Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693744

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693744

India Feed Minerals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 176 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

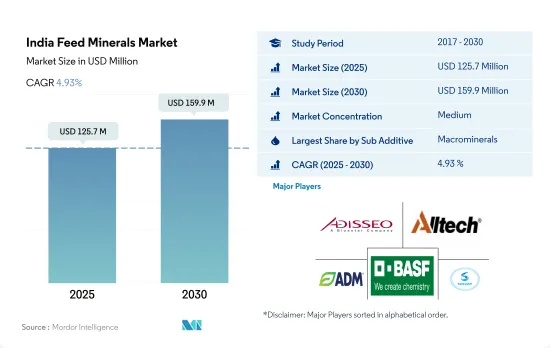

The India Feed Minerals Market size is estimated at 125.7 million USD in 2025, and is expected to reach 159.9 million USD by 2030, growing at a CAGR of 4.93% during the forecast period (2025-2030).

- India was the second-largest country in Asia-Pacific with respect to the feed minerals market in 2022, accounting for 9.8% of the market. In India, the feed minerals segment of the feed additives market accounted for almost 11.3% in 2022, valued at USD 0.11 billion.

- Macrominerals had the largest share, valued at almost USD 100 million in 2022. Macrominerals such as calcium, magnesium, phosphorus, potassium, and others are essential to all types of animals in their diet, and the deficiency of these minerals leads to various kinds of diseases. Ruminants were the largest segment by animal type in the feed minerals market, accounting for 52.4% in 2022. The usage of minerals in ruminants was higher because of the higher dosage rates and their importance in preventing acidosis and alkalis in ruminant animals.

- Microminerals were valued at USD 9.2 million in 2022. They are majorly consumed by the poultry sector in the country; poultry accounted for 68% of the feed microminerals market in 2022.

- The segment for macrominerals in the feed minerals market is expected to grow at a rapid pace, registering a CAGR of 5% during the forecast period. With the growing awareness of the usage of minerals and the increase in commercial farming, especially with respect to dairy cattle, broilers, and layers, the market is expected to grow in the country, registering a CAGR of 4.9% during the forecast period.

- The feed minerals market in India is expected to witness growth in the coming years, with the macromineral segment leading the way. This growth is expected to be driven by factors such as the importance of minerals in animal health, the increase in commercial farming, and the growing awareness of the usage of minerals.

India Feed Minerals Market Trends

Rising demand for poultry meat and egg consumption is increasing the poultry production but diseases such as Avian Influenza had negative impact on poultry population

- The Indian poultry industry is one of the largest producers of eggs and broiler meat worldwide. In recent years, the industry has undergone significant transformations, driven primarily by the rise in the consumption of poultry meat and egg, which contributed to a 7.1% increase in poultry production in 2022 from 2017. The country's per capita consumption of poultry meat reached 2.65 kg in 2022, a 13.7% increase from 2017, and the per capita availability of eggs increased to 91 eggs per annum in 2021, four more units than the previous year.

- The Indian poultry market is primarily concentrated in Andhra Pradesh, Tamil Nadu, and Telangana, accounting for a significant portion of the country's production. The Indian poultry industry has established itself as a significant player in the global market, with 320,240.46 metric tons of poultry products exported in 2021-22, amounting to USD 71.04 million. Major importers of Indian poultry products include Oman, Maldives, Indonesia, Vietnam, Japan, and Russia.

- The Indian poultry industry faces several challenges. The outbreak of avian influenza and other diseases in poultry led to the culling of birds, resulting in significant financial losses for the industry. The industry is plagued by issues such as high feed costs, inadequate processing and storage facilities, and limited access to credit. To overcome such challenges, the industry requires significant investments in infrastructure and technology and government support. Overall, the increasing demand for poultry meat from importing countries, coupled with rising domestic demand, led to a significant increase in poultry production in India.

India being third largest fish producing country and the surge in demand for seafood as well as the government's initiatives is increasing the aqua feed demand and production

- India's aquaculture industry experienced significant growth due to the surge in demand for seafood, leading to a sudden increase in the aqua feed market. In 2022, the country's aquaculture feed production reached 2.2 million metric tons, a 48.6% increase from 2017-2022, primarily driven by the increasing aquaculture in the country. Fish feed dominates the aqua feed market in India, accounting for 87% of the production in the country in 2022, followed by shrimp feed at 6.6%. The demand for fish is rising domestically and internationally, making it essential for the aqua feed market to maintain the quality of fish in the country.

- India is the world's third-largest fish-producing country, contributing 7.96% to global production. In 2020-21, the country produced 14.7 million metric tons of fish. Andhra Pradesh is the largest fish-feed-consuming state in India, followed by West Bengal, owing to its high fish production. Shrimp feed production grew by 75.6% from 2018. The increasing global demand for shrimp led aqua feed manufacturers to produce large quantities of shrimp feed to cater to the demand.

- The increasing demand for seafood, coupled with the government's initiatives and growing investments in the aquaculture sector, such as offering subsidies and incentives for the construction of new ponds, purchasing feeds, and setting up processing units, is expected to fuel the growth of the aqua feed market in India. The expansion of the aqua feed market is expected to support the growth of the Indian economy, create employment opportunities, and contribute to food security.

India Feed Minerals Industry Overview

The India Feed Minerals Market is moderately consolidated, with the top five companies occupying 50.29%. The major players in this market are Adisseo, Alltech, Inc., Archer Daniel Midland Co., BASF SE and Solvay S.A. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93778

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Macrominerals

- 5.1.2 Microminerals

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 Archer Daniel Midland Co.

- 6.4.4 BASF SE

- 6.4.5 Cargill Inc.

- 6.4.6 Kemin Industries

- 6.4.7 Marubeni Corporation (Orffa International Holding B.V.)

- 6.4.8 Novus International, Inc.

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Solvay S.A.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.