flip-tops, pumps, and fine mist sprays to tamper-evident caps catering to a spectrum of industries. Moreover, these manufacturers are increasingly diversifying their portfolio, introducing specialty and bespoke caps, further propelling the market in both Australia and New Zealand.

- Despite the market's growth trajectory, there's a looming concern over the environmental impact of plastic caps and closures in Australia and New Zealand. The prevalent practice of sending plastic waste, including bottles and caps, to landfills often leads to incineration, a process that not only occupies valuable space but also releases harmful pollutants, significantly compromising air quality, a pressing challenge for the market's continued expansion.

Australia and New Zealand Plastic Caps and Closures Market Trends

Polyethylene (PE) Segment is Estimated to Have the Largest Market Share

- In Australia and New Zealand, manufacturers of plastic caps and closures primarily rely on PP and PE as their key raw materials. These materials, known for their cost-effectiveness, have become a go-to choice across industries. Notably, heat induction cap liners, compatible with a variety of plastic bottles such as PP, HDPE, and LDPE, not only prevent leaks but also provide tamper resistance. With these benefits in mind, the caps and closures market is set for substantial growth in the near future.

- Australian and New Zealand consumers, known for their fast-paced lifestyles, are increasingly seeking lightweight, user-friendly closures for a range of applications. This demand has led to a shift in packaging, with a focus on compactness and practicality. Responding to this trend, custom caps and closures manufacturers are introducing designs, predominantly from PE, that are not only lighter but also easier to open, handle, and dispense. This shift is a key driver of market growth.

- Key players in the Australian and New Zealand caps and closures market, such as Bericap Holding GmbH and Guala Closures SpA, are at the forefront of innovation. They are crafting leak-proof closures from PE and cater to food, beverage, and industrial applications. These closures not only ensure leak protection but also enhance user convenience, a factor pivotal in driving market growth.

- The surge in demand for PE caps, closures, and lids in the personal care and cosmetics sector in Australia and New Zealand is directly linked to the increasing consumer preference for natural skincare products and growing innovation in the industry. Data from the International Trade Centre (ITC) reveals that in 2023, imports of beauty and make-up products in Australia were valued at USD 1,143.72 million, marking a 17.31% increase from the previous year. Similarly, New Zealand saw a 1.16% rise, with imports valued at USD 248.49 million.

Beverage Segment Expected to Dominate the Market

- The caps and closures market is witnessing a surge in demand, largely driven by the increasing popularity of packaged beverages. This uptick is predominantly attributed to rising awareness of health among consumers, leading to a preference for healthier beverage options. As a result, healthy and natural energy drinks, a flagship of this health-conscious trend, are gaining prominence, further boosting the plastic caps and closures segment.

- Australia is witnessing a growing appetite for carbonated soft drinks, energy drinks, and juices, largely due to a rising demand for zero-calorie, sugar-free options available in a myriad of flavors. Notably, data from the Australian Beverage Council underscores a notable uptick in juice consumption among 9 to 13-year-olds, with rates soaring from 12% to 33%.

- Conversely, New Zealand exhibits a strong affinity for sugary drinks, a trend that significantly drives the demand for caps and closures. The New Zealand Beverage Council's data reveals that carbonated soft drinks make up a modest 7.2% of the country's total beverage consumption. Despite their high sugar content, the market for sugar-sweetened carbonated soft drinks is on the rise.

- Insights from the International Trade Centre (ITC) indicate that both Australia and New Zealand are key importers of non-alcoholic beverages. In 2023, Australia's import value for such beverages stood at USD 399.61 million, while New Zealand's was at USD 145.04 million. Given this significant import volume, the demand for beverage packaging, including caps and closures, is poised for growth in the region.

Australia and New Zealand Plastic Caps and Closures Industry Overview

The Australian and New Zealand plastic caps and closures market is moderately consolidated, with domestic players such as Caprice Australia Pty Ltd and Caps and Closures Pty Ltd, and International players including Bericap Holding GmbH, Pact Group Holdings Ltd, and Guala Closures SpA operating in the market. To solidify their footprint in the market, the players focus on new product development, partnerships, participation in trade expos, mergers and acquisitions, and collaborations.

- July 2023: Caps and Closures Pty Ltd, an Australian company, participated in the Australian Waste & Recycling Expo (AWRE), an event held at the International Convention Centre in Sydney. The company showcased sustainable caps and closure solutions for the food and beverage industries at the expo.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Food and Beverage Sector

- 5.1.2 Rising Demand of Innovative Caps and Closures

- 5.2 Market Challenge

- 5.2.1 Rising Environmental Concerns Regarding Plastic Waste

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Resin

- 7.1.1 Polyethylene (PE)

- 7.1.2 Polyethylene Terephthalate (PET)

- 7.1.3 Polypropylene (PP)

- 7.1.4 Other Plastic Materials (Polystyrene, PVC, Polycarbonate, etc.)

- 7.2 By Product Type

- 7.2.1 Threaded

- 7.2.2 Dispensing

- 7.2.3 Unthreaded

- 7.2.4 Child-resistant

- 7.3 By End-user Industries

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.2.1 Bottled Water

- 7.3.2.2 Carbonated Soft Drinks

- 7.3.2.3 Alcoholic Beverages

- 7.3.2.4 Juices and Energy Drinks

- 7.3.2.5 Other Beverages

- 7.3.3 Personal Care and Cosmetics

- 7.3.4 Household Chemicals

- 7.3.5 Other End-user Industries

- 7.4 By Country

- 7.4.1 Australia

- 7.4.2 New Zealand

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group GmbH

- 8.1.2 Bericap Holding GmbH

- 8.1.3 Pact Group Holdings Limited

- 8.1.4 Caprite Australia Pty Ltd

- 8.1.5 Guala Closures SPA

- 8.1.6 Primo Plastics

- 8.1.7 Caps and Closures Pty Ltd

- 8.1.8 Forward Plastics Ltd

- 8.1.9 Flexicon Plastics

9 RECYCLING & SUSTAINABILITY LANDSCAPE

10 FUTURE OUTLOOK