PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851717

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851717

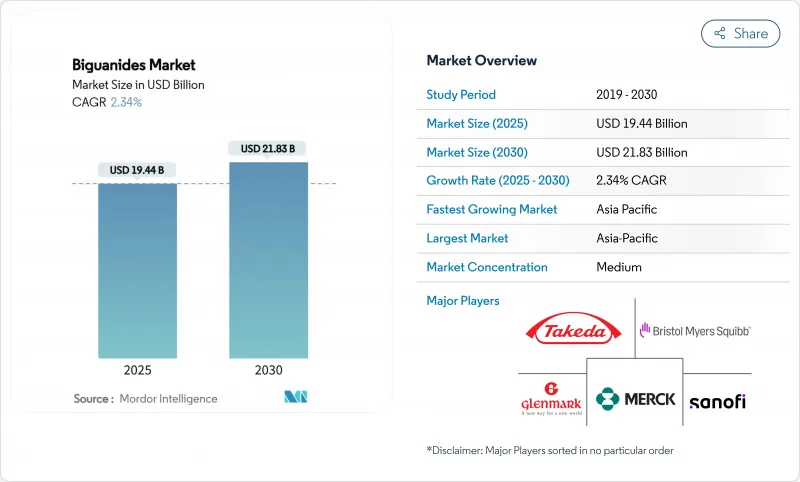

Biguanides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biguanides market size stood at USD 19.44 billion in 2025 and is forecast to reach USD 21.83 billion by 2030, advancing at a 2.34% CAGR over the period.

Steady demand for metformin as first-line therapy in type-2 diabetes anchors revenue, while incremental growth arises from newer dosage forms, women's health indications, and wider regional access. Asia-Pacific drives volume through large diabetic populations and vigorous generic competition, whereas North America sustains value through premium fixed-dose combinations. Regulatory actions that contain N-nitrosodimethylamine (NDMA) impurities, alongside digital pharmacy expansion, shape both supply resilience and distribution strategy. Competitive focus therefore rests on manufacturing quality, pricing agility, and formulation innovation to protect share against GLP-1 receptor agonists and SGLT-2 inhibitors that now influence first-line choices.

Global Biguanides Market Trends and Insights

Rising Global Prevalence of Type-2 Diabetes (T2DM)

The projected rise to 783 million diabetes cases by 2045 sustains prescription volumes for metformin, particularly in Asia-Pacific where incidence is climbing fastest. Emerging markets deliver high unit growth because competitive generics reduce entry price; developed markets prefer premium fixed-dose combinations that couple glycemic control with cardiovascular benefit. Guideline reaffirmation of metformin as first-line therapy sustains baseline demand even while combination therapy gains momentum. Manufacturers therefore pursue dual strategy: defend high-volume core tablets for cost-sensitive health systems and promote value-added formats in wealthier segments. The global footprint of diabetes ensures that biguanides market expansion remains linked to prevention and early intervention programs as governments confront mounting healthcare costs.

Favourable First-Line Therapy Status in Most Diabetes Guidelines

Diabetes guidelines for 2025 kept metformin at the center of initial pharmacologic treatment, a position that guarantees continued volume stability. The same updates advocate earlier introduction of add-on agents such as SGLT-2 inhibitors, increasing opportunities for dual and triple combinations that embed metformin. Health systems adopting preventive approaches extend metformin's clinical utility to prediabetes, enlarging its candidate pool. Regional nuances appear: Europe stresses cost-effectiveness, North America rewards outcome-based evidence, and emerging markets weigh affordability over optimization. Overall, guideline alignment secures metformin demand while encouraging manufacturers to innovate around combination ratios, dosing convenience, and patient groups beyond core diabetes.

