PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444890

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444890

Europe Biguanide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

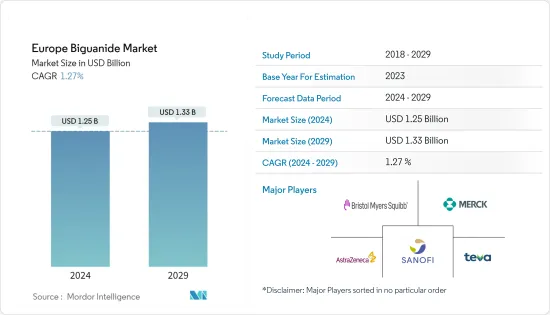

The Europe Biguanide Market size is estimated at USD 1.25 billion in 2024, and is expected to reach USD 1.33 billion by 2029, growing at a CAGR of 1.27% during the forecast period (2024-2029).

The COVID-19 pandemic has substantially impacted the European Biguanide Market. People with diabetes have a weak immune system so, with COVID-19, the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people. The manufacturers of diabetes drugs have taken care during COVID-19 to deliver the medications to diabetes patients with the help of local governments. Novo Nordisk stated on their website that 'Since the start of COVID-19, our commitment to patients, our employees and the communities where we operate has remained unchanged, we continue to supply our medicines and devices to people living with diabetes and other serious chronic diseases, safeguard the health of our employees, and take actions to support doctors and nurses as they work to defeat COVID-19.'

Diabetic drugs are medicines developed to stabilize and control blood glucose levels amongst people with diabetes. Diabetic drugs have been potential candidates for treating diabetic patients affected by SARS-CoV-2 infection during the COVID-19 pandemic. According to the diabetes category, the estimated cost per hospital admission during the first wave of COVID-19 in Europe ranged from EUR 25,018 for type 2 diabetes patients in good glycemic control to EUR 57,244 for type 1 diabetes patients in poor glycemic control, reflecting a higher risk of intensive care, ventilator support, and a longer hospital stay. The estimated cost for patients without diabetes was EUR 16,993. The expected total direct expenditures for COVID-19 secondary care in Europe were 13.9 billion euros. Diabetes treatment thus accounted for 23.5% of total expenditures.

Biguanides are a class of medications used to treat type 2 diabetes. They work by reducing the production of glucose that occurs during digestion. Metformin is the only biguanide currently available in most countries for treating diabetes. Glucophage (metformin) and Glucophage XR (metformin extended release) are well-known brand names for these drugs. Others include Fortamet, Glumetza, and Riomet. Metformin is also available in combination with several other types of diabetes medications, such as sulfonylureas.

The European region had witnessed an alarming increase in the prevalence of diabetes, in recent years. Diabetes is associated with many health complications. Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Europe Biguanide Market Trends

Increasing diabetes prevalence

The diabetes population in the European region is expected to rise by more than 5% over the forecast period.

According to the IDF, the overall diabetes expenditure in Europe among the population aged 20-79 years was USD 156 billion, and it is expected to increase to USD 174 billion by 2040. These figures indicate that approximately 9% of the total healthcare expenditure is spent on diabetes in Europe. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic drugs.

Oral anti-diabetic drugs have been available internationally and are recommended for use when escalation of treatment for type-2 diabetes is required along with lifestyle management. These are typically the first medications used in the treatment of type-2 diabetes due to their wide range of efficacy, safety, and mechanisms of action. Antidiabetic drugs help diabetes patients keep their condition under control and lower the risk of diabetes complications. People with diabetes may need to take antidiabetic drugs for their whole lives to control their blood glucose levels and avoid hypoglycemia and hyperglycemia. They present the advantages of easier management and lower cost, so they became an attractive alternative to insulin with better acceptance, which enhances adherence to the treatment.

The government, along with the companies, are working towards better diabetes management. For instance, the National Service Framework (NSF) program is improving services by setting national standards to drive up service quality and tackle variations in care. The Association of British HealthTech Industries (ABHI) launched a diabetes section, enabling diabetes technology companies to work together in the first forum of its kind.

Owing to the rising rate of obesity, the growing genetic factors for type-2 diabetes, the increasing prevalence, and the aforementioned factors, it is likely that the market will continue to grow.

Germany holds the highest market share in the Europe Biguanide Market in the current year

Germany holds the highest market share of about 44% in the European biguanide market in the current year.

Diabetes is a significant health problem and one of the astounding challenges facing healthcare systems all over Germany. The prevalence of known type-1 and type-2 diabetes in the German adult population is very high, along with a high number of patients who are not yet diagnosed with the disease. Due to an aging population and an unhealthy lifestyle, the prevalence of type-2 diabetes is expected to increase steadily over the next few years. High-quality care, including adequate monitoring, control of risk factors, and active self-management, are the key factors for preventing complications in German patients with type-2 diabetes.

Diabetes reduces lifespan, and people with the disease are likely to experience blindness and be hospitalized for amputations, kidney failure, heart attacks, strokes, and heart failure. The first-line therapy used in patients with type-2 diabetes is metformin monotherapy. When metformin is contraindicated or not tolerated, or when treatment goals are not achieved after three months of use at the maximum tolerated dose, other options need to be considered. Dipeptidyl peptidase-4 inhibitors, sodium-glucose cotransporter-2 inhibitors, and glucagon-like peptide-1 agonists are generally used to supplement treatment with metformin.

About 8.5 million people in Germany suffer from diabetes, according to the German Diabetes Center (DDZ). The number of people with type-2 diabetes in Germany will continue to increase over the next twenty years. German law requires public plans to cap out-of-pocket health care costs and to cover all medically necessary treatment, including insulin. Germany is one of the most developed countries in terms of healthcare facilities. Moreover, the reimbursement policy and the pricing policy are highly regulated, which drives the market. The roll-out of many new products, increasing international research collaborations in technological advancement, and increasing awareness about diabetes among people are some of the market opportunities for the players in the German diabetes drug market.

Europe Biguanide Industry Overview

The Europe biguanide market is fragmented consisting of manufacturers like Teva, Takeda, Merck, Sanofi, GlaxoSmithKline, Bristol-Myers Squibb, and Boehringer Ingelheim Pharmaceuticals, etc. having a global market presence and other regional manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Biguanide

- 5.2 Geography

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Italy

- 5.2.4 Russia

- 5.2.5 Spain

- 5.2.6 United Kingdom

- 5.2.7 Rest of Europe

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teva

- 7.1.2 Merck

- 7.1.3 Takeda

- 7.1.4 GlaxoSmithKline

- 7.1.5 Sanofi

- 7.1.6 Boehringer Ingelheim

- 7.1.7 Glenmark

- 7.1.8 AstraZeneca

- 7.1.9 Bristol-Myers Squibb

- 7.2 Company Share Analysis

- 7.2.1 Merck

- 7.2.2 Takeda

- 7.2.3 Sanofi

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS