Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685838

Europe Feed Minerals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 231 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

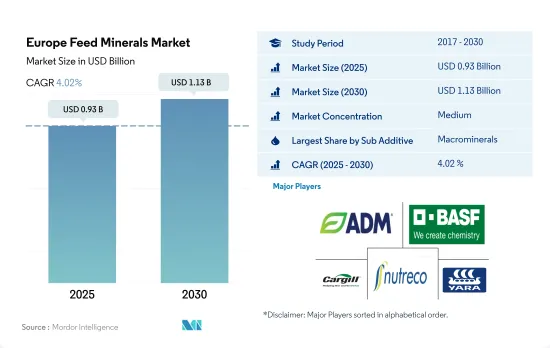

The Europe Feed Minerals Market size is estimated at 0.93 billion USD in 2025, and is expected to reach 1.13 billion USD by 2030, growing at a CAGR of 4.02% during the forecast period (2025-2030).

- Minerals play a crucial role in promoting optimal growth, development, overall health, and disease prevention in livestock. In Europe, the feed additives market for minerals was recently ranked third. In 2022, the market accounted for 10.8% of the total volume of the global market, and it was valued at USD 829.1 million. The increasing demand for animal production and well-established dairy and poultry industries are the key drivers leading to market growth.

- Ruminants are the largest consumers of minerals, accounting for 48% of Europe's feed minerals market in 2022. Minerals are essential to maintain osmotic balance, develop bone growth, reduce muscle contractions, and enhance the nervous system. Poultry and swine follow next, holding market shares of 27.3% and 21.5%, respectively, due to high demand for good-quality poultry meat and red meat.

- Macrominerals represented 9.7% of the European feed additives market in 2022, accounting for a value of USD 741.0 million. Ruminants were the largest consumers of macrominerals, accounting for 50.9% of the total value of the European macrominerals market. Spain held the highest market share, accounting for 16%.

- Microminerals, the fastest-growing sub-segment, is expected to register a CAGR of 4.1% during the forecast period. The value of this sub-segment is expected to grow from USD 88.1 million in 2022 to USD 116.3 million in 2029. In 2022, poultry was the largest consumer of microminerals, accounting for 39.3% of the total market value. Microminerals are involved in cellular metabolism, and they help in the formation of skeletal structures among poultry birds.

- The consumption of meat and meat products and increased awareness about the usage of minerals for promoting animal growth are expected to drive the minerals market, registering a CAGR of 4% during the forecast period.

- The feed minerals market in Europe is growing steadily, driven by the rising feed production in the region. The market was valued at USD 829.1 million, accounting for 10.8% of the European feed additives market, and is expected to register a CAGR of 4.1% during the forecast period.

- Spain dominates the feed minerals market in Europe, valued at USD 132.1 million in 2022, and it is expected to register a CAGR of 4.2% during the forecast period. Macrominerals are the most-consumed additives in Spain, accounting for 89.7% of Spain's feed minerals market in terms of value in 2022. The swine feed minerals market in Spain is growing at the fastest rate, and it is expected to register a CAGR of 4.7% during 2023-2029 due to the increasing swine headcount.

- Germany is the second-largest market for feed minerals in the region, valued at USD 127.6 million in 2022. Macrominerals held a share of 89.0% of Germany's feed minerals market. Ruminants are the primary consumers of feed minerals in the country, accounting for 59.7% of the market value in 2022.

- The United Kingdom is the fastest-growing country in the region, and it is expected to register a CAGR of 4.8% during the forecast period, followed by Russia with a 4.3% CAGR. The driving factors are the rapidly growing livestock production and feed production. The swine population in Russia increased by 15% between 2017 and 2020. Turkey held the smallest share of the feed minerals market in Europe, valued at USD 32.8 million in 2022. The major restraints are unstable economies and increased operational expenses.

- The increasing use of feed minerals to meet the nutritional needs of animals is expected to drive the feed minerals market in Europe during the forecast period.

Europe Feed Minerals Market Trends

Europe is 3rd largest exporter of poultry meat and broiler meat production accounted for 82.6% of poultry meat production which is expected to drive the demand for poultry production

- Europe is a prominent poultry meat producer and exporter. The region accounted for an estimated annual poultry meat production volume of approximately 13.4 million metric tons in 2021. Despite being the second-most consumed meat in the region (26.9 kg per capita per year), poultry production in Europe has not been able to keep up with the rising global demand. The largest poultry meat producers in the European region include Poland (accounting for 19.2% of the production volume or 2.5 million metric tons), France (12.5% of the production volume or 1.6 million metric tons), Spain (12.3% of the production volume), Germany (12% of the production volume), and Italy (10.4% of the production volume).

- Within the European Union, broiler meat production constituted the majority (82.6%) of the total poultry meat production in 2021, followed by duck meat (3.3%). Europe's poultry flock number was approximately 2.45 billion birds in 2021, with Russia, France, the Netherlands, Ukraine, Poland, and the United Kingdom collectively comprising more than 50% of the total European poultry population. The number of hens in Europe is rising due to increased egg consumption, which rose to 6,135 thousand metric tons in 2021 from 5,864 metric tons in 2017.

- As the fourth-largest importer and third-largest exporter of poultry meat, Europe is a significant participant in the global poultry meat market. In 2021, the European Union exported roughly 2,252 thousand metric tons (carcass weight) of poultry meat to a variety of countries, including the United Kingdom, Ghana, and Ukraine. Overall, the rising production of poultry birds, increasing demand for poultry products, and the growing consumption of eggs are expected to be the key drivers of market growth in the European region.

High demand for fish feed which accounted for 82% and surge in seafood imports had a negative impact on compound feed for aquaculture

- In 2022, Europe accounted for 8% of the global aquaculture compound feed production, registering a production volume of 4.5 million metric tons. The production of compound feed witnessed a notable increase of 15% during 2018-2022, driven by the rising demand for nutrient-balanced feed to reduce the risk of diseases and improve feed efficiency. However, aquaculture feed production observed a decline of 21.2% in 2018, which may have been influenced by the surge in seafood imports and the relatively lower prices of imported seafood. These factors impacted the compound feed market in 2018.

- The major aquafeed producers in the European region are Turkey, the United Kingdom, the Netherlands, Spain, Italy, and France. The region produced 17.4 million metric tons of aquaculture feed in 2021, recording a growth of 1.7% compared to 2018. This growth was attributed to the rise in population and per capita consumption of seafood, thereby driving aquaculture production in the region. This, in turn, is propelling the demand for compound feed, which is expected to increase by 18.2% during the forecast period (2023-2029).

- Fish feed dominates aquafeed production. It accounted for 82% of the total market share in 2022, followed by shrimp feed and feed for other aquatic species, accounting for shares of 4.3% and 13.7%, respectively. Fish feed is the most widely consumed aquatic food across the region. It is produced in high volumes compared to feed for other aquatic species. The expanding aquaculture sector, driven by the rising demand for seafood and aquaculture products, and the growing awareness about quality meat are the major factors that are augmenting the growth of the market studied.

Europe Feed Minerals Industry Overview

The Europe Feed Minerals Market is moderately consolidated, with the top five companies occupying 43.67%. The major players in this market are Archer Daniel Midland Co., BASF SE, Cargill Inc., SHV (Nutreco NV) and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 48369

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Macrominerals

- 5.1.2 Microminerals

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 BASF SE

- 6.4.5 Cargill Inc.

- 6.4.6 Kemin Industries

- 6.4.7 MIAVIT Stefan Niemeyer GmbH

- 6.4.8 Novus International, Inc.

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.