Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693738

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693738

China Feed Minerals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 176 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

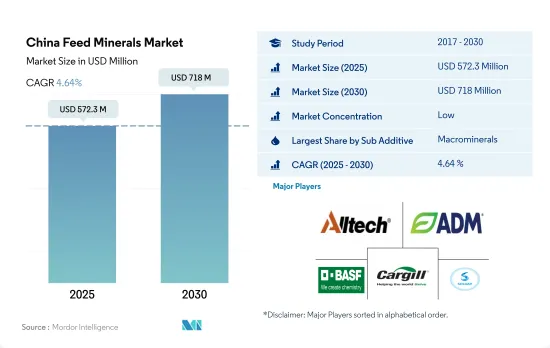

The China Feed Minerals Market size is estimated at 572.3 million USD in 2025, and is expected to reach 718 million USD by 2030, growing at a CAGR of 4.64% during the forecast period (2025-2030).

- The feed minerals market in China witnessed a substantial increase in value, reaching USD 501.6 million in 2022 and exhibiting a growth rate of 33.6% during 2017-2022. However, the market experienced a sudden decline in 2020, primarily attributed to the negative impact of the COVID-19 pandemic, which decreased feed production and reduced the consumption of feed minerals.

- Macrominerals are the most extensively used feed minerals in China, accounting for a significant share of the market, valued at USD 441.9 million in 2022. Poultry birds were the largest consumers of macrominerals, accounting for 49% of the market. Calcium, phosphorus, and magnesium are the most in-demand macrominerals, with calcium being a vital mineral for eggshell formation in poultry birds. The macrominerals segment is expected to be the fastest-growing segment and register a growth rate of 4.7% during the forecast period.

- Microminerals, valued at USD 59.7 million, are also widely used in China's animal feed industry, with poultry birds and ruminants accounting for 49.4% and 35.3%, respectively. Zinc, copper, manganese, iron, and selenium are the most commonly supplemented microminerals for poultry birds.

- The growing demand for high-quality meat and dairy products, driven by health-conscious consumers, is a significant driver of the feed minerals industry in China. In the Asia-Pacific region, China holds the largest market share, accounting for 45.2% in 2022. As the demand for meat and livestock products for domestic consumption continues to rise and the consumption of feed additives is increasingly associated with health benefits, the feed minerals market in China is expected to register a CAGR of 4.6% during the forecast period.

China Feed Minerals Market Trends

Increasing per capita consumption of poultry products and African Swine Fever (ASF) affecting swine helped in increasing the poultry demand and poultry production

- China's poultry industry holds a dominant position in the global market, with the major producers of poultry located in Beijing, Tianjin, Shanghai, Shandong, and Guangdong. The industry's growth is primarily attributed to the rising population and urbanization, increased income levels, and shifting consumer preferences toward poultry meat, owing to the African swine fever outbreak that led to a reduction in the supply of pork meat. From 2017 to 2022, China's per capita consumption of poultry increased by 2.06 kg, further driving the demand for poultry products.

- The country's poultry industry produces chickens, ducks, and quails, with chickens being the main poultry bird, accounting for 495.9 million heads and 40% of the global egg production in 2022. The adoption of layer farming is increasing, with over 900 million stock-laying hens and 60 million chicks hatching annually at the country's largest layer farming center. Poultry meat consumption in China increased due to favorable prices, increasing awareness of high-protein diets, and a shift in consumer preferences. As a result, broilers are being raised at a higher rate to meet the demand for poultry meat. To improve productivity and meet the growing demand for poultry products, three domestic varieties of broiler genetics were released in 2021, including Shengze 901, Guangming No. 2, and Wode 188.

- The continued investment, commercialization, and release of new and improved breeds in the market, coupled with the increasing production of poultry, per capita consumption, and awareness of the health benefits and nutritional value of poultry meat, are expected to drive the growth of the poultry industry in China during the forecast period.

Rising demand for seafood and shifting of producers from conventional feed to compound feed is increasing the feed production for aquaculture species

- The aquaculture feed production in China witnessed a significant increase of 54.1% in 2022, reaching 22.8 million metric tons compared to 2017. However, there was a 21.3% drop in 2020 from the previous year due to the COVID-19 outbreak and the resulting closure of feed industries. The rapid expansion of aquaculture production in China is driven by the increasing seafood demand in the country and the expansion of the feed production units. For instance, Grobest China established a new aquaculture feed factory in Guangdong Leizhou with an investment of USD 37.7 million and an annual production capacity of 250,000 tons.

- Fish is the primary aquaculture species in China. Feed production increased by 3.2% in 2022 from the previous year due to increased demand, as the cultivation of fish increased to 37.5 million metric tons in 2022 from 37.4 million metric tons in 2018. Producers are shifting from conventional feed to compound feed due to the increasing awareness about nutrient management and good farming practices.

- In 2022, shrimp accounted for 2.9% of the aquafeed market share in the country, with a production of 0.6 million metric tons. The demand for shrimp feed in China is driven by the increasing demand for shrimp, owing to the nutrition transition that Chinese consumers are undergoing. Shrimps are a good source of antioxidants and astaxanthin, which strengthens the nervous and musculoskeletal systems. The rapid expansion of the aquaculture sector and increasing awareness about nutrient management in aquaculture production are expected to boost the market's growth during the forecast period.

China Feed Minerals Industry Overview

The China Feed Minerals Market is fragmented, with the top five companies occupying 33.51%. The major players in this market are Alltech, Inc., Archer Daniel Midland Co., BASF SE, Cargill Inc. and Solvay S.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93772

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Macrominerals

- 5.1.2 Microminerals

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 BASF SE

- 6.4.5 Cargill Inc.

- 6.4.6 Impextraco NV

- 6.4.7 Kemin Industries

- 6.4.8 Phibro Animal Health Corporation

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Solvay S.A.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.