NDMA Impurity Recalls Denting Prescriber Confidence

Successive recalls since 2020 exposed NDMA levels above regulatory limits in several metformin batches, forcing stock withdrawals from Teva, Apotex, and others. New research shows NDMA can form in-vivo when tablets encounter nitrites, intensifying safety scrutiny. Manufacturers responded by adopting antioxidants such as ascorbic acid in granulation and installing tighter gas-phase testing protocols, but clinician wariness lingers. U.S. and European regulators now require lot-specific certificates before market release, lengthening lead times. While supply has stabilized, heightened awareness accelerates switching to alternative drug classes and raises compliance costs, moderating the biguanides market trajectory in the near term.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Genericisation Driving Affordability in LMICs

- Increasing Use of Metformin in Women's Health (PCOS, GDM)

- Rising Popularity of GLP-1 RAs & SGLT-2s as First-Line Options

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metformin generated 95.51% of biguanides market revenue in 2024, underpinning class leadership through unmatched clinical familiarity and affordability. Buformin's 7.65% CAGR highlights how unmet needs in metabolic oncology and specific regional approvals allow smaller molecules to carve shares. Phenformin finds renewed interest in anticancer programs despite historic safety withdrawals, leveraging deeper mitochondrial penetration for enhanced tumoricidal effect. Major suppliers hedge portfolios by investing modest sums into these secondary biguanides while continuing high-volume metformin manufacture. Pricing flexibility is greater in niche molecules, but limited indication scope constrains absolute revenue potential. Observers expect metformin's share to taper gradually yet remain dominant throughout the forecast window as broader labels sustain prescriptions. The biguanides market size attached to metformin alone still exceeds USD 15 billion, underscoring the molecule's structural importance.

Second-generation molecules attract research funding aimed at optimizing bioavailability, targeting tissue-specific AMPK activation, and reducing lactic acidosis risk. European consortia explore buformin micro-dosing for hepatocellular carcinoma prevention, while Japanese groups test phenformin in combination with checkpoint inhibitors. Regulatory acceptance rests on demonstrable safety margins, and early results suggest manageable profiles with proper dosing controls. If oncology trials yield approval, premium pricing could offset smaller patient pools, contributing fresh but measured top-line additions to the biguanides market.

Immediate-release tablets retained a 60.53% share in 2024 owing to entrenched prescribing habits and the lowest cost per milligram. Extended-release tablets, though, are advancing at 6.85% CAGR as once-daily regimens boost adherence and minimize gastrointestinal discomfort. Proprietary hydrophilic matrices and laser-drilled osmotic pumps sustain controlled dissolution, commanding higher unit prices and lengthier patent life. High-strength 1,000 mg formats reduce pill burden and align with weight-based dosing guidelines in overweight populations. The biguanides market size tied to extended-release lines is projected to rise from USD 5.1 billion in 2025 to USD 7.1 billion by 2030.

Oral solutions, though minor, serve pediatric and geriatric segments unable to swallow tablets. Novel taste-masking excipients and small-volume concentrates aim to widen acceptance. Sachet granules tailored for low-resource settings bypass water scarcity issues and simplify dosing in rural clinics. Collectively, dosage-form diversification strengthens brand identity, allowing manufacturers to differentiate beyond price in a maturing therapeutic category.

The Biguanide Market Report is Segmented by Molecule (Metformin, Phenformin, and Buformin), Dosage Form (Immediate-Release Tablets, and More), Indication (Type-2 Diabetes Mellitus, Prediabetes, and More), Formulation Type (Monotherapy and Fixed-Dose Combinations), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 35.62% of 2024 revenue and is on track to deliver an 8.35% CAGR, driven by China's centralized procurement that cut prices yet expanded volume and India's vast untreated diabetic base. Rapid urbanization coupled with lifestyle shifts boosts diagnosis rates, ensuring prescription growth even under price caps. Southeast Asian governments subsidize metformin within universal coverage schemes, emphasizing affordability over premium formulations.

North America embodies a value-focused yet slower-growing arena where sophisticated payers favor agents offering cardiorenal benefit. Fixed-dose combinations that integrate metformin maintain relevance, but GLP-1 receptor agonists increasingly command formulary preference. NDMA recall fallout accelerated hospital stewardship programs, raising documentation thresholds for suppliers. Despite flat volumes, revenue holds steady owing to higher average selling prices.

Europe balances innovation adoption with budget oversight. National health systems negotiate volume-based discounts yet reimburse extended-release and combination tablets when pharmacoeconomic models demonstrate reduced complications. EMA approvals of patient-centric modalities such as weekly insulin augment the therapeutic toolbox and encourage combination regimens featuring metformin.

Middle East & Africa experience rising diabetes prevalence but variable infrastructure. Gulf Cooperation Council states import high-quality brands, while sub-Saharan markets rely on donor-financed generics. Supply security challenges persist due to cold-chain gaps and counterfeit penetration.

South America, led by Brazil, witnesses rising metformin uptake in gestational diabetes protocols under the SUS system. Price controls limit margins, but public procurement covers vast populations, offering volume certainty for compliant manufacturers. Collectively, regional heterogeneity obliges companies to tailor packaging, price tiers, and distribution logistics, sustaining overall biguanides market expansion despite localized headwinds.

- Teva Pharmaceutical Industries

- Merck

- Takeda Pharmaceuticals

- GlaxoSmithKline

- Sanofi

- Boehringer Ingelheim

- Glenmark Pharma

- Zydus Lifesciences

- Bristol-Myers Squibb

- Sun Pharmaceuticals Industries

- Aurobindo Pharma

- Lupin

- Ajanta Pharma

- Granules India

- Apotex

- IOL Chemicals & Pharma

- Sandoz Group

- Dr. Reddy's Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Prevalence Of Type-2 Diabetes (T2DM)

- 4.2.2 Favourable First-Line Therapy Status In Most Diabetes Guidelines

- 4.2.3 Rapid Genericisation Driving Affordability In LMICs

- 4.2.4 Increasing Use of Metformin In Women's Health (PCOS, GDM)

- 4.2.5 Exploration of Biguanides As Geroprotective & Anti-Cancer Agents

- 4.2.6 AI-Enabled Molecule Repurposing Accelerating Fixed-Dose Combos

- 4.3 Market Restraints

- 4.3.1 NDMA Impurity Recalls Denting Prescriber Confidence

- 4.3.2 Rising Popularity Of GLP-1 Ras & SGLT-2s As First-Line Options

- 4.3.3 Price-Control Policies In India, China And Brazil Compressing Margins

- 4.3.4 Sub-Standard / Counterfeit Metformin In E-Commerce Channels

- 4.4 Porter's Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Molecule

- 5.1.1 Metformin

- 5.1.2 Phenformin

- 5.1.3 Buformin

- 5.2 By Dosage Form

- 5.2.1 Immediate-Release Tablets

- 5.2.2 Extended-Release Tablets

- 5.2.3 Oral Solution

- 5.3 By Indication

- 5.3.1 Type-2 Diabetes Mellitus

- 5.3.2 Prediabetes

- 5.3.3 Polycystic Ovary Syndrome (PCOS)

- 5.3.4 Gestational Diabetes Mellitus (GDM)

- 5.4 By Formulation Type

- 5.4.1 Monotherapy

- 5.4.2 Fixed-Dose Combinations (FDCs)

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Teva Pharmaceutical Industries

- 6.3.2 Merck & Co.

- 6.3.3 Takeda Pharmaceutical

- 6.3.4 GSK plc

- 6.3.5 Sanofi

- 6.3.6 Boehringer Ingelheim

- 6.3.7 Glenmark Pharma

- 6.3.8 Zydus Lifesciences

- 6.3.9 Bristol-Myers Squibb

- 6.3.10 Sun Pharma

- 6.3.11 Aurobindo Pharma

- 6.3.12 Lupin Ltd.

- 6.3.13 Ajanta Pharma

- 6.3.14 Granules India

- 6.3.15 Apotex

- 6.3.16 IOL Chemicals & Pharma

- 6.3.17 Sandoz AG

- 6.3.18 Dr. Reddy's Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